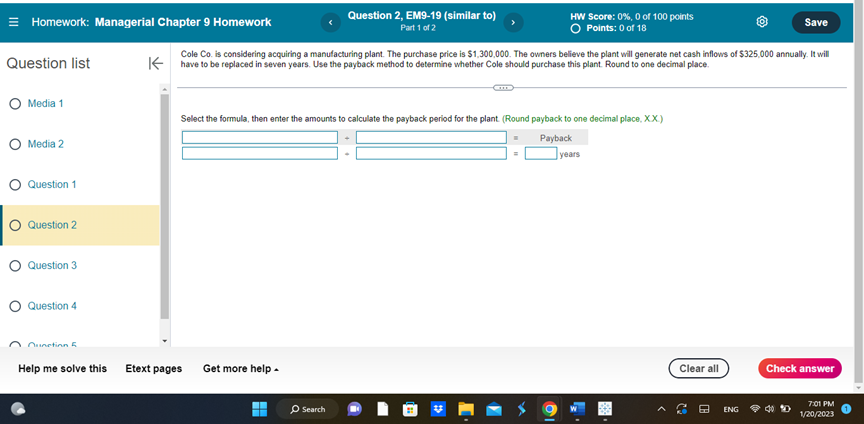

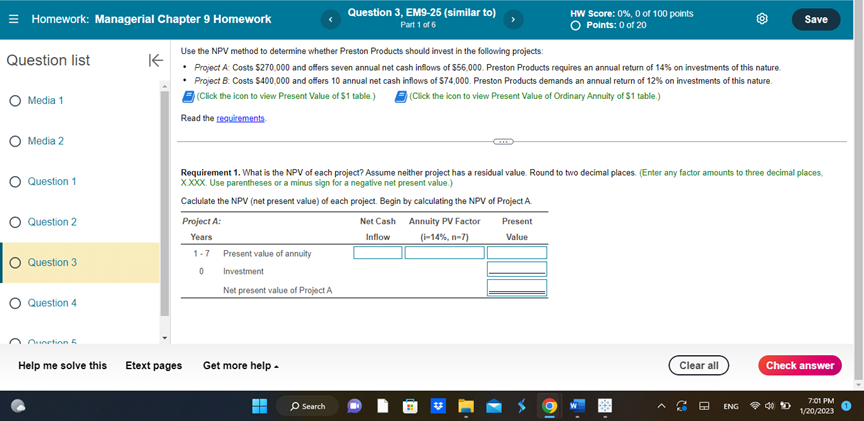

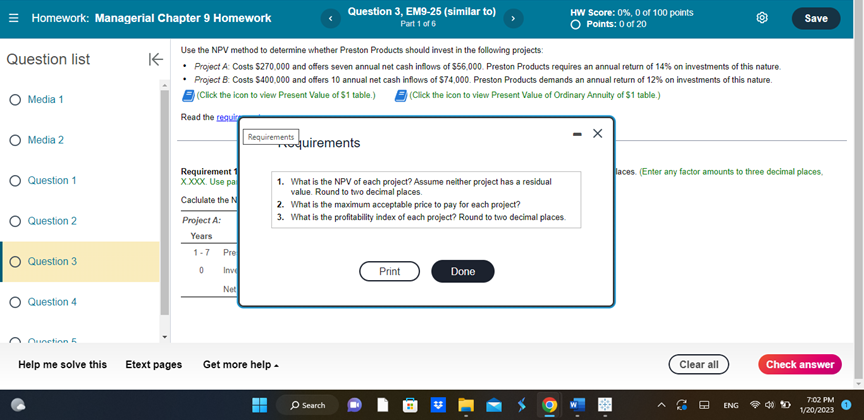

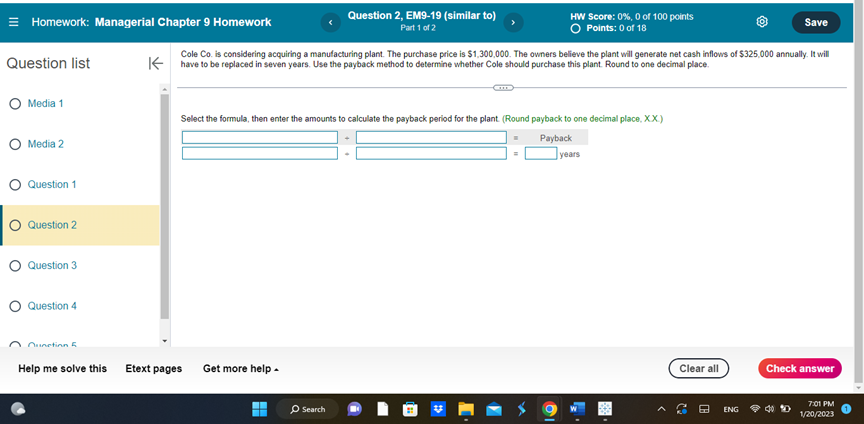

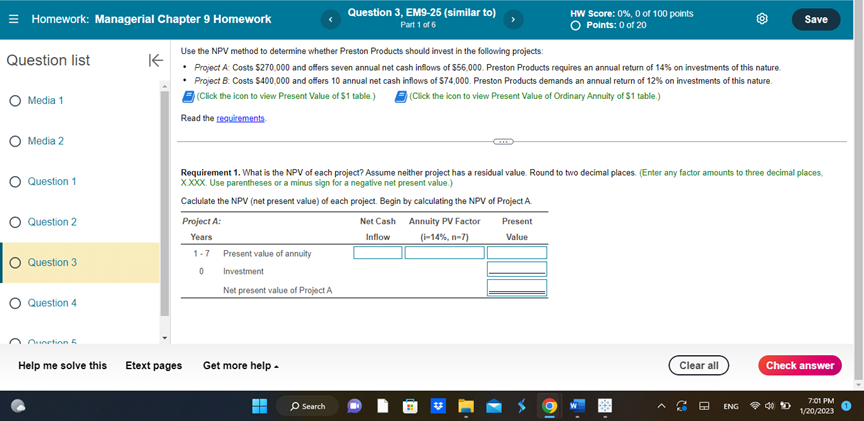

Cole Co. is considering acquiring a manufacturing plant. The purchase price is $1,300,000. The owners believe the plant will generate net cash inflows of $325,000 annually. It will have to be replaced in seven years. Use the payback method to determine whether Cole should purchase this plant. Round to one decimal place. Use the NPV method to determine whether Preston Products should invest in the following projects: - Project A. Costs $270.000 and offers seven annual net cash inflows of $56.000. Preston Products requires an annual return of 14% on investments of this nature. - Project B. Costs $400,000 and offers 10 annual net cash inflows of $74,000. Preston Products demands an annual return of 12% on investments of this nature. \# (Click the icon to view Present Value of $1 table.) (Cick the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, XXOX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Use the NPV method to determine whether Preston Products should irvest in the following projects: - Project A. Costs $270.000 and offers seven annual net cash inflows of $56.000. Preston Products requires an annual return of 14% on investments of this nature. - Project B. Costs $400,000 and offers 10 annual net cash inflows of $74,000. Preston Products demands an annual return of 12% on investments of this nature. \# (Click the icon to view Present Value of $1 table.) (Cick the icon to view Present Value of Ordinary Annulty of $1 table.) Read the requir Requirement 1 X.XCX. Use pa 1. What is the NPV of each project? Assume neither project has a residual Caclulate the N value. Round to two decimal places. 2. What is the maximum acceptable price to pay for each project? Project A: 3. What is the profitability index of each project? Round to two decimal places