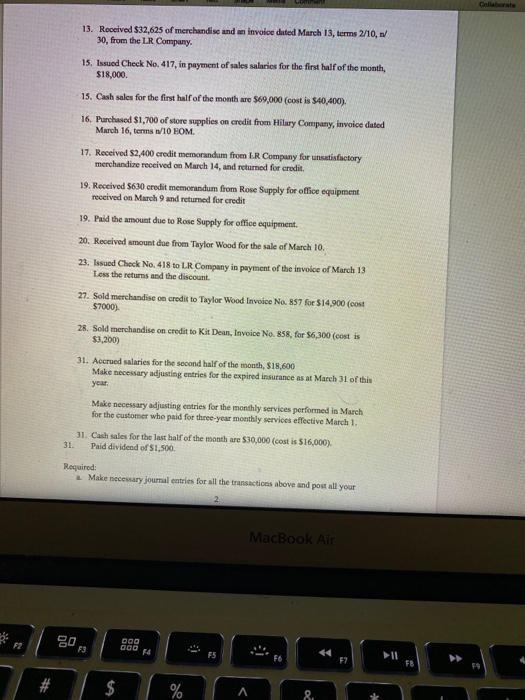

Collaborate 13. Received $32,625 of merchandise and an invoice dated March 13, terms 2/10, 30, from the LR Company. 15. Issued Check No. 417, in payment of sales salaries for the first half of the month, $18,000 15. Cash sales for the first half of the month are $69,000 (cost is $40.400). 16. Purchased $1,700 of store supplies on credit from Hilary Company, invoice dated March 16, terms 10 EOM. 17. Received $2,400 credit memorandum from LR Company for unsatisfactory merchandize received on March 14, and returned for credit 19. Received $630 credit memorandum from Rose Supply for office equipment received on March 9 and returned for credit 19. Paid the amount due to Rose Supply for office equipment 20. Received amount due from Taylor Wood for the sale of March 10. 23. Issued Check No. 418 to LR Company in payment of the invoice of March 13 Less the returns and the discount. 27. Sold merchandise on credit to Taylor Wood Invoice No. 857 for $14,900 (cost $7000) 28. Sold merchandise on credit to Kit Dean, Invoice No. 858, for 56,300 (cost is $3,200) 31. Accrued salaries for the second half of the month, $18,600 Make necessary adjusting entries for the expired insurance as at March 31 of this year. Make necessary adjusting entries for the monthly services performed in March for the customer who paid for three-year monthly services effective March 1. 31. Cash sales for the last half of the month are $30,000 (cost is 516,000). 31. Paid dividend of S1,500 Required a Make necessary journal entries for all the transactions above and post all your MacBook Air F2 80 000 F3 000 74 FS II 57 FB $ % & Collaborate 13. Received $32,625 of merchandise and an invoice dated March 13, terms 2/10, 30, from the LR Company. 15. Issued Check No. 417, in payment of sales salaries for the first half of the month, $18,000 15. Cash sales for the first half of the month are $69,000 (cost is $40.400). 16. Purchased $1,700 of store supplies on credit from Hilary Company, invoice dated March 16, terms 10 EOM. 17. Received $2,400 credit memorandum from LR Company for unsatisfactory merchandize received on March 14, and returned for credit 19. Received $630 credit memorandum from Rose Supply for office equipment received on March 9 and returned for credit 19. Paid the amount due to Rose Supply for office equipment 20. Received amount due from Taylor Wood for the sale of March 10. 23. Issued Check No. 418 to LR Company in payment of the invoice of March 13 Less the returns and the discount. 27. Sold merchandise on credit to Taylor Wood Invoice No. 857 for $14,900 (cost $7000) 28. Sold merchandise on credit to Kit Dean, Invoice No. 858, for 56,300 (cost is $3,200) 31. Accrued salaries for the second half of the month, $18,600 Make necessary adjusting entries for the expired insurance as at March 31 of this year. Make necessary adjusting entries for the monthly services performed in March for the customer who paid for three-year monthly services effective March 1. 31. Cash sales for the last half of the month are $30,000 (cost is 516,000). 31. Paid dividend of S1,500 Required a Make necessary journal entries for all the transactions above and post all your MacBook Air F2 80 000 F3 000 74 FS II 57 FB $ % &