Answered step by step

Verified Expert Solution

Question

1 Approved Answer

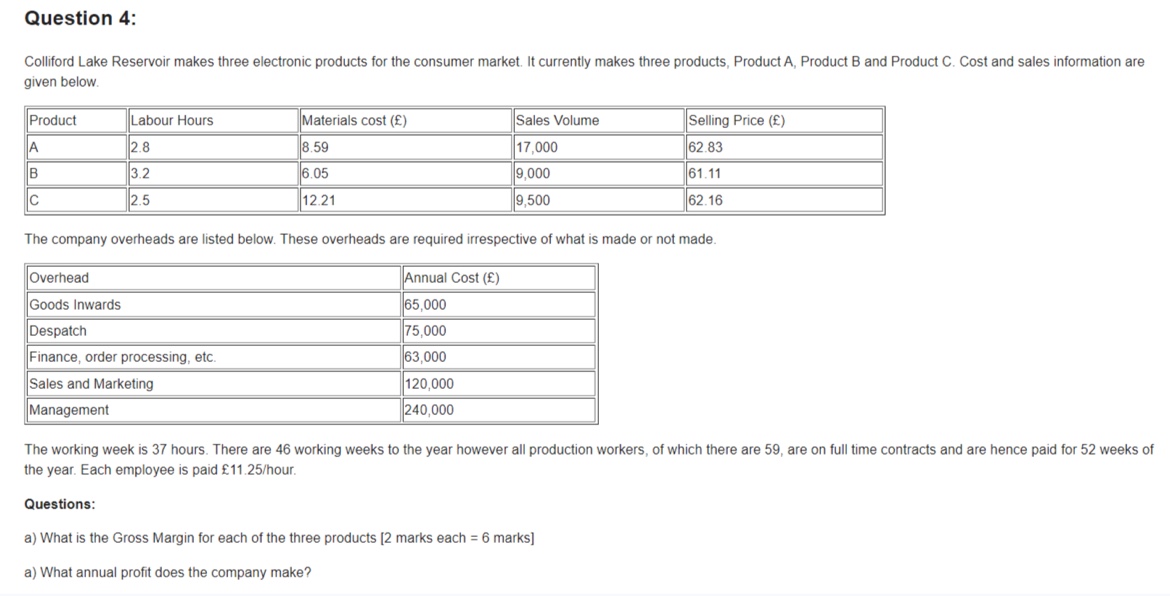

Colliford Lake Reservoir makes three electronic products for the consumer market. It currently makes three products, Product A, Product B and Product C. Cost and

