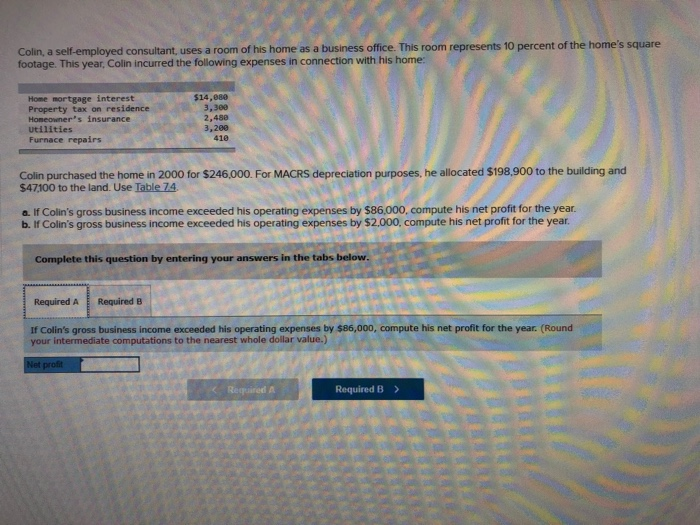

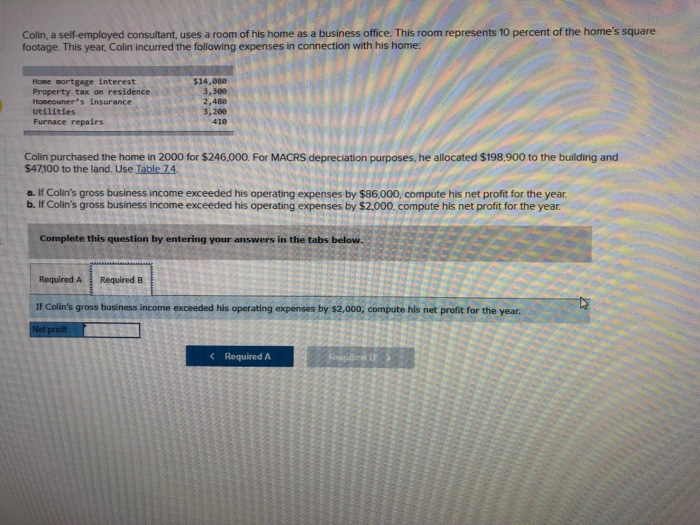

Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the home's square footage. This year, Colin incurred the following expenses in connection with his home: Home mortgage interest Property tax on residence Homeowner's insurance utilities Furnace repairs $14,888 3,300 2,488 3,280 410 Colin purchased the home in 2000 for $246,000. For MACRS depreciation purposes, he allocated $198,900 to the building and $47100 to the land. Use Table 74 a. If Colin's gross business income exceeded his operating expenses by $86,000, compute his net profit for the year b. If Colin's gross business income exceeded his operating expenses by $2.000, compute his net profit for the year. Complete this question by entering your answers in the tabs below. Required ARequired B If Colin's gross business income exceeded his operating expenses by $86,000, compute his net profit for the year. (Round your intermediate computations to the nearest whole dollar value.) Required B > Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the home's square footage. This year, Colin incurred the following expenses in connection with his home: Home mortgage interest Property tax on residence Homeowner's insurance Utilities Furnace repairs $14,080 3,308 2,480 3,200 410 Colin purchased the home in 2000 for $246,000. For MACRS depreciation purposes, he allocated $198,900 to the building and $47,100 to the land. Use Table 74 o. If Colin's gross business income exceeded his operating expenses by $86.000, compute his net profit for the year b. If Colin's gross business income exceeded his operating expenses by $2.000. compute his net profit for the year Complete this question by entering your answers in the tabs below. Required A Required B If Colin's gross business income exceeded his operating expenses by $2,000, compute his net profit for the year. Required A Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the home's square footage. This year, Colin incurred the following expenses in connection with his home: Home mortgage interest Property tax on residence Homeowner's insurance utilities Furnace repairs $14,888 3,300 2,488 3,280 410 Colin purchased the home in 2000 for $246,000. For MACRS depreciation purposes, he allocated $198,900 to the building and $47100 to the land. Use Table 74 a. If Colin's gross business income exceeded his operating expenses by $86,000, compute his net profit for the year b. If Colin's gross business income exceeded his operating expenses by $2.000, compute his net profit for the year. Complete this question by entering your answers in the tabs below. Required ARequired B If Colin's gross business income exceeded his operating expenses by $86,000, compute his net profit for the year. (Round your intermediate computations to the nearest whole dollar value.) Required B > Colin, a self-employed consultant, uses a room of his home as a business office. This room represents 10 percent of the home's square footage. This year, Colin incurred the following expenses in connection with his home: Home mortgage interest Property tax on residence Homeowner's insurance Utilities Furnace repairs $14,080 3,308 2,480 3,200 410 Colin purchased the home in 2000 for $246,000. For MACRS depreciation purposes, he allocated $198,900 to the building and $47,100 to the land. Use Table 74 o. If Colin's gross business income exceeded his operating expenses by $86.000, compute his net profit for the year b. If Colin's gross business income exceeded his operating expenses by $2.000. compute his net profit for the year Complete this question by entering your answers in the tabs below. Required A Required B If Colin's gross business income exceeded his operating expenses by $2,000, compute his net profit for the year. Required A