You are the newly appointed financial manager of The Shoebox (Pty) Ltd, which operates a chain of 20 large retail shoe stores in and

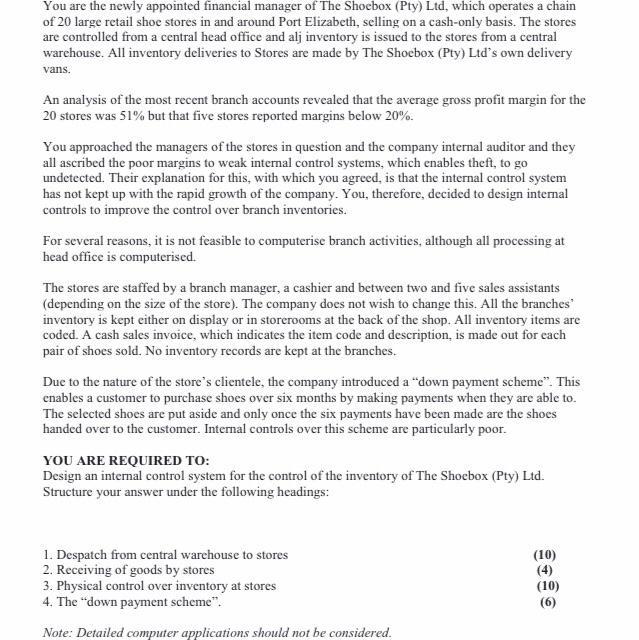

You are the newly appointed financial manager of The Shoebox (Pty) Ltd, which operates a chain of 20 large retail shoe stores in and around Port Elizabeth, selling on a cash-only basis. The stores are controlled from a central head office and alj inventory is issued to the stores from a central warehouse. All inventory deliveries to Stores are made by The Shoebox (Pty) Ltd's own delivery vans. An analysis of the most recent branch accounts revealed that the average gross profit margin for the 20 stores was 51% but that five stores reported margins below 20%. You approached the managers of the stores in question and the company internal auditor and they all ascribed the poor margins to weak internal control systems, which enables theft, to go undetected. Their explanation for this, with which you agreed, is that the internal control system has not kept up with the rapid growth of the company. You, therefore, decided to design internal controls to improve the control over branch inventories. For several reasons, it is not feasible to computerise branch activities, although all processing at head office is computerised. The stores are staffed by a branch manager, a cashier and between two and five sales assistants (depending on the size of the store). The company does not wish to change this. All the branches inventory is kept either on display or in storerooms at the back of the shop. All inventory items are coded. A cash sales invoice, which indicates the item code and description, is made out for each pair of shoes sold. No inventory records are kept at the branches. Due to the nature of the store's clientele, the company introduced a "down payment scheme". This enables a customer to purchase shoes over six months by making payments when they are able to. The selected shoes are put aside and only once the six payments have been made are the shoes handed over to the customer. Internal controls over this scheme are particularly poor. YOU ARE REQUIRED TO: Design an internal control system for the control of the inventory of The Shoebox (Pty) Ltd. Structure your answer under the following headings: 1. Despatch from central warehouse to stores (10) 2. Receiving of goods by stores 3. Physical control over inventory at stores 4. The "down payment scheme". Note: Detailed computer applications should not be considered. (10) (6)

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Despatch from the central warehouse to store Answer The biggest theft threats often come from inside a company Employees are in the best position to steal and your companys warehouse is a perfect ta...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started