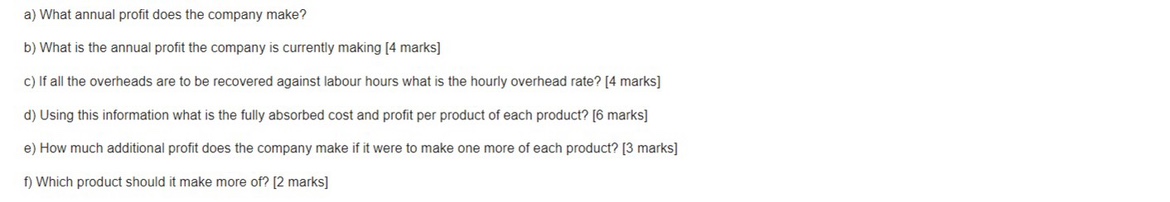

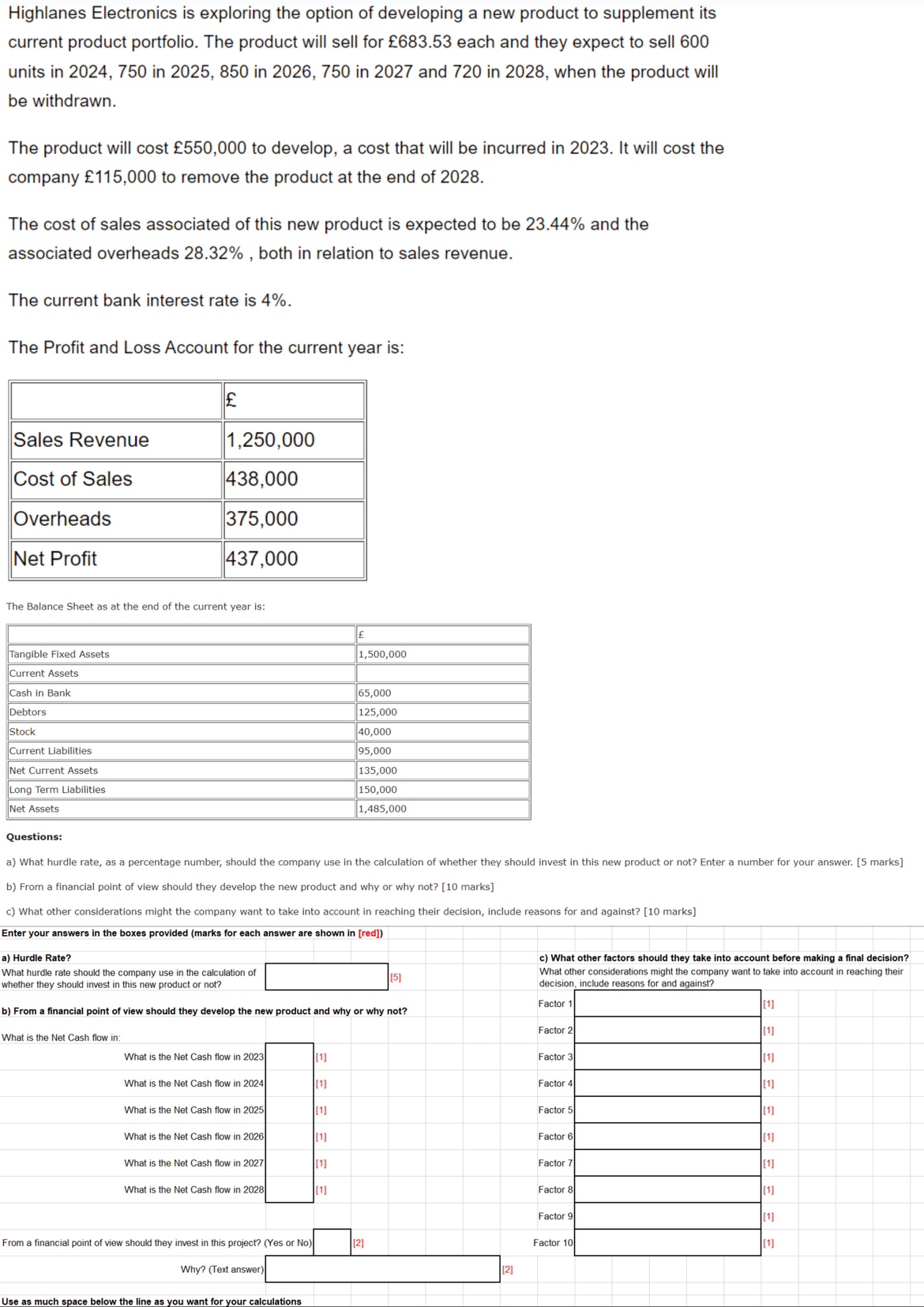

Colliford Lake Reservoir makes three electronic products for the consumer market. It currently makes three products, Product A, Product B and Product C. Cost and sales information are given below. The company overheads are listed below. These overheads are required irrespective of what is made or not made. The working week is 37 hours. There are 46 working weeks to the year however all production workers, of which there are 59 , are on full time contracts and are hence paid for 52 weeks of the year. Each employee is paid 11.25/ hour. Questions: a) What is the Gross Margin for each of the three products [2 marks each = 6 marks] a) What annual profit does the company make? a) What annual profit does the company make? b) What is the annual profit the company is currently making [4 marks] c) If all the overheads are to be recovered against labour hours what is the hourly overhead rate? [4 marks] d) Using this information what is the fully absorbed cost and profit per product of each product? [6 marks] e) How much additional profit does the company make if it were to make one more of each product? [3 marks] f) Which product should it make more of? [2 marks] Highlanes Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 683.53 each and they expect to sell 600 units in 2024,750 in 2025, 850 in 2026, 750 in 2027 and 720 in 2028, when the product will be withdrawn. The product will cost 550,000 to develop, a cost that will be incurred in 2023. It will cost the company 115,000 to remove the product at the end of 2028 . The cost of sales associated of this new product is expected to be 23.44% and the associated overheads 28.32%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for the current year is: The Balance Sheet as at the end of the current year is: Questions: b) From a financial point of view should they develop the new product and why or why not? [10 marks] c) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? [10 marks] Enter your answers in the boxes provided (marks for each answer are shown in [red]) a) Hurdle Rate? c) What other factors should they take into account before making a final decision? What hurdle rate should the company use in the calculation of What other considerations might the company want to take into account in reaching their whether they should invest in this new product or not? b) From a financial point of view should they develop the new product and why or why not? What is the Nat Cach flow in From a financial point of view should they invest in this project? (Yes or No) \lceil Colliford Lake Reservoir makes three electronic products for the consumer market. It currently makes three products, Product A, Product B and Product C. Cost and sales information are given below. The company overheads are listed below. These overheads are required irrespective of what is made or not made. The working week is 37 hours. There are 46 working weeks to the year however all production workers, of which there are 59 , are on full time contracts and are hence paid for 52 weeks of the year. Each employee is paid 11.25/ hour. Questions: a) What is the Gross Margin for each of the three products [2 marks each = 6 marks] a) What annual profit does the company make? a) What annual profit does the company make? b) What is the annual profit the company is currently making [4 marks] c) If all the overheads are to be recovered against labour hours what is the hourly overhead rate? [4 marks] d) Using this information what is the fully absorbed cost and profit per product of each product? [6 marks] e) How much additional profit does the company make if it were to make one more of each product? [3 marks] f) Which product should it make more of? [2 marks] Highlanes Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 683.53 each and they expect to sell 600 units in 2024,750 in 2025, 850 in 2026, 750 in 2027 and 720 in 2028, when the product will be withdrawn. The product will cost 550,000 to develop, a cost that will be incurred in 2023. It will cost the company 115,000 to remove the product at the end of 2028 . The cost of sales associated of this new product is expected to be 23.44% and the associated overheads 28.32%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for the current year is: The Balance Sheet as at the end of the current year is: Questions: b) From a financial point of view should they develop the new product and why or why not? [10 marks] c) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? [10 marks] Enter your answers in the boxes provided (marks for each answer are shown in [red]) a) Hurdle Rate? c) What other factors should they take into account before making a final decision? What hurdle rate should the company use in the calculation of What other considerations might the company want to take into account in reaching their whether they should invest in this new product or not? b) From a financial point of view should they develop the new product and why or why not? What is the Nat Cach flow in From a financial point of view should they invest in this project? (Yes or No) \lceil

