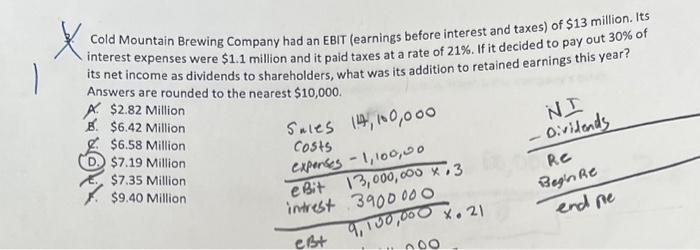

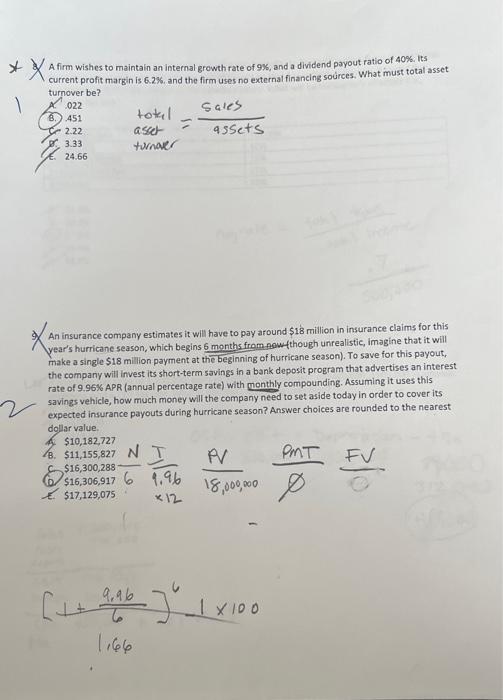

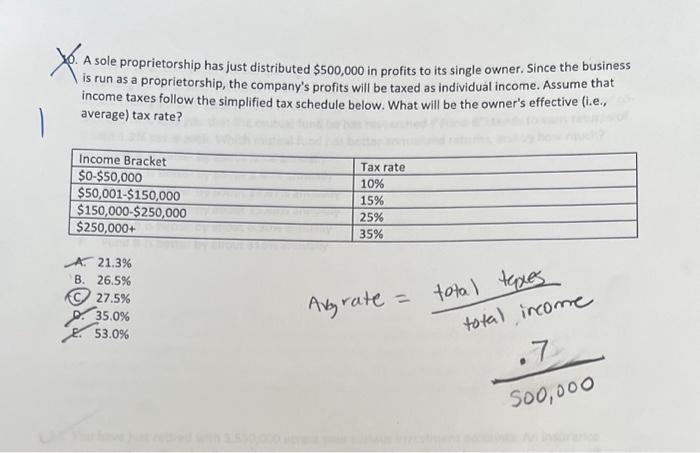

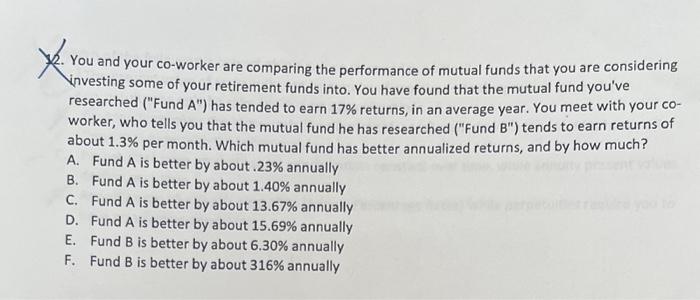

Cold Mountain Brewing Company had an EBIT (earnings before interest and taxes) of $13 million. Its interest expenses were $1.1 million and it paid taxes at a rate of 21%. If it decided to pay out 30% of its net income as dividends to shareholders, what was its addition to retained earnings this year? Answers are rounded to the nearest $10,000. A firm wishes to maintain an internal growth rate of 9%, and a dividend payout ratio of 40% its current profit margin is 6.2%, and the firm uses no external financing soces. What must total asset turnover be? 1.0221.2.22r.3.33totelascettroaer=assetssales 9. An insurance company estimates it will have to pay around $18 million in insurance claims for this year's hurricane season, which begins 6 months from now (though unrealistic, imagine that it will make a single $18 million payment at the beginning of hurricane season). To save for this payout, the company will invest its short-term savings in a bank deposit program that advertises an interest: rate of 9.96% APR (annual percentage rate) with monthly compounding. Assuming it uses this savings vehicle, how much money will the company need to set aside today in order to cover its. expected insurance payouts during hurricane season? Answer choices are rounded to the nearest dollar value. 17. $10,182,727 E. $17,129,07518,000,000 A sole proprietorship has just distributed $500,000 in profits to its single owner. Since the business is run as a proprietorship, the company's profits will be taxed as individual income. Assume that income taxes follow the simplified tax schedule below. What will be the owner's effective (i.e., average) tax rate? A. 21.3% B. 26.5% (C) 27.5% D. 35.0% Abyrate=totalincorefotaltypes 2. You and your co-worker are comparing the performance of mutual funds that you are considering investing some of your retirement funds into. You have found that the mutual fund you've researched ("Fund A ) has tended to earn 17\% returns, in an average year. You meet with your coworker, who tells you that the mutual fund he has researched ("Fund B") tends to earn returns of about 1.3% per month. Which mutual fund has better annualized returns, and by how much? A. Fund A is better by about. 23% annually B. Fund A is better by about 1.40% annually C. Fund A is better by about 13.67% annually D. Fund A is better by about 15.69% annually E. Fund B is better by about 6.30% annually F. Fund B is better by about 316% annually