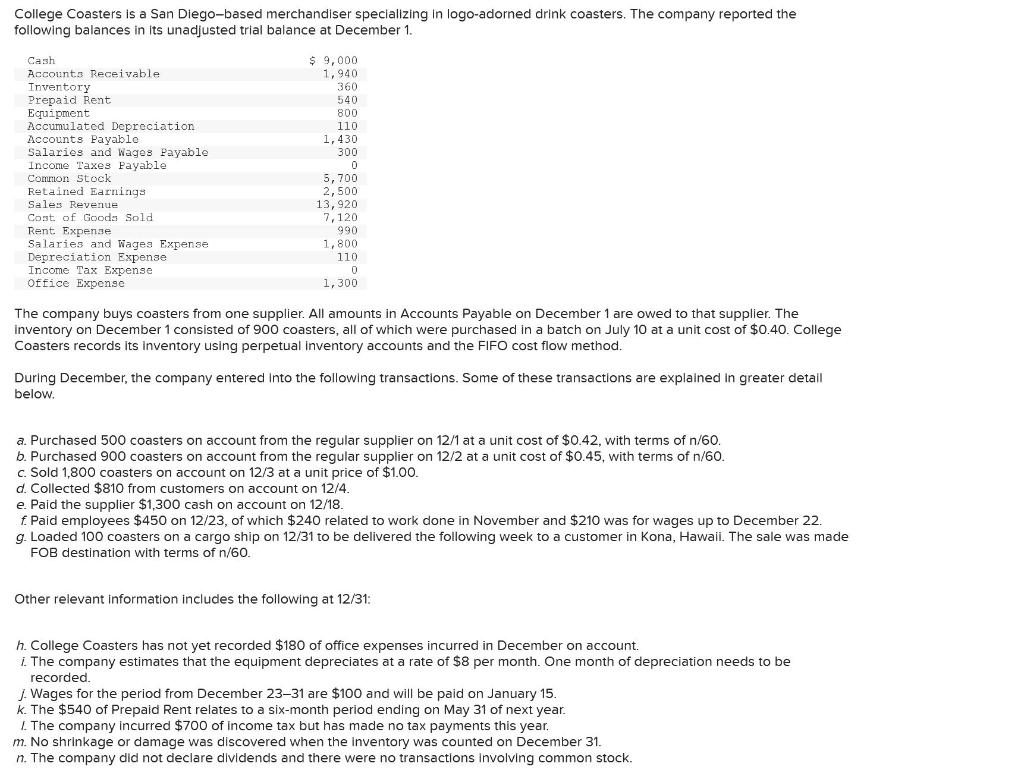

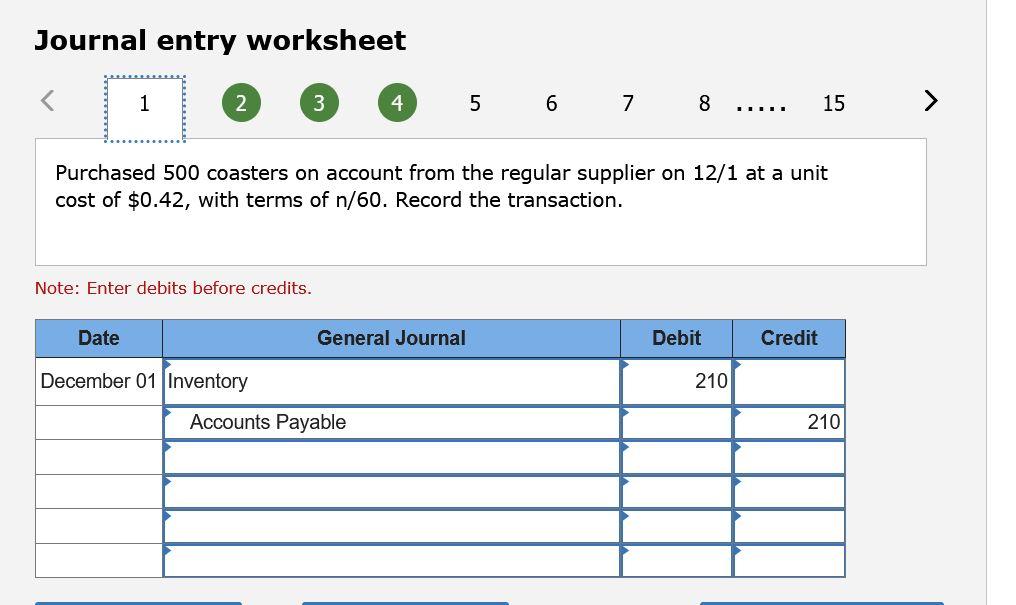

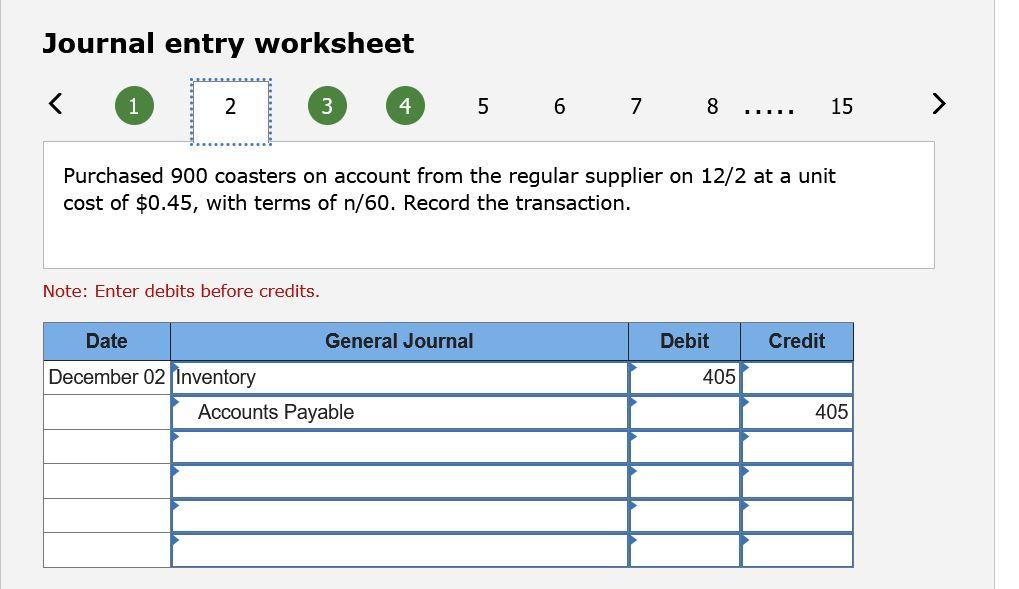

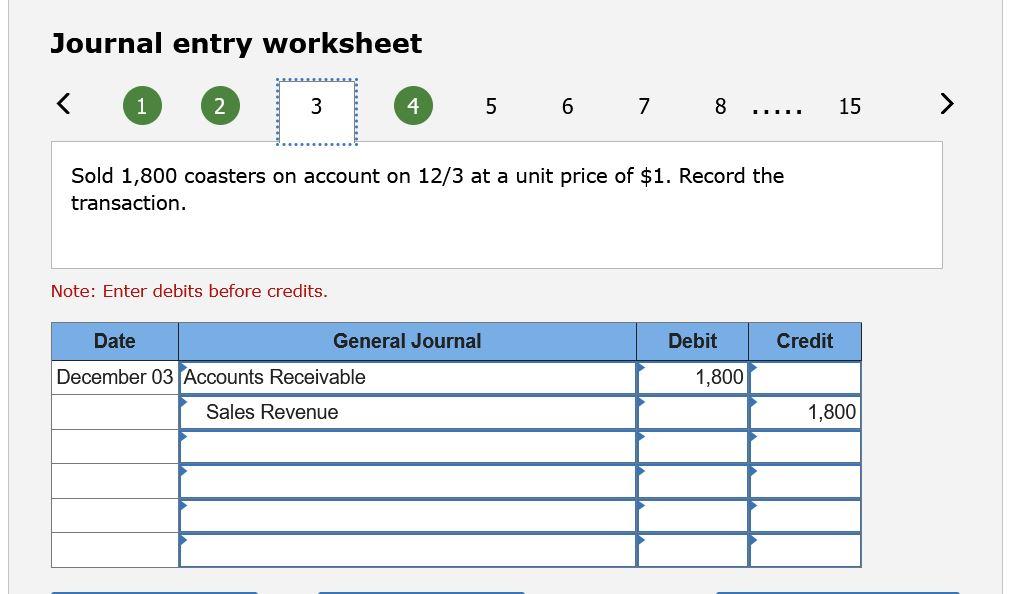

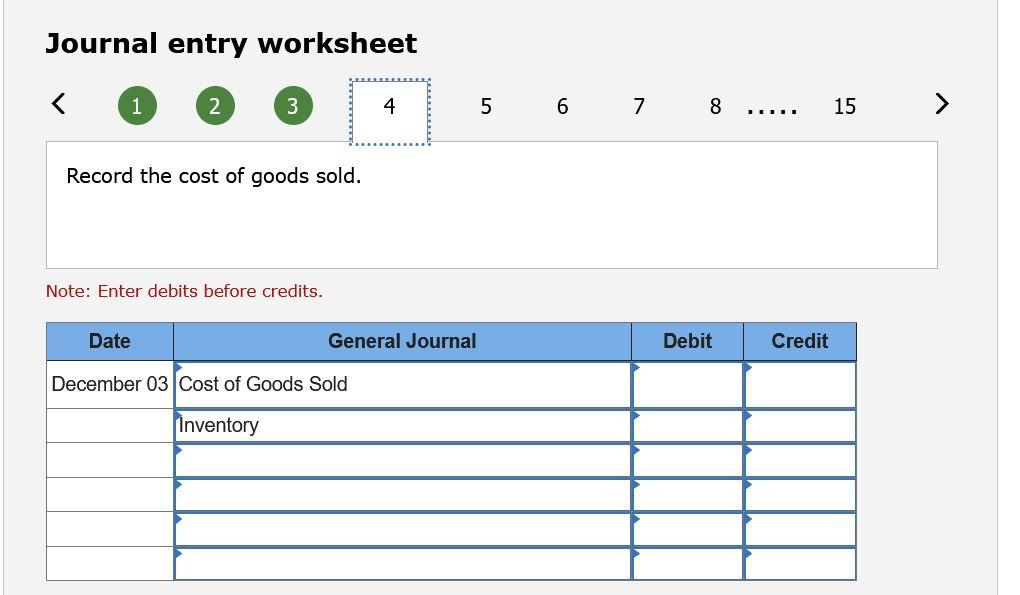

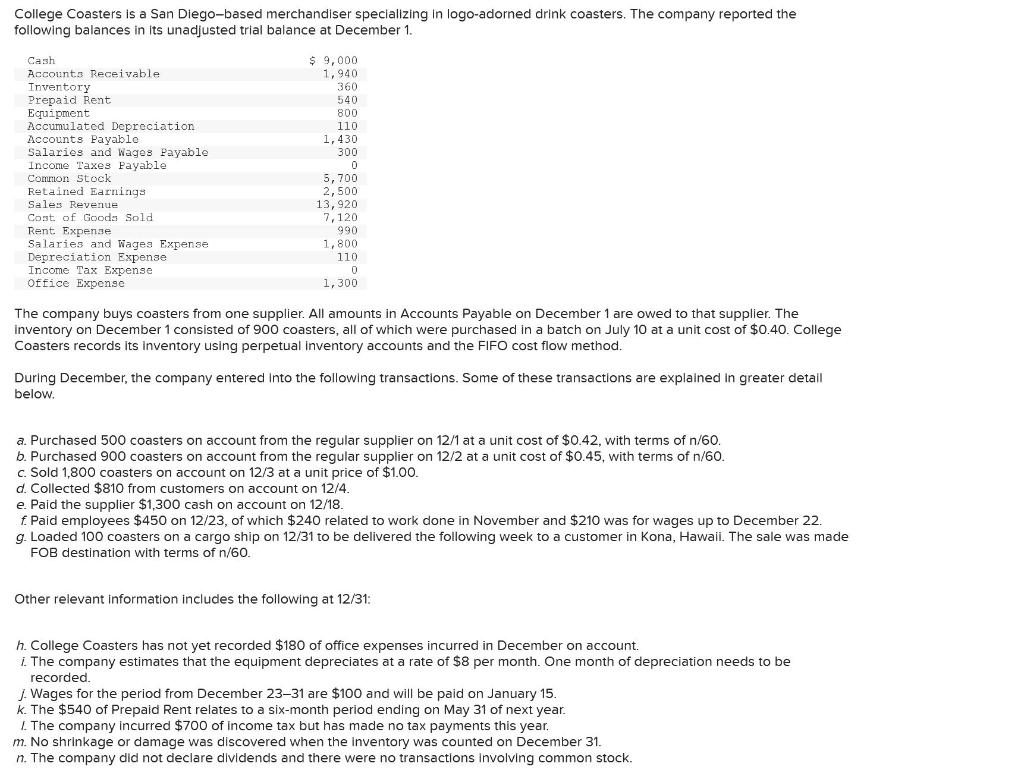

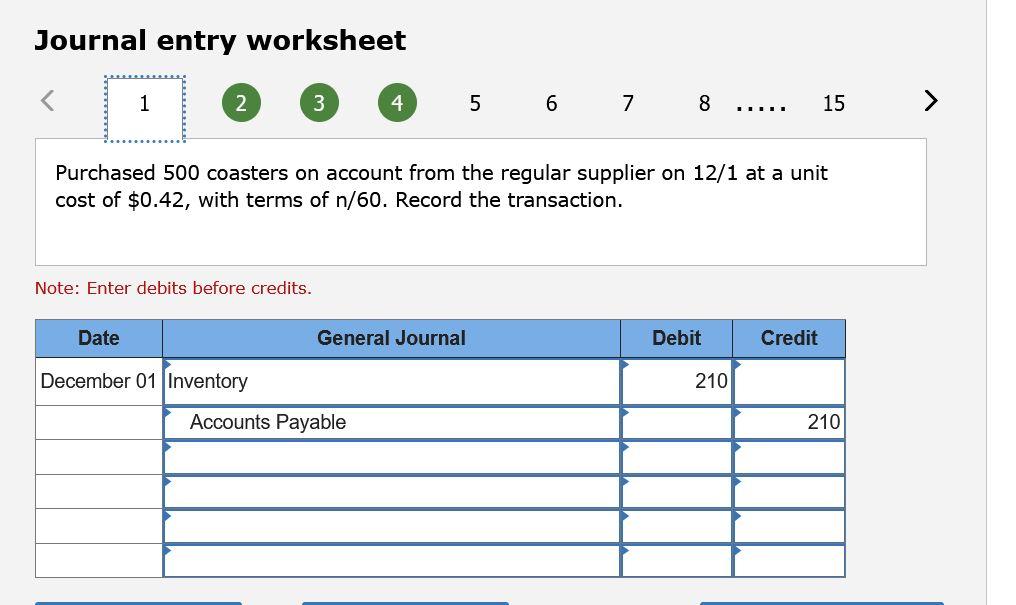

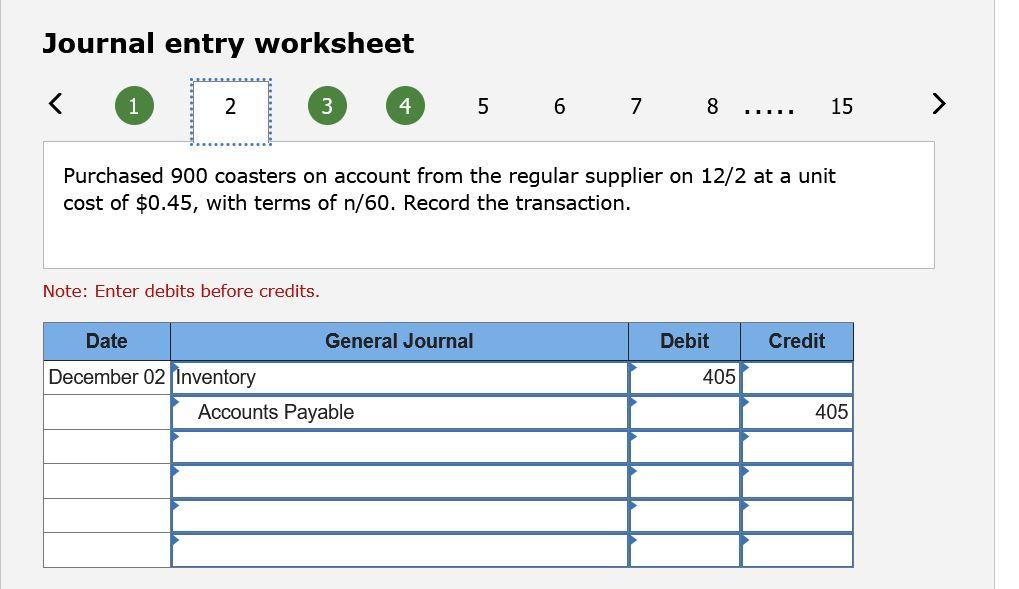

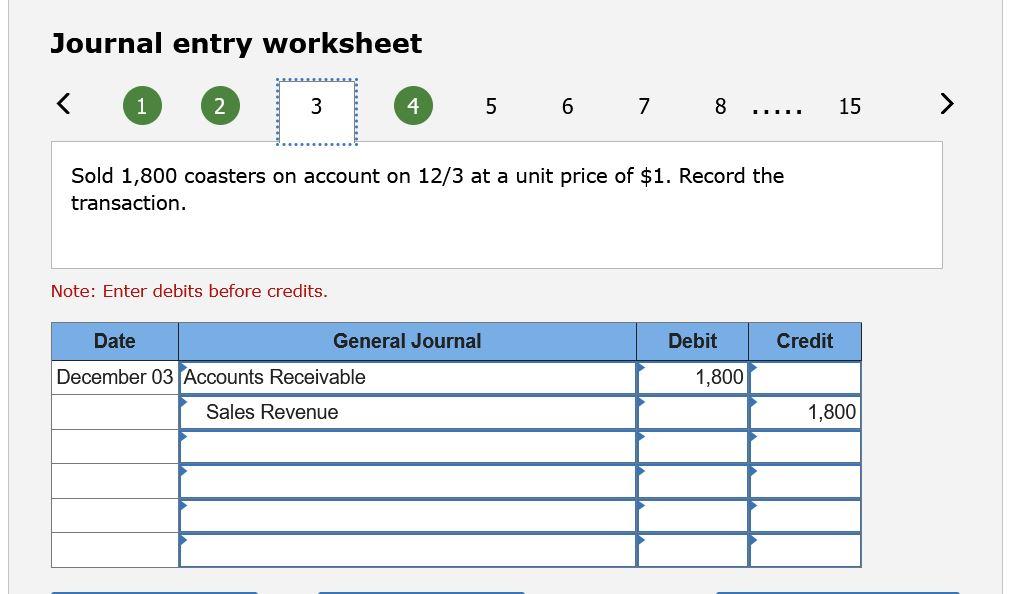

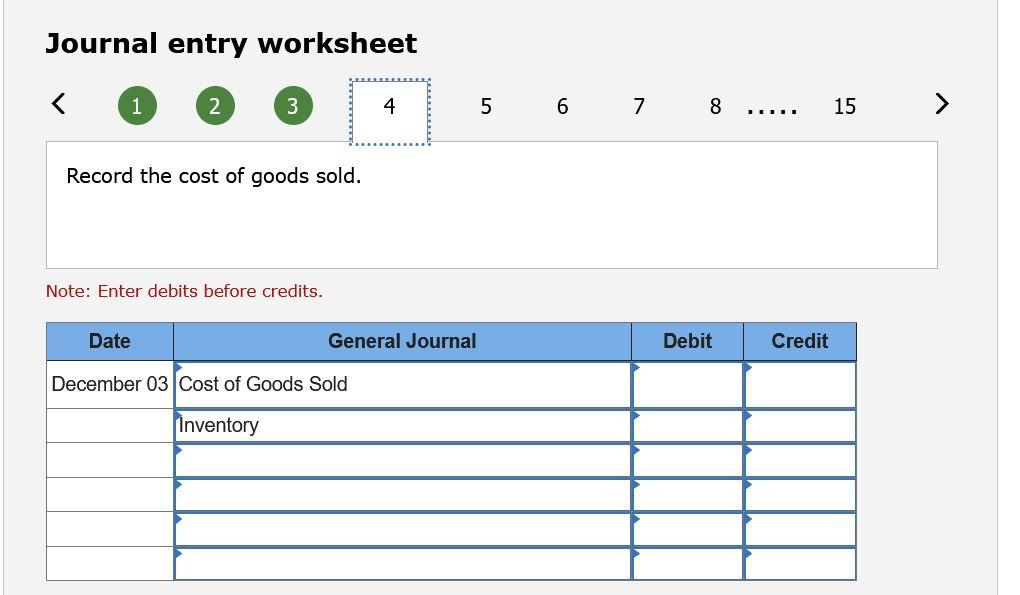

College Coasters is a San Diego-based merchandiser specializing in logo-adorned drink coasters. The company reported the following balances in its unadjusted trial balance at December 1. $ 9,000 