Colliford Lake Reservoir makes three electronic products for the consumer market. It currently makes three products, Product A, Product B and Product C. Cost and sales information are given below. The company overheads are listed below. These overheads are required irrespective of what is made or not made. The working week is 37 hours. There are 46 working weeks to the year however all production workers, of which there are 59 , are on full time contracts and are hence paid for 52 weeks of the year. Each employee is paid 11.25/ hour. Questions: a) What is the Gross Margin for each of the three products [2 marks each = 6 marks] a) What annual profit does the company make? a) What annual profit does the company make? b) What is the annual profit the company is currently making [4 marks] c) If all the overheads are to be recovered against labour hours what is the hourly overhead rate? [4 marks] d) Using this information what is the fully absorbed cost and profit per product of each product? [6 marks] e) How much additional profit does the company make if it were to make one more of each product? [3 marks] f) Which product should it make more of? [2 marks] Highlanes Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 683.53 each and they expect to sell 600 units in 2024,750 in 2025, 850 in 2026, 750 in 2027 and 720 in 2028, when the product will be withdrawn. The product will cost 550,000 to develop, a cost that will be incurred in 2023. It will cost the company 115,000 to remove the product at the end of 2028 . The cost of sales associated of this new product is expected to be 23.44% and the associated overheads 28.32%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for the current year is: The Balance Sheet as at the end of the current year is: Questions: b) From a financial point of view should they develop the new product and why or why not? [10 marks] c) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? [10 marks] Enter your answers in the boxes provided (marks for each answer are shown in [red]) a) Hurdle Rate? c) What other factors should they take into account before making a final decision? What hurdle rate should the company use in the calculation of What other considerations might the company want to take into account in reaching their whether they should invest in this new product or not? b) From a financial point of view should they develop the new product and why or why not? What is the Nat Cach flow in From a financial point of view should they invest in this project? (Yes or No) \lceil Colliford Lake Reservoir makes three electronic products for the consumer market. It currently makes three products, Product A, Product B and Product C. Cost and sales information are given below. The company overheads are listed below. These overheads are required irrespective of what is made or not made. The working week is 37 hours. There are 46 working weeks to the year however all production workers, of which there are 59 , are on full time contracts and are hence paid for 52 weeks of the year. Each employee is paid 11.25/ hour. Questions: a) What is the Gross Margin for each of the three products [2 marks each = 6 marks] a) What annual profit does the company make? a) What annual profit does the company make? b) What is the annual profit the company is currently making [4 marks] c) If all the overheads are to be recovered against labour hours what is the hourly overhead rate? [4 marks] d) Using this information what is the fully absorbed cost and profit per product of each product? [6 marks] e) How much additional profit does the company make if it were to make one more of each product? [3 marks] f) Which product should it make more of? [2 marks] Highlanes Electronics is exploring the option of developing a new product to supplement its current product portfolio. The product will sell for 683.53 each and they expect to sell 600 units in 2024,750 in 2025, 850 in 2026, 750 in 2027 and 720 in 2028, when the product will be withdrawn. The product will cost 550,000 to develop, a cost that will be incurred in 2023. It will cost the company 115,000 to remove the product at the end of 2028 . The cost of sales associated of this new product is expected to be 23.44% and the associated overheads 28.32%, both in relation to sales revenue. The current bank interest rate is 4%. The Profit and Loss Account for the current year is: The Balance Sheet as at the end of the current year is: Questions: b) From a financial point of view should they develop the new product and why or why not? [10 marks] c) What other considerations might the company want to take into account in reaching their decision, include reasons for and against? [10 marks] Enter your answers in the boxes provided (marks for each answer are shown in [red]) a) Hurdle Rate? c) What other factors should they take into account before making a final decision? What hurdle rate should the company use in the calculation of What other considerations might the company want to take into account in reaching their whether they should invest in this new product or not? b) From a financial point of view should they develop the new product and why or why not? What is the Nat Cach flow in From a financial point of view should they invest in this project? (Yes or No) \lceil Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started