Answered step by step

Verified Expert Solution

Question

1 Approved Answer

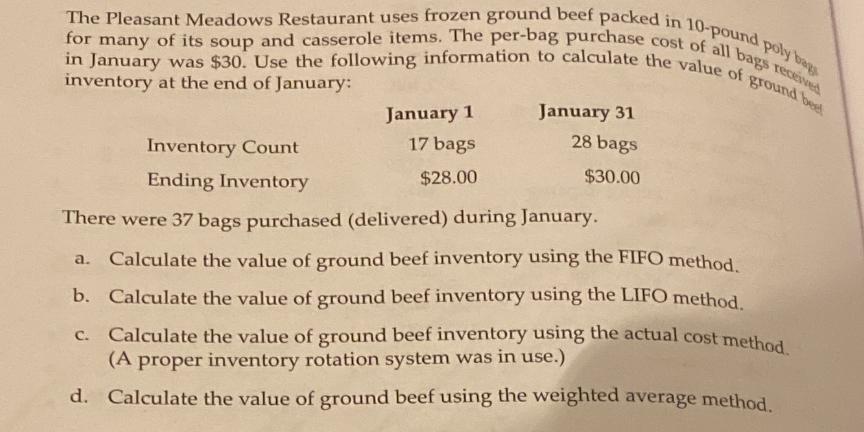

for many of its soup and casserole items. The per-bag purchase cost of all bags received in January was $30. Use the following information

for many of its soup and casserole items. The per-bag purchase cost of all bags received in January was $30. Use the following information to calculate the value of ground beet The Pleasant Meadows Restaurant uses frozen ground beef packed in 10-pound poly bags inventory at the end of January: Inventory Count Ending Inventory January 1 17 bags $28.00 January 31 28 bags $30.00 There were 37 bags purchased (delivered) during January. Calculate the value of ground beef inventory using the FIFO method. b. Calculate the value of ground beef inventory using the LIFO method. Calculate the value of ground beef inventory using the actual cost method. (A proper inventory rotation system was in use.) d. Calculate the value of ground beef using the weighted average method,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Understanding the Problem Problem Calculate the value of ground beef inventory at the end of January using different inventory valuation methods Given Information Perbag purchase cost 30 Beginning inv...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started