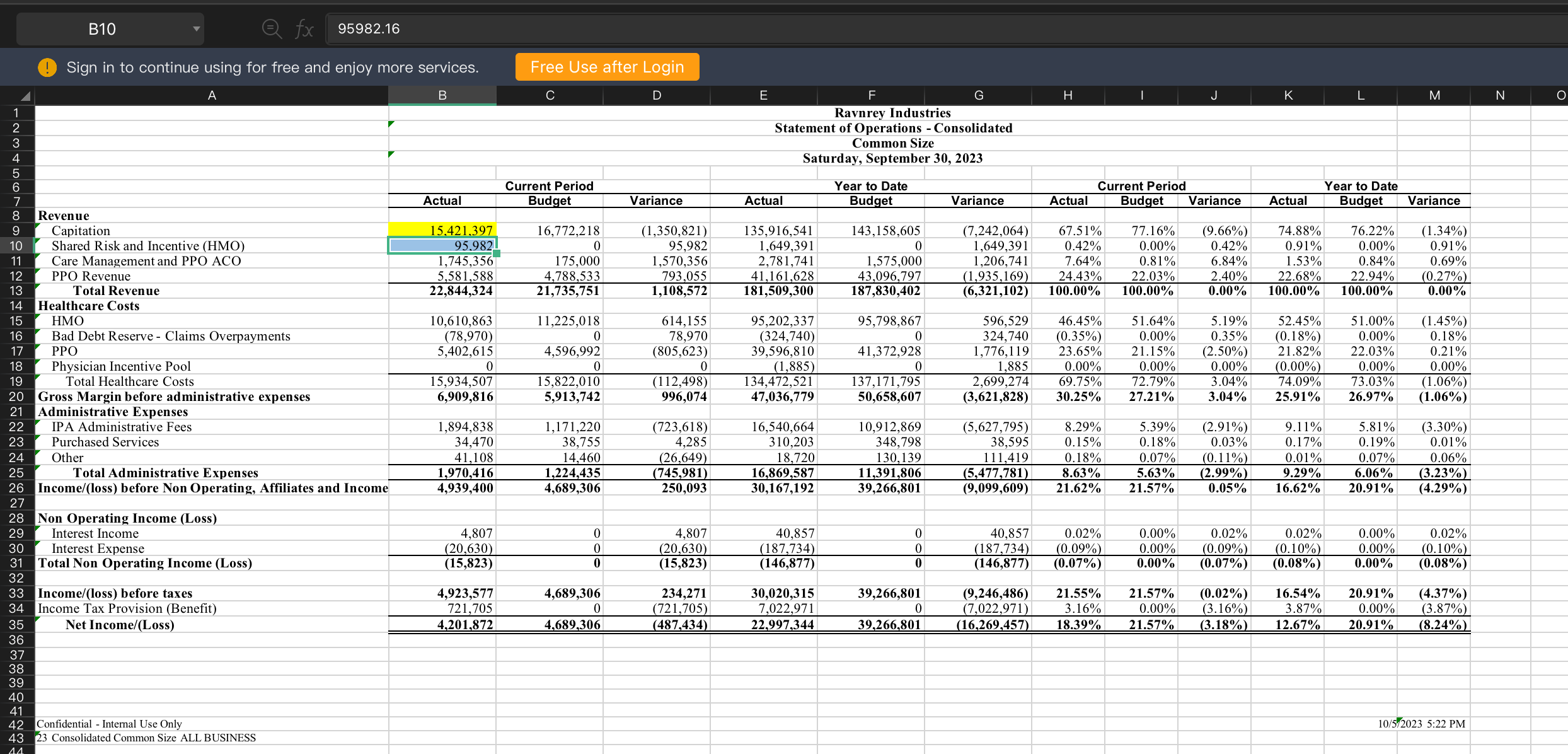

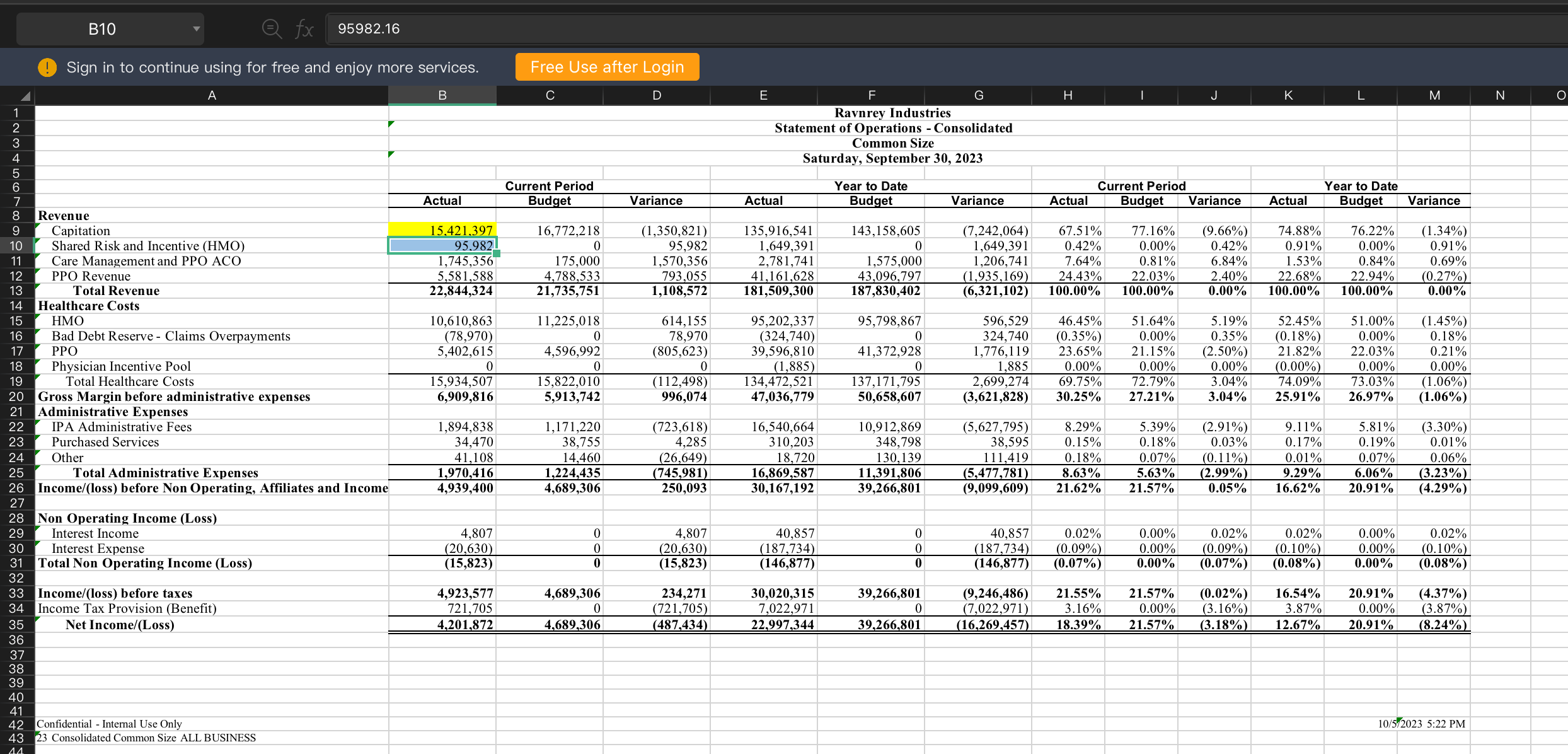

Color code what is in the revenue detail (A) what is in revenue revenue summary (F) only for the actuals.