1,940 360 540 800 110 1,430 300 Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation Accounts Payablo Salaries and Wages Payable Income Taxes Payable Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Salaries and Wages Expense Depreciation Expense Income Tax Expense Office Expense 5,700 2,500 13,920 7,120 990 1,800 110 0 1,300 The company buys coasters from one supplier. All amounts in Accounts Payable on December 1 are owed to that supplier. The Inventory on December 1 consisted of 900 coasters, all of which were purchased in a batch on July 10 at a unit cost of $0.40. College Coasters records its inventory using perpetual Inventory accounts and the FIFO cost flow method. During December, the company entered into the following transactions. Some of these transactions are explained in greater detail below. a. Purchased 500 coasters on account from the regular supplier on 12/1 at a unit cost of $0.42, with terms of n/60. b. Purchased 900 coasters on account from the regular supplier on 12/2 at a unit cost of $0.45, with terms of n/60. c. Sold 1,800 coasters on account on 12/3 at a unit price of $1.00. d. Collected $810 from customers on account on 12/4. e Paid the supplier $1,300 cash on account on 12/18. f Paid employees $450 on 12/23, of which $240 related to work done in November and $210 was for wages up to December 22. g. Loaded 100 coasters on a cargo ship on 12/31 to be delivered the following week to a customer in Kona, Hawaii. The sale was made FOB destination with terms of n/60. Other relevant information includes the following at 12/31: h. College Coasters has not yet recorded $180 of office expenses incurred in December on account. 1. The company estimates that the equipment depreciates at a rate of $8 per month. One month of depreciation needs to be recorded. 1. Wages for the period from December 23-31 are $100 and will be paid on January 15. k. The $540 of Prepaid Rent relates to a six-month period ending on May 31 of next year. 1. The company incurred $700 of income tax but has made no tax payments this year. m. No shrinkage or damage was discovered when the inventory was counted on December 31. n. The company did not declare dividends and there were no transactions involving common stock. Journal entry worksheet 1 2 3 4 5 6 7 8 15 > Purchased 500 coasters on account from the regular supplier on 12/1 at a unit cost of $0.42, with terms of n/60. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit December 01 Inventory 210 Accounts Payable 210 Journal entry worksheet 1 2 3 4 5 6 7 6 8 III. 15 Purchased 900 coasters on account from the regular supplier on 12/2 at a unit cost of $0.45, with terms of n/60. Record the transaction. Note: Enter debits before credits. Date General Journal Debit Credit 405 December 02 Inventory Accounts Payable 405 Journal entry worksheet 1 2 3 4 5 6 7 8 15 Sold 1,800 coasters on account on 12/3 at a unit price of $1. Record the transaction. Note: Enter debits before credits. Debit Credit Date General Journal December 03 Accounts Receivable 1,800 Sales Revenue 1,800 Journal entry worksheet