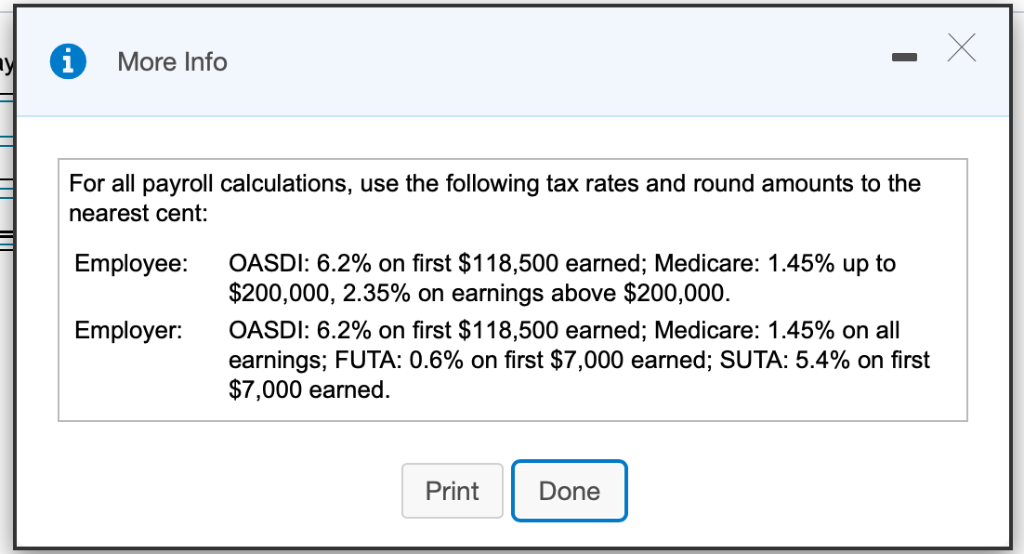

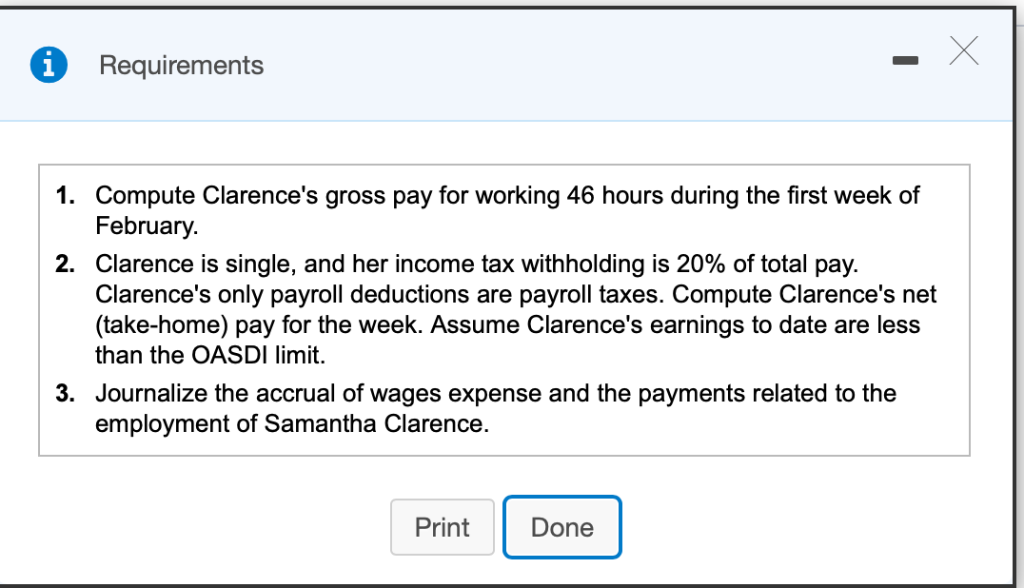

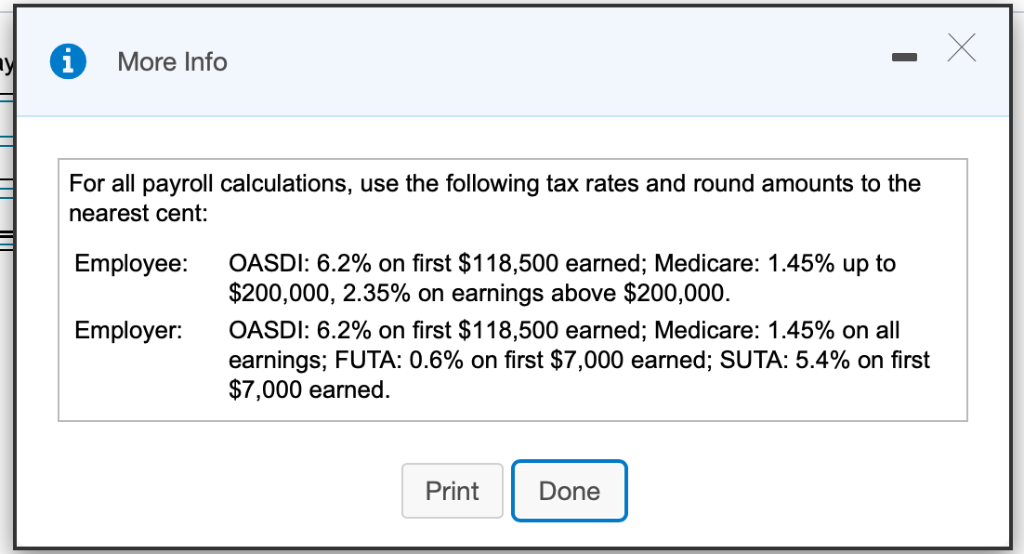

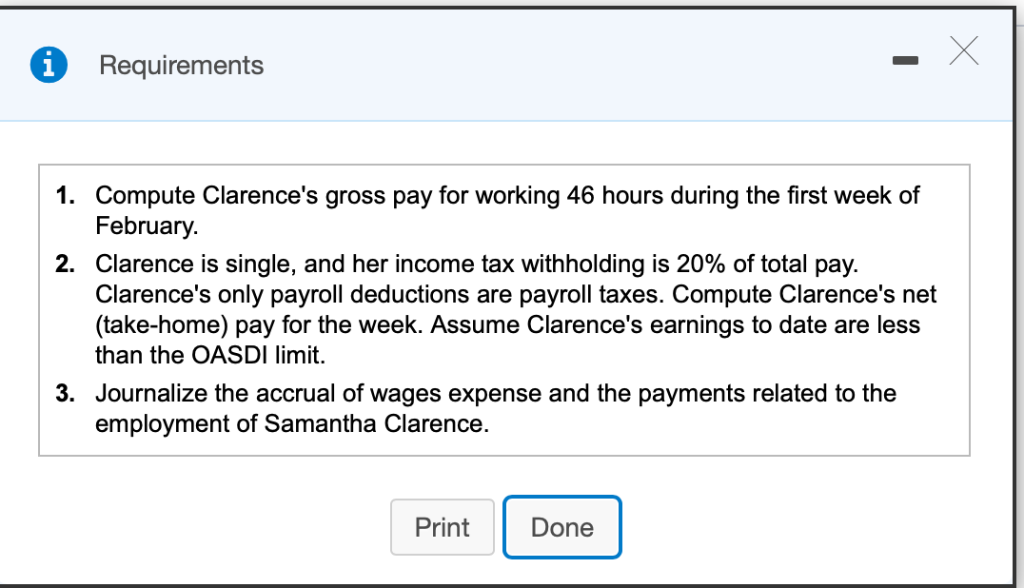

College of Austin and is paid $45 per hour for a 40-hour workweek and time-and-a-half for hours above 40. Samantha Clarence works i Click the icon to view payroll tax rate information.) Read the requirements Requirement 1. Compute Clarence's gross pay for working 46 hours during the first week of February Gross Pay (i More Info y For all payroll calculations, use the following tax rates and round amounts to the nearest cent: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned Employer: Print Done iRequirements 1. Compute Clarence's gross pay for working 46 hours during the first week of February 2. Clarence is single, and her income tax withholding is 20% of total pay. Clarence's only payroll deductions are payroll taxes. Compute Clarence's net (take-home) pay for the week. Assume Clarence's earnings to date are less than the OASDI limit. 3. Journalize the accrual of wages expense and the payments related to the employment of Samantha Clarence. Print Done College of Austin and is paid $45 per hour for a 40-hour workweek and time-and-a-half for hours above 40. Samantha Clarence works i Click the icon to view payroll tax rate information.) Read the requirements Requirement 1. Compute Clarence's gross pay for working 46 hours during the first week of February Gross Pay (i More Info y For all payroll calculations, use the following tax rates and round amounts to the nearest cent: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned Employer: Print Done iRequirements 1. Compute Clarence's gross pay for working 46 hours during the first week of February 2. Clarence is single, and her income tax withholding is 20% of total pay. Clarence's only payroll deductions are payroll taxes. Compute Clarence's net (take-home) pay for the week. Assume Clarence's earnings to date are less than the OASDI limit. 3. Journalize the accrual of wages expense and the payments related to the employment of Samantha Clarence. Print Done