B10 95982.16 Sign in to continue using for free and enjoy more services. Free Use after Login \begin{tabular}{|l} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} A Shared Risk and Incentive (HMO) Care Management and PPO ACO PPO Revenue Total Revenue Healthcare Costs HMO Bad Debt Reserve - Claims Overpayments PPO Physician Incentive Pool Total Healthcare Costs Gross Margin before administrative expenses Administrative Expenses IPA Administrative Fees Purchased Services Other Total Administrative Expenses Income/(loss) before Non Operating, Affiliates and Income Non Operating Income (Loss) Interest Income Interest Expense Total Non Operating Income (Loss) Income/(loss) before taxes Income Tax Provision (Benefit) Net Income/(Loss) Confidential - Internal Use Only B r E C D D F Ravnrey Industries Statement of Operations - Consolidated Common Size Saturday, September 30, 2023 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Current Period } & \multicolumn{3}{|c|}{ Year to Date } & \multicolumn{3}{|c|}{ Current Period } & \multicolumn{3}{|c|}{ Year to Date } \\ \hline Actual & Budget & Variance & Actual & Budget & Variance & Actual & Budget & Variance & Actual & Budget & Variance \\ \hline 15.421 .397 & 16,772,218 & (1,350,821) & 135,916,541 & 143,158,605 & (7,242,064) & 67.51% & 77.16% & (9.66%) & 74.88% & 76.22% & (1.34%) \\ \hline 95.982 & 0 & 95,982 & 1,649,391 & 0 & 1,649,391 & 0.42% & 0.00% & 0.42% & 0.91% & 0.00% & 0.91% \\ \hline 1,745,356 & 175,000 & 1,570,356 & 2,781,741 & 1,575,000 & 1,206,741 & 7.64% & 0.81% & 6.84% & 1.53% & 0.84% & 0.69% \\ \hline 5,581,588 & 4,788,533 & 793,055 & 41,161,628 & 43,096,797 & (1,935,169) & 24.43% & 22.03% & 2.40% & 22.68% & 22.94% & (0.27%) \\ \hline 22,844,324 & 21,735,751 & 1,108,572 & 181,509,300 & 187,830,402 & (6,321,102) & 100.00% & 100.00% & 0.00% & 100.00% & 100.00% & 0.00% \\ \hline 10,610,863 & 11,225,018 & 614,155 & 95,202,337 & 95,798,867 & 596,529 & 46.45% & 51.64% & 5.19% & 52.45% & 51.00% & (1.45%) \\ \hline(78,970) & 0 & 78,970 & (324,740) & 0 & 324,740 & (0.35%) & 0.00% & 0.35% & (0.18%) & 0.00% & 0.18% \\ \hline 5,402,615 & 4,596,992 & (805,623) & 39,596,810 & 41,372,928 & 1,776,119 & 23.65% & 21.15% & (2.50%) & 21.82% & 22.03% & 0.21% \\ \hline 0 & 0 & 0 & (1,885) & 0 & 1,885 & 0.00% & 0.00% & 0.00% & (0.00%) & 0.00% & 0.00% \\ \hline 15,934,507 & 15,822,010 & (112,498) & 134,472,521 & 137,171,795 & 2,699,274 & 69.75% & 72.79% & 3.04% & 74.09% & 73.03% & (1.06%) \\ \hline 6,909,816 & 5,913,742 & 996,074 & 47,036,779 & 50,658,607 & (3,621,828) & 30.25% & 27.21% & 3.04% & 25.91% & 26.97% & (1.06%) \\ \hline 1,894,838 & 1,171,220 & (723,618) & 16,540,664 & 10,912,869 & (5,627,795) & 8.29% & 5.39% & (2.91%) & 9.11% & 5.81% & (3.30%) \\ \hline 34,470 & 38,755 & 4,285 & 310,203 & 348,798 & 38,595 & 0.15% & 0.18% & 0.03% & 0.17% & 0.19% & 0.01% \\ \hline 41,108 & 14,460 & (26,649) & 18,720 & 130,139 & 111,419 & 0.18% & 0.07% & (0.11%) & 0.01% & 0.07% & 0.06% \\ \hline 1,970,416 & 1,224,435 & (745,981) & 16,869,587 & 11,391,806 & (5,477,781) & 8.63% & 5.63% & (2.99%) & 9.29% & 6.06% & (3.23%) \\ \hline 4,939,400 & 4,689,306 & 250,093 & 30,167,192 & 39,266,801 & (9,099,609) & 21.62% & 21.57% & 0.05% & 16.62% & 20.91% & (4.29%) \\ \hline & & & & & & & & & & & \\ \hline 4,807 & 0 & 4,807 & 40,857 & 0 & 40,857 & 0.02% & 0.00% & 0.02% & 0.02% & 0.00% & 0.02% \\ \hline(20,630) & 0 & (20,630) & (187,734) & 0 & (187,734) & (0.09%) & 0.00% & (0.09%) & (0.10%) & 0.00% & (0.10%) \\ \hline(15,823) & 0 & (15,823) & (146,877) & 0 & (146,877) & (0.07%) & 0.00% & (0.07%) & (0.08%) & 0.00% & (0.08%) \\ \hline 4,923,577 & 4,689,306 & 234,271 & 30,020,315 & 39,266,801 & (9,246,486) & 21.55% & 21.57% & (0.02%) & 16.54% & 20.91% & (4.37%) \\ \hline 721,705 & 0 & (721,705) & 7,022,971 & 0 & (7,022,971) & 3.16% & 0.00% & (3.16%) & 3.87% & 0.00% & (3.87%) \\ \hline 4,201,872 & 4,689,306 & (487,434) & 22,997,344 & 39,266,801 & (16,269,457) & 18.39% & 21.57% & (3.18%) & 12.67% & 20.91% & (8.24%) \\ \hline \end{tabular} 3 Consolidated Common Size ALL BUSINESS 10/5/2023 5:22 PM B10 95982.16 Sign in to continue using for free and enjoy more services. Free Use after Login \begin{tabular}{|l} \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \end{tabular} A Shared Risk and Incentive (HMO) Care Management and PPO ACO PPO Revenue Total Revenue Healthcare Costs HMO Bad Debt Reserve - Claims Overpayments PPO Physician Incentive Pool Total Healthcare Costs Gross Margin before administrative expenses Administrative Expenses IPA Administrative Fees Purchased Services Other Total Administrative Expenses Income/(loss) before Non Operating, Affiliates and Income Non Operating Income (Loss) Interest Income Interest Expense Total Non Operating Income (Loss) Income/(loss) before taxes Income Tax Provision (Benefit) Net Income/(Loss) Confidential - Internal Use Only B r E C D D F Ravnrey Industries Statement of Operations - Consolidated Common Size Saturday, September 30, 2023 \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{3}{|c|}{ Current Period } & \multicolumn{3}{|c|}{ Year to Date } & \multicolumn{3}{|c|}{ Current Period } & \multicolumn{3}{|c|}{ Year to Date } \\ \hline Actual & Budget & Variance & Actual & Budget & Variance & Actual & Budget & Variance & Actual & Budget & Variance \\ \hline 15.421 .397 & 16,772,218 & (1,350,821) & 135,916,541 & 143,158,605 & (7,242,064) & 67.51% & 77.16% & (9.66%) & 74.88% & 76.22% & (1.34%) \\ \hline 95.982 & 0 & 95,982 & 1,649,391 & 0 & 1,649,391 & 0.42% & 0.00% & 0.42% & 0.91% & 0.00% & 0.91% \\ \hline 1,745,356 & 175,000 & 1,570,356 & 2,781,741 & 1,575,000 & 1,206,741 & 7.64% & 0.81% & 6.84% & 1.53% & 0.84% & 0.69% \\ \hline 5,581,588 & 4,788,533 & 793,055 & 41,161,628 & 43,096,797 & (1,935,169) & 24.43% & 22.03% & 2.40% & 22.68% & 22.94% & (0.27%) \\ \hline 22,844,324 & 21,735,751 & 1,108,572 & 181,509,300 & 187,830,402 & (6,321,102) & 100.00% & 100.00% & 0.00% & 100.00% & 100.00% & 0.00% \\ \hline 10,610,863 & 11,225,018 & 614,155 & 95,202,337 & 95,798,867 & 596,529 & 46.45% & 51.64% & 5.19% & 52.45% & 51.00% & (1.45%) \\ \hline(78,970) & 0 & 78,970 & (324,740) & 0 & 324,740 & (0.35%) & 0.00% & 0.35% & (0.18%) & 0.00% & 0.18% \\ \hline 5,402,615 & 4,596,992 & (805,623) & 39,596,810 & 41,372,928 & 1,776,119 & 23.65% & 21.15% & (2.50%) & 21.82% & 22.03% & 0.21% \\ \hline 0 & 0 & 0 & (1,885) & 0 & 1,885 & 0.00% & 0.00% & 0.00% & (0.00%) & 0.00% & 0.00% \\ \hline 15,934,507 & 15,822,010 & (112,498) & 134,472,521 & 137,171,795 & 2,699,274 & 69.75% & 72.79% & 3.04% & 74.09% & 73.03% & (1.06%) \\ \hline 6,909,816 & 5,913,742 & 996,074 & 47,036,779 & 50,658,607 & (3,621,828) & 30.25% & 27.21% & 3.04% & 25.91% & 26.97% & (1.06%) \\ \hline 1,894,838 & 1,171,220 & (723,618) & 16,540,664 & 10,912,869 & (5,627,795) & 8.29% & 5.39% & (2.91%) & 9.11% & 5.81% & (3.30%) \\ \hline 34,470 & 38,755 & 4,285 & 310,203 & 348,798 & 38,595 & 0.15% & 0.18% & 0.03% & 0.17% & 0.19% & 0.01% \\ \hline 41,108 & 14,460 & (26,649) & 18,720 & 130,139 & 111,419 & 0.18% & 0.07% & (0.11%) & 0.01% & 0.07% & 0.06% \\ \hline 1,970,416 & 1,224,435 & (745,981) & 16,869,587 & 11,391,806 & (5,477,781) & 8.63% & 5.63% & (2.99%) & 9.29% & 6.06% & (3.23%) \\ \hline 4,939,400 & 4,689,306 & 250,093 & 30,167,192 & 39,266,801 & (9,099,609) & 21.62% & 21.57% & 0.05% & 16.62% & 20.91% & (4.29%) \\ \hline & & & & & & & & & & & \\ \hline 4,807 & 0 & 4,807 & 40,857 & 0 & 40,857 & 0.02% & 0.00% & 0.02% & 0.02% & 0.00% & 0.02% \\ \hline(20,630) & 0 & (20,630) & (187,734) & 0 & (187,734) & (0.09%) & 0.00% & (0.09%) & (0.10%) & 0.00% & (0.10%) \\ \hline(15,823) & 0 & (15,823) & (146,877) & 0 & (146,877) & (0.07%) & 0.00% & (0.07%) & (0.08%) & 0.00% & (0.08%) \\ \hline 4,923,577 & 4,689,306 & 234,271 & 30,020,315 & 39,266,801 & (9,246,486) & 21.55% & 21.57% & (0.02%) & 16.54% & 20.91% & (4.37%) \\ \hline 721,705 & 0 & (721,705) & 7,022,971 & 0 & (7,022,971) & 3.16% & 0.00% & (3.16%) & 3.87% & 0.00% & (3.87%) \\ \hline 4,201,872 & 4,689,306 & (487,434) & 22,997,344 & 39,266,801 & (16,269,457) & 18.39% & 21.57% & (3.18%) & 12.67% & 20.91% & (8.24%) \\ \hline \end{tabular} 3 Consolidated Common Size ALL BUSINESS 10/5/2023 5:22 PM