Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In September 2021 Apple shares are priced at $180 a share. You believe that they are considerably overvalued and are worth only $65 a

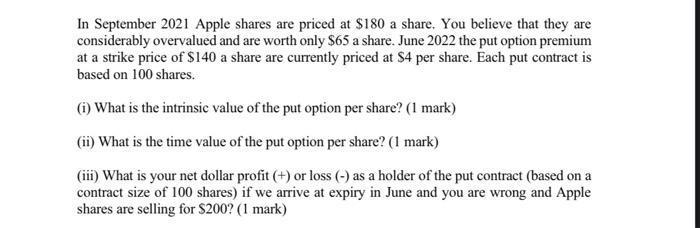

In September 2021 Apple shares are priced at $180 a share. You believe that they are considerably overvalued and are worth only $65 a share. June 2022 the put option premium at a strike price of $140 a share are currently priced at $4 per share. Each put contract is based on 100 shares. (i) What is the intrinsic value of the put option per share? (1 mark) (ii) What is the time value of the put option per share? (1 mark) (iii) What is your net dollar profit (+) or loss (-) as a holder of the put contract (based on a contract size of 100 shares) if we arrive at expiry in June and you are wrong and Apple shares are selling for $200? (1 mark)

Step by Step Solution

★★★★★

3.50 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i The intrinsic value of put option is MaxStrike P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635e3a4a18fd6_182533.pdf

180 KBs PDF File

635e3a4a18fd6_182533.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started