Question

Colonial North Manufacturing, Inc. is considering eliminating one of its product lines. The fixed costs currently allocated to the product line will be allocated

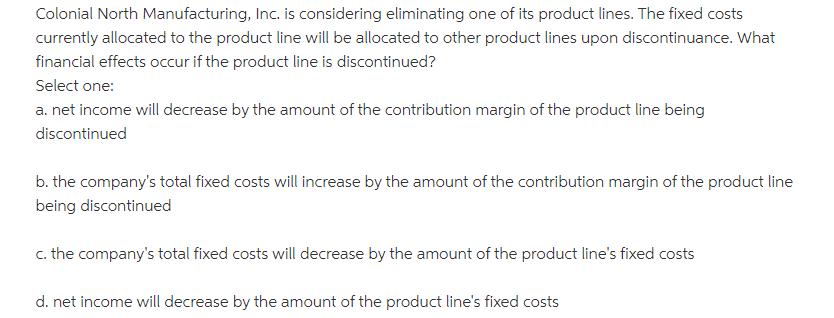

Colonial North Manufacturing, Inc. is considering eliminating one of its product lines. The fixed costs currently allocated to the product line will be allocated to other product lines upon discontinuance. What financial effects occur if the product line is discontinued? Select one: a. net income will decrease by the amount of the contribution margin of the product line being discontinued b. the company's total fixed costs will increase by the amount of the contribution margin of the product line being discontinued c. the company's total fixed costs will decrease by the amount of the product line's fixed costs d. net income will decrease by the amount of the product line's fixed costs

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answers Answer Correct Answer Option A Net income will de...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: John J. Wild, Ken W. Shaw

2010 Edition

9789813155497, 73379581, 9813155493, 978-0073379586

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App