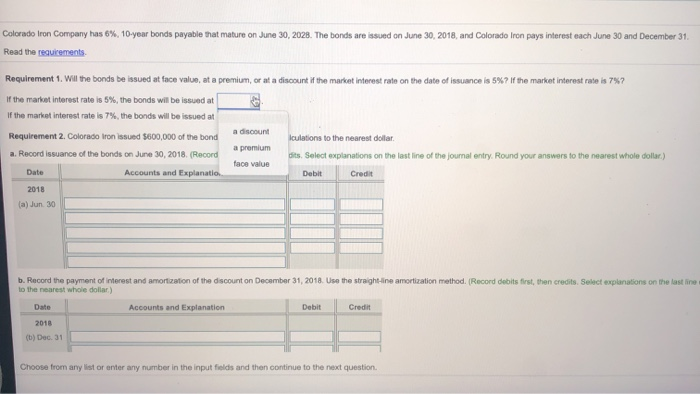

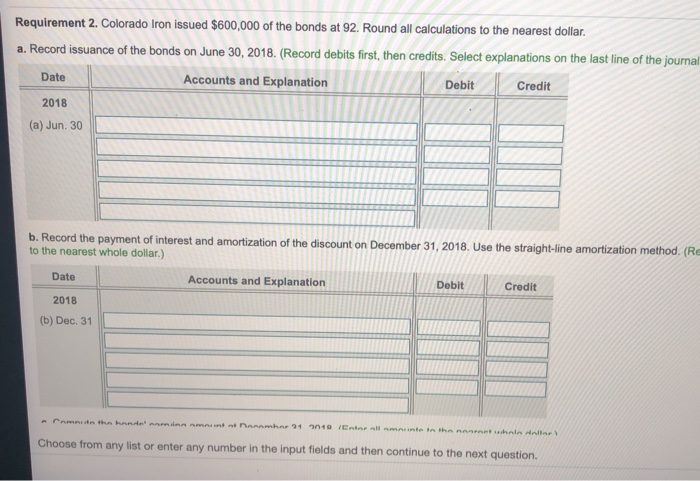

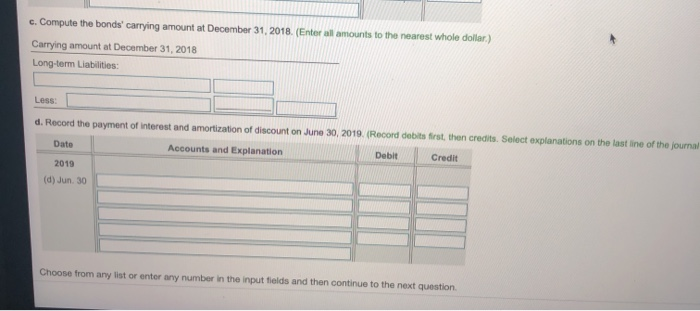

Colorado Iron Company has 6%, 10 year bonds payable that mature on June 30, 2028. The bonds are issued on June 30, 2018 and Colorado Iron pays interest each June 30 and December 31 Read the requirements Requirement 1. Will the bonds be issued at face value at a premium, or at a discount if the market interest rate on the date of issuance is 5% if the market interest rate is 7%? If the market interest rate is 5%, the bonds will be issued at If the market interest rate is 7%, the bonds will be issued at a discount Requirement 2. Colorado Iron issued 5600,000 of the bond lculations to the nearest dollar a premium a. Record issuance of the bonds on June 30, 2018 Record dits. Select explanations on the last line of the journal entry Round your answers to the nearest whole dollar) face value Date Accounts and Explanatio. Debit Credit 2018 (a) Jun 30 b. Record the payment of interest and mortation of the discount on December 31, 2018 Use the straight line amortization method. Record debits first, then credits Select explanations on the last line to the nearest whole dollar) De Accounts and Explanation Debit 2018 Dec. 31 Choose from any list or enter any number in the input fields and then continue to the next question Requirement 2. Colorado Iron issued $600,000 of the bonds at 92. Round all calculations to the nearest dollar a. Record issuance of the bonds on June 30, 2018. (Record debits first, then credits. Select explanations on the last line of the journal Date Accounts and Explanation Debit Credit 2018 (a) Jun 30 b. Record the payment of interest and amortization of the discount on December 31, 2018. Use the straight-line amortization method. (Re to the nearest whole dollar.) Date Accounts and Explanation Debit Credit 2018 (b) Dec. 31 the hand om 11 te te th e bar Choose from any list or enter any number in the input fields and then continue to the next question c. Compute the bonds' carrying amount at December 31, 2018. (Enteral amounts to the nearest whole dollar) Carrying amount at December 31, 2018 Long-term Liabilities: Less: d. Record the payment of interest and amortization of discount on June 30, 2019. (Record debits first, then credits. Select explanations on the last line of the journal Date Accounts and Explanation Debit Credit 2019 (d) Jun 30 Choose from any list or enter any number in the input fields and then continue to the next