Answered step by step

Verified Expert Solution

Question

1 Approved Answer

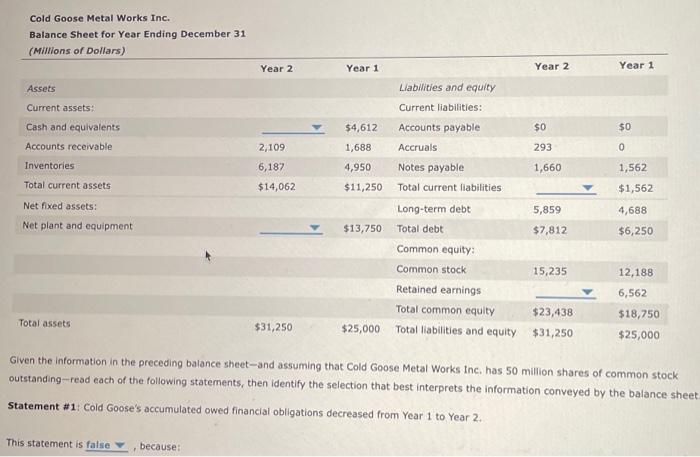

Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Assets Current assets: Cash and equivalents Accounts receivable Inventories Total

Cold Goose Metal Works Inc. Balance Sheet for Year Ending December 31 (Millions of Dollars) Assets Current assets: Cash and equivalents Accounts receivable Inventories Total current assets Net fixed assets: Net plant and equipment Total assets This statement is false " Year 2 because: 2,109 6,187 $14,062 $31,250 Year 1 $4,612 1,688 4,950 $11,250 $13,750 $25,000 Liabilities and equity Current liabilities: Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total debt Common equity: Common stock Retained earnings Total common equity Total liabilities and equity Year 2 $0 293 1,660 5,859 $7,812 15,235 $23,438 $31,250 Year 1 $0 0 1,562 $1,562 Given the information in the preceding balance sheet-and assuming that Cold Goose Metal Works Inc. has 50 million shares of common stock outstanding-read each of the following statements, then identify the selection that best interprets the information conveyed by the balance sheet. Statement #1: Cold Goose's accumulated owed financial obligations decreased from Year 1 to Year 2. 4,688 $6,250 12,188 6,562 $18,750 $25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started