Question

Net Income of $34000 was reported and Dividend of $13000 were paid in 2010. New Equipment was purchased and none was sold. Requirement: Prepare

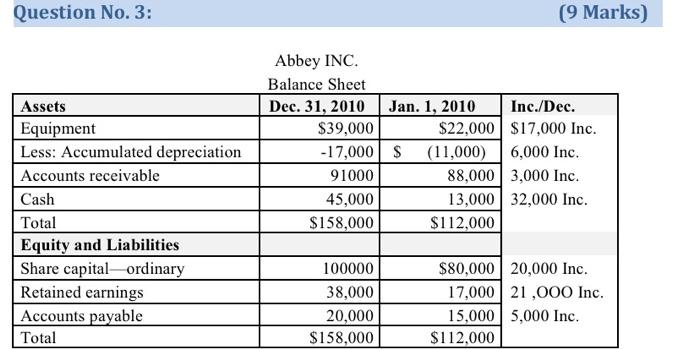

Net Income of $34000 was reported and Dividend of $13000 were paid in 2010. New Equipment was purchased and none was sold. Requirement: Prepare Statement of Cash Flow for the year 2010. Question No. 3: Assets Equipment Less: Accumulated depreciation Accounts receivable Cash Total Equity and Liabilities Share capital ordinary Retained earnings Accounts payable Total Abbey INC. Balance Sheet Dec. 31, 2010 $39,000 -17,000 $ 91000 45,000 $158,000 100000 38,000 20,000 $158,000 Jan. 1, 2010 Inc./Dec. $17,000 Inc. 6,000 Inc. 88,000 3,000 Inc. 13,000 32,000 Inc. $112,000 $80,000 20,000 Inc. 17,000 21,000 Inc. 15,000 5,000 Inc. $22,000 (11,000) (9 Marks) $112,000

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Net Income 3400000 Add Depreciation 17000 11000 600000 Add Increase in account payabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Information For Decisions

Authors: Robert w Ingram, Thomas L Albright

6th Edition

9780324313413, 324672705, 324313411, 978-0324672701

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App