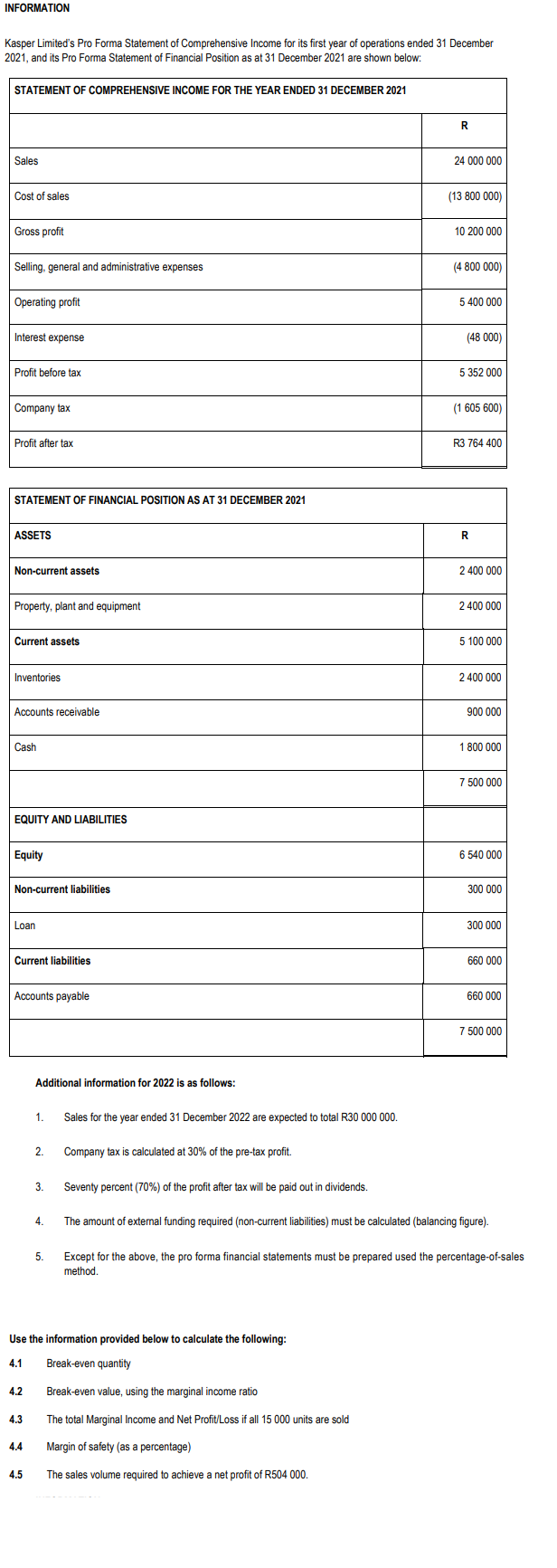

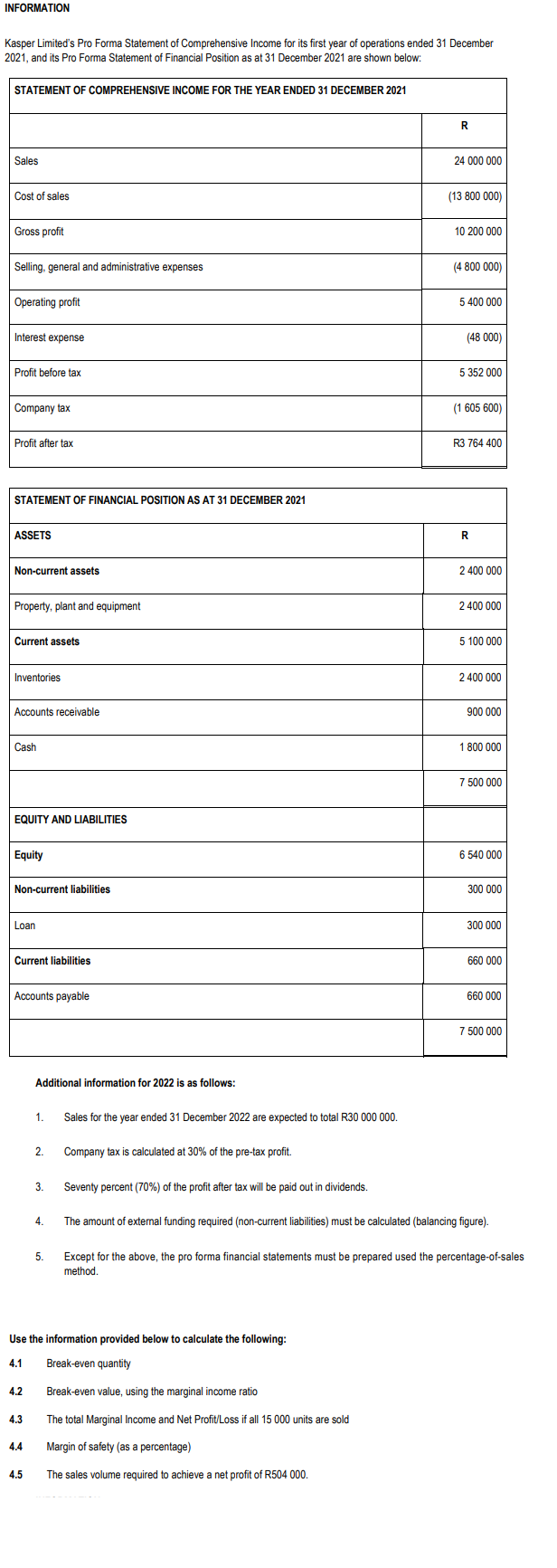

INFORMATION Kasper Limited's Pro Forma Statement of Comprehensive Income for its first year of operations ended 31 December 2021, and its Pro Forma Statement of Financial Position as at 31 December 2021 are shown below: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 R Sales 24 000 000 Cost of sales (13 800 000) Gross profit 10 200 000 Selling, general and administrative expenses (4 800 000) Operating profit 5 400 000 Interest expense (48 000) Profit before tax 5 352 000 Company tax (1 605 600) Profit after tax R3 764 400 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 ASSETS R Non-current assets 2 400 000 Property, plant and equipment 2 400 000 Current assets 5 100 000 Inventories 2 400 000 Accounts receivable 900 000 Cash 1 800 000 7 500 000 EQUITY AND LIABILITIES Equity 6 540 000 Non-current liabilities 300 000 Loan 300 000 Current liabilities 660 000 Accounts payable 660 000 7 500 000 Additional information for 2022 is as follows: 1. Sales for the year ended 31 December 2022 are expected to total R30 000 000 2. . Company tax is calculated at 30% of the pre-tax profit. 3. Seventy percent (70%) of the profit after tax will be paid out in dividends. 4. The amount of external funding required (non-current liabilities) must be calculated (balancing figure). 5. Except for the above, the pro forma financial statements must be prepared used the percentage-of-sales method. Use the information provided below to calculate the following: 4.1 Break-even quantity 4.2 Break-even value, using the marginal income ratio 4.3 The total Marginal Income and Net Profit/Loss if all 15 000 units are sold 4.4 Margin of safety (as a percentage) 4.5 The sales volume required to achieve a net profit of R504 000. INFORMATION Kasper Limited's Pro Forma Statement of Comprehensive Income for its first year of operations ended 31 December 2021, and its Pro Forma Statement of Financial Position as at 31 December 2021 are shown below: STATEMENT OF COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 2021 R Sales 24 000 000 Cost of sales (13 800 000) Gross profit 10 200 000 Selling, general and administrative expenses (4 800 000) Operating profit 5 400 000 Interest expense (48 000) Profit before tax 5 352 000 Company tax (1 605 600) Profit after tax R3 764 400 STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 2021 ASSETS R Non-current assets 2 400 000 Property, plant and equipment 2 400 000 Current assets 5 100 000 Inventories 2 400 000 Accounts receