Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Collier's Clothing, Inc. was founded 3 0 years ago in Sarasota, Florida as a full - service retail men's clothing provider by the firm's founder,

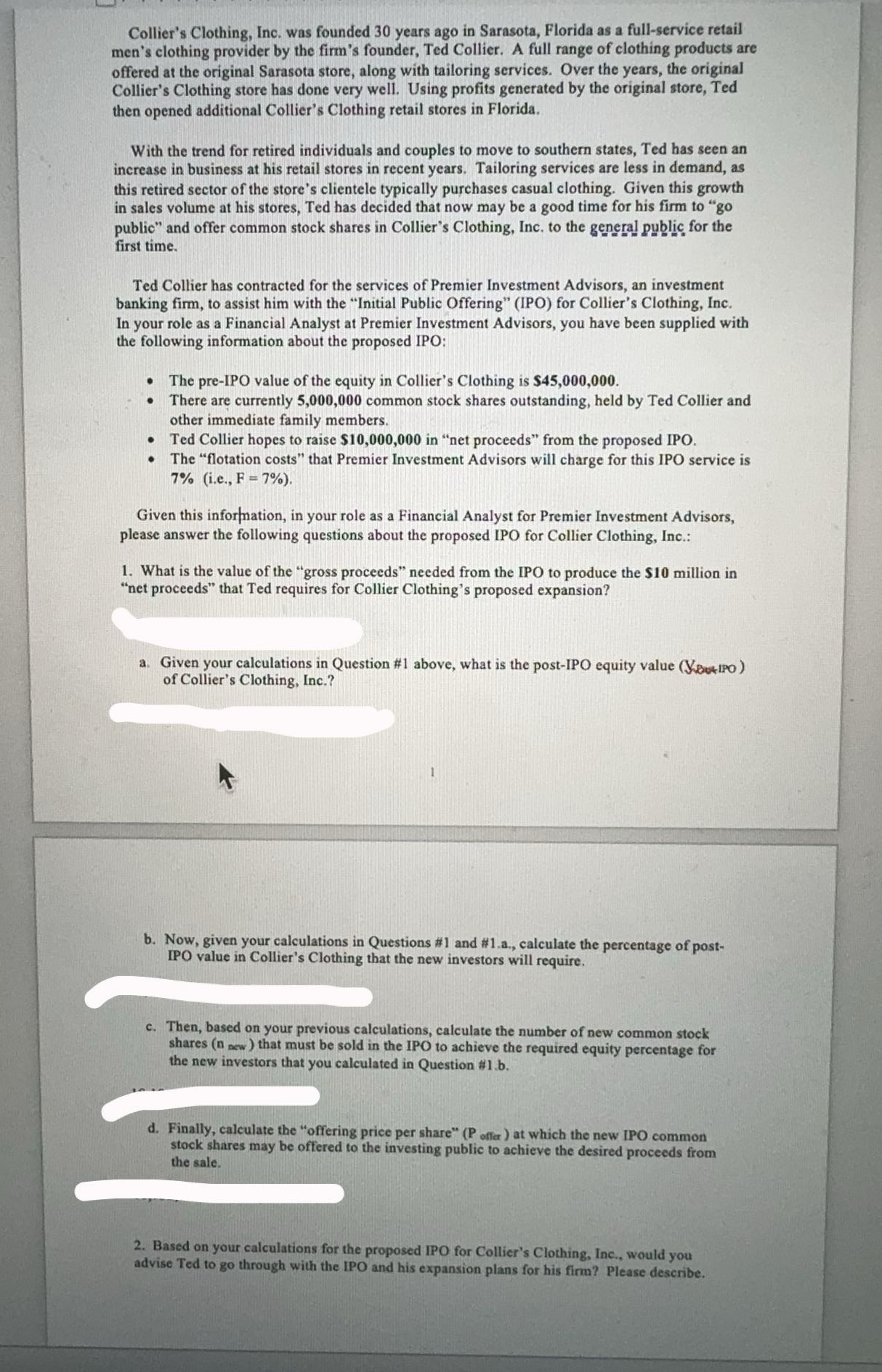

Collier's Clothing, Inc. was founded years ago in Sarasota, Florida as a fullservice retail men's clothing provider by the firm's founder, Ted Collier. A full range of clothing products are offered at the original Sarasota store, along with tailoring services. Over the years, the original Collier's Clothing store has done very well. Using profits generated by the original store, Ted then opened additional Collier's Clothing retail stores in Florida.

With the trend for retired individuals and couples to move to southern states, Ted has seen an increase in business at his retail stores in recent years. Tailoring services are less in demand, as this retired sector of the store's clientele typically purchases casual clothing. Given this growth in sales volume at his stores, Ted has decided that now may be a good time for his firm to go public" and offer common stock shares in Collier's Clothing, Inc. to the general public for the first time.

Ted Collier has contracted for the services of Premier Investment Advisors, an investment banking firm, to assist him with the "Initial Public Offering" IPO for Collier's Clothing, Inc. In your role as a Financial Analyst at Premier Investment Advisors, you have been supplied with the following information about the proposed IPO:

The preIPO value of the equity in Collier's Clothing is $

There are currently common stock shares outstanding, held by Ted Collier and other immediate family members.

Ted Collier hopes to raise $ in "net proceeds" from the proposed IPO.

The "flotation costs" that Premier Investment Advisors will charge for this IPO service is ie

Given this inforfnation, in your role as a Financial Analyst for Premier Investment Advisors, please answer the following questions about the proposed IPO for Collier Clothing, Inc.:

What is the value of the "gross proceeds" needed from the IPO to produce the million in "net proceeds" that Ted requires for Collier Clothing's proposed expansion?

a Given your calculations in Question # above, what is the postIPO equity value of Collier's Clothing, Inc.?

b Now, given your calculations in Questions # and #a calculate the percentage of postIPO value in Collier's Clothing that the new investors will require.

c Then, based on your previous calculations, calculate the number of new common stock shares that must be sold in the IPO to achieve the required equity percentage for the new investors that you calculated in Question #b

d Finally, calculate the "offering price per share" at which the new IPO common stock shares may be offered to the investing public to achieve the desired proceeds from the sale.

Based on your calculations for the proposed IPO for Collier's Clothing, Inc., would you advise Ted to go through with the IPO and his expansion plans for his firm? Please describe.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started