Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Cohen Inc. is a manufacturer of sports drinks and operates primarily in the East Coast of the U.S. The company is currently managed very

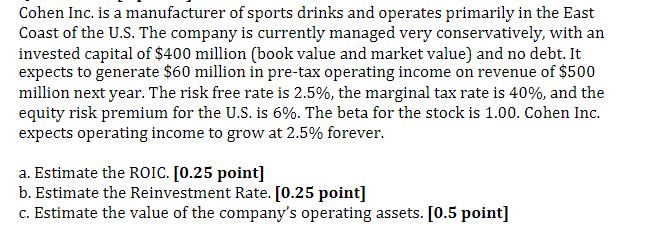

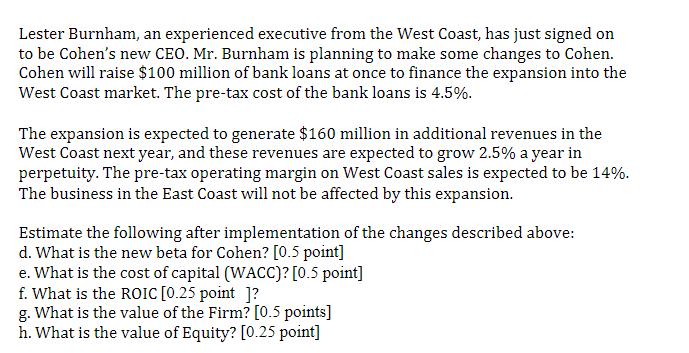

Cohen Inc. is a manufacturer of sports drinks and operates primarily in the East Coast of the U.S. The company is currently managed very conservatively, with an invested capital of $400 million (book value and market value) and no debt. It expects to generate $60 million in pre-tax operating income on revenue of $500 million next year. The risk free rate is 2.5%, the marginal tax rate is 40%, and the equity risk premium for the U.S. is 6%. The beta for the stock is 1.00. Cohen Inc. expects operating income to grow at 2.5% forever. a. Estimate the ROIC. [0.25 point] b. Estimate the Reinvestment Rate. [0.25 point] c. Estimate the value of the company's operating assets. [0.5 point] Lester Burnham, an experienced executive from the West Coast, has just signed on to be Cohen's new CEO. Mr. Burnham is planning to make some changes to Cohen. Cohen will raise $100 million of bank loans at once to finance the expansion into the West Coast market. The pre-tax cost of the bank loans is 4.5%. The expansion is expected to generate $160 million in additional revenues in the West Coast next year, and these revenues are expected to grow 2.5% a year in perpetuity. The pre-tax operating margin on West Coast sales is expected to be 14%. The business in the East Coast will not be affected by this expansion. Estimate the following after implementation of the changes described above: d. What is the new beta for Cohen? [0.5 point] e. What is the cost of capital (WACC)? [0.5 point] f. What is the ROIC [0.25 point ]? g. What is the value of the Firm? [0.5 points] h. What is the value of Equity? [0.25 point]

Step by Step Solution

★★★★★

3.54 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

1 a ROIC Operating Income Invested Capital ROIC 60000000 400000000 015 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started