Answered step by step

Verified Expert Solution

Question

1 Approved Answer

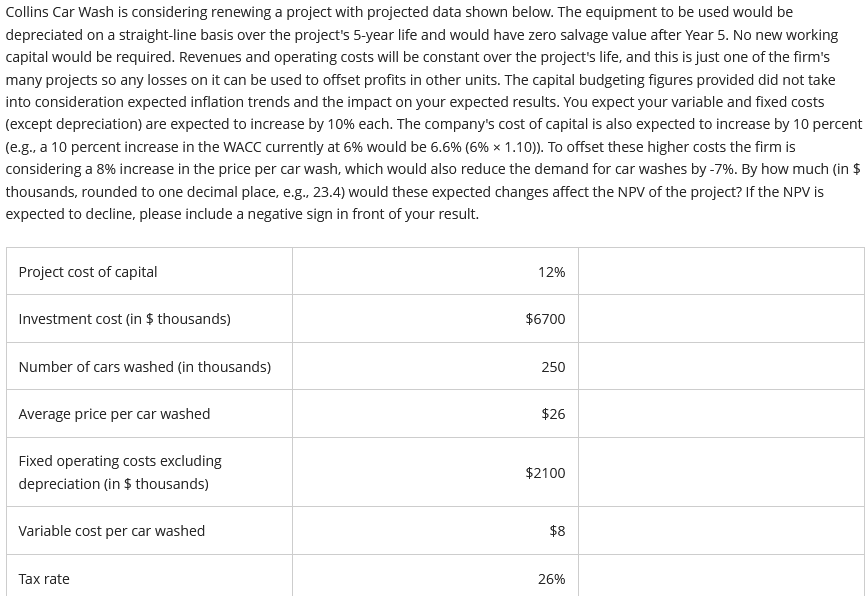

Collins Car Wash is considering renewing a project with projected data shown below. The equipment to be used would be depreciated on a straight -

Collins Car Wash is considering renewing a project with projected data shown below. The equipment to be used would be depreciated on a straightline basis over the project's year life and would have zero salvage value after Year No new working capital would be required. Revenues and operating costs will be constant over the project's life, and this is just one of the firm's many projects so any losses on it can be used to offset profits in other units. The capital budgeting figures provided did not take into consideration expected inflation trends and the impact on your expected results. You expect your variable and fixed costs except depreciation are expected to increase by each. The company's cost of capital is also expected to increase by percent eg a percent increase in the WACC currently at would be times To offset these higher costs the firm is considering a increase in the price per car wash, which would also reduce the demand for car washes by By how much in $ thousands, rounded to one decimal place, eg would these expected changes affect the NPV of the project? If the NPV is expected to decline, please include a negative sign in front of your result.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started