Question

Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the products they produce. AC

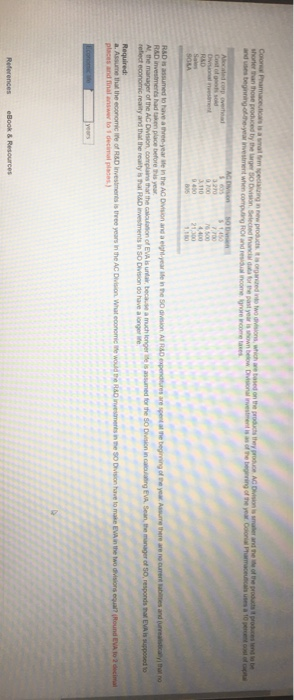

Colonial Pharmaceuticals is a small firm specializing in new products. It is organized into two divisions, which are based on the products they produce. AC Division is smaller and the life of the products it produces tend to be shorter than those produced by the larger SO Division. Selected financial data for the past year is shown below. Divisional investment is as of the beginning of the year. Colonial Pharmaceuticals uses a 10 percent cost of capital and uses beginning-of-the-year investment when computing ROI and residual income. Ignore income taxes.

| AC Division | SO Division | |||||

| Allocated corp. overhead | $ | 635 | $ | 1,450 | ||

| Cost of goods sold | 3,270 | 7,700 | ||||

| Divisional investment | 9,700 | 76,500 | ||||

| R&D | 3,110 | 4,400 | ||||

| Sales | 9,400 | 21,300 | ||||

| SG&A | 805 | 1,180 | ||||

R&D is assumed to have a three-year life in the AC Division and a eight-year life in the SO division. All R&D expenditures are spent at the beginning of the year. Assume there are no current liabilities and (unrealistically) that no R&D investments had taken place before this year.

Al, the manager of the AC Division, complains that the calculation of EVA is unfair, because a much longer life is assumed for the SO Division in calculating EVA. Sean, the manager of SO, responds that EVA is supposed to reflect economic reality and that the reality is that R&D investments in SO Division do have a longer life.

Required:

a. Assume that the economic life of R&D investments is three years in the AC Division. What economic life would the R&D investments in the SO Division have to make EVA in the two divisions equal? (Round EVA to 2 decimal places and final answer to 1 decimal places.)

Coro Pharmaceutica is a watum pecting new products, sowed to two sons, which we based on the products they pre AG Division is made of the products proceso shorter than those produced by the larges Division Selected and forest you is hown below Division investment is the beging of the year com a person and se beginning the year investment when com Rondres income recome so binden S 1450 320 0.700 RAD 3110 4400 21100 Son R&D assumed to have a three-year in the AC Division and an eight years in the division AIRSD expenditures are spent the beginning of the year. Assume there are no current and realistic that R&D investments had taken place before this year the manager of the AC Division, complains that the calculation of EVA is una case a much longer les assumed for the son og EVA Sean, the manager of So, responds supposed to reflect economic reality and that the reality is a RAD investments in Division do have a longer Required: 2. Assume that the economice of R&D Investments in three years in the AC Division. Wat economic we would be one in the SO Division Move to make in the two divisions equal? (Round EVA 102 decimal places and final answer to 1 decimales) References eBook & Resources

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started