Answered step by step

Verified Expert Solution

Question

1 Approved Answer

College Accounting 13th edition Slater p.269, 7B-3, 7B-4, 7B-5, 7B-6 From the following information, calculate the payroll tax expense for New Company for the payroll

College Accounting 13th edition Slater p.269, 7B-3, 7B-4, 7B-5, 7B-6

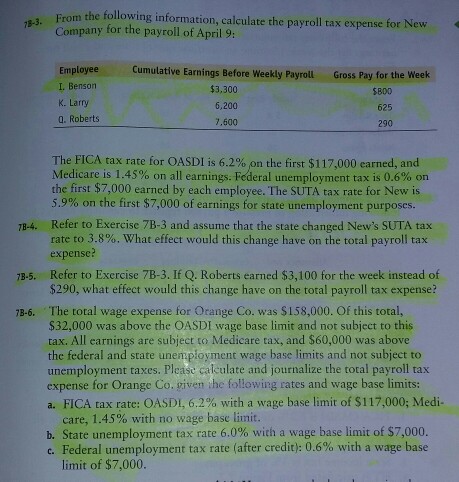

From the following information, calculate the payroll tax expense for New Company for the payroll of April 9 cumulative Earnings Before weekly Payroll Gross Pay for the week Employee I. Benson $3,300 $800 6,200 625 a. Roberts 7,600 290 The FICA tax rate for OASDI is 6.2%. on the first $117,000 earned, and Medicare is 1.45% on all earnings. Federal unemployment tax is 0.6% on the first $7,000 earned by each employee. The SUTA tax rate for New is 5.9% on the first $7,000 of earnings for state unemployment purposes TB-4. Refer to Exercise 7B-3 and assume that the state changed New's SUTA tax rate to 3.8%. What effect would this change have on the total payroll tax expense 7B-5. Refer to Exercise 7B-3. If Q. Roberts earned $3,100 for the week instead of $290, what effect would this change have on the total payroll tax expense? 78-6. The total wage expense for Orange Co. was S158,000. Of this total, $32,000 was above the OASDI wage base limit and not subject to this tax. All earnings are subject to Medicare tax, and $60,000 was above the federal and state unemployment wage base limits and not subject to unemployment taxes. Please calculate and journalize the total payroll tax expense for Orange Co. given the following rates and wage base limits: a. FICA tax rate: OASDI, 6.2% with a wage base limit of S117,000; Medi- care, 1.45% with no wage base limit. b. State unemployment tax rate 6.0% with a wage base limit of $7,000. c. Federal unemployment tax rate (after credit): 0.6% with a wage base limit of $7,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started