Question

Colla Company had annual sales of 2,500,000. Its average collection period is 45 days, and bad debts are 3 percent of sales. The credit and

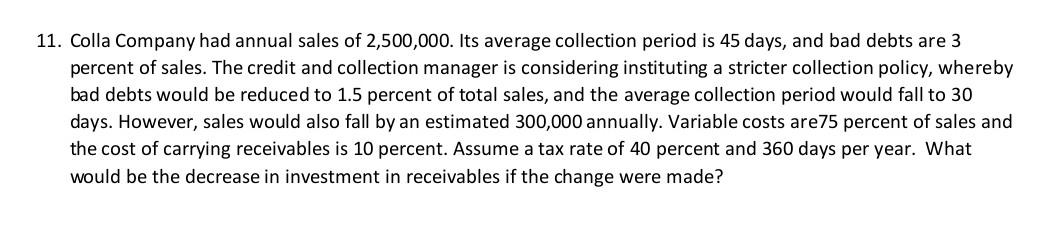

Colla Company had annual sales of 2,500,000. Its average collection period is 45 days, and bad debts are 3 percent of sales. The credit and collection manager is considering instituting a stricter collection policy, whereby bad debts would be reduced to 1.5 percent of total sales, and the average collection period would fall to 30 days. However, sales would also fall by an estimated 300,000 annually. Variable costs are75 percent of sales and the cost of carrying receivables is 10 percent. Assume a tax rate of 40 percent and 360 days per year. What would be the decrease in investment in receivables if the change were made?

11. Colla Company had annual sales of 2,500,000. Its average collection period is 45 days, and bad debts are 3 percent of sales. The credit and collection manager is considering instituting a stricter collection policy, whereby bad debts would be reduced to 1.5 percent of total sales, and the average collection period would fall to 30 days. However, sales would also fall by an estimated 300,000 annually. Variable costs are 75 percent of sales and the cost of carrying receivables is 10 percent. Assume a tax rate of 40 percent and 360 days per year. What would be the decrease in investment in receivables if the change were madeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started