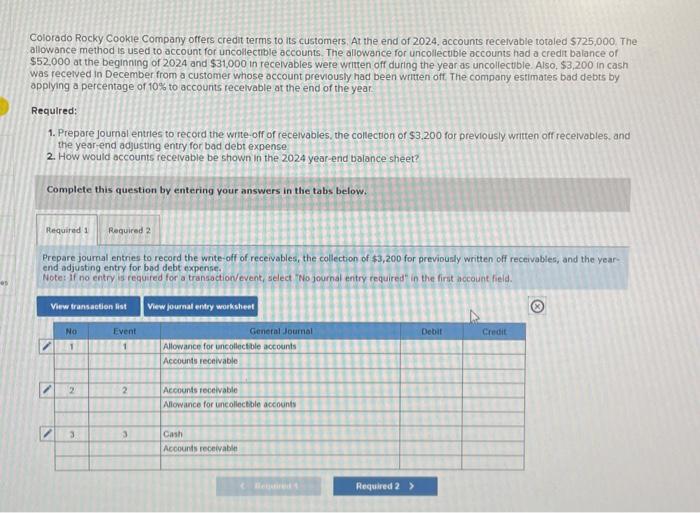

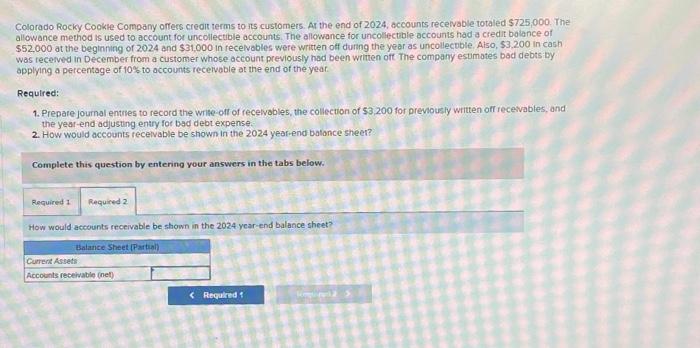

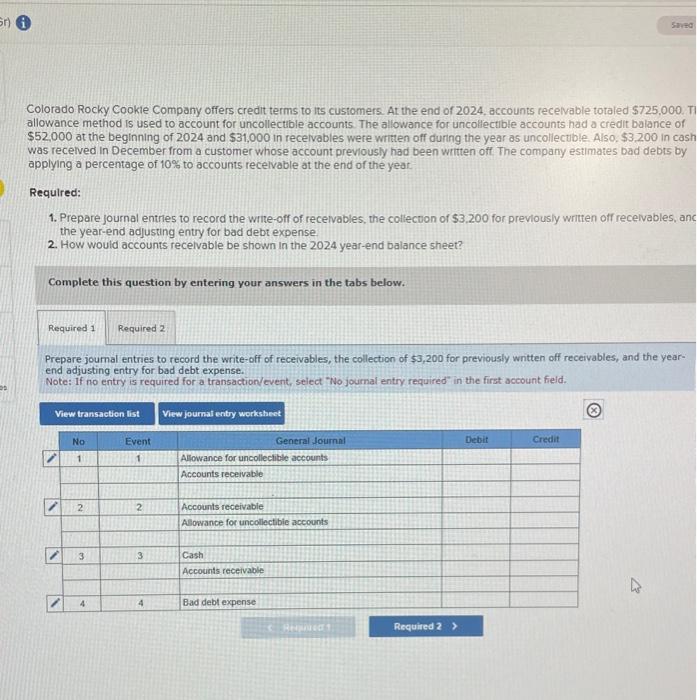

Colorado Rocky Cookre Company offers credit terms to its customers. At the end of 2024, accounts recenable totaled $725,000. The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounis had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off durng the year as uncollectuble. Aiso, $3.200 in cash was receved in December from a customer whose account previously had been writhen oft The company esumates bad debts by applying a percentage of 10% to accounts recervable at the end of the year. Requtred: 1. Prepare joumal entries to record the write- oft of recenvables, the collection of 53,200 for premously wrtten ofr receivables, and the year -end adjusting entry for bad debtexpense. 2. How would accounts receivable be shown in the 2024 year-end batonce sheer? Complete this question by entering your answers in the tabs below. How would accounts receivable be shown in the 2024 year-end balance sheet? Colorado Rocky Cookle Company offers credit terms to its customers. At the end of 2024 , accounts recelvable toraled $725,000. T allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollectible Also, $3,200 in cast was recelved in December from a customer whose account previously had been written off. The company estimates bad debts by applying a percentage of 10% to accounts recelvable at the end of the year: Requlred: 1. Prepare journal entries to record the write-off of recelvables, the collectoon of $3.200 for previously written off recelvables, an the year-end adjusting entry for bad debt expense 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare joumal entries to record the write-off of receivables, the collection of $3,200 for previously written off receivables, and the yearend adjusting entry for bad debt expense. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account feld. Colorado Rocky Cookle Company offers credit terms to its customers, At the end of 2024, accounts recelvable totaled $725;000, The allowance method is used to account for uncollectible accounts. The allowance for uncollectible accounts had a credit balance of $52,000 at the beginning of 2024 and $31,000 in recelvables were written off during the year as uncollectible. Also, $3,200 in cash was recelved in December from a customer whose occount previously had been written oft. The company estimates bad debts by applying a percentage of 10% to accounts recelvable at the end of the year: Required: 1. Prepare journal entrles to record the wrte-off of recelvables, the collection or $3.200 for previously written off recelvables, and the year-end adjusting entry for bad debt expense 2. How would accounts recelvable be shown in the 2024 year-end balance sheet? Complete this question by entering your answers in the tabs below. Prepare journal entries to record the write-off of receivables, the collection of $3,200 for previously written off receivables, and the yearend adjusting entry for bad debt expense. Note: if no entry is required for a transactionvevent, seled "No journal entry required" in the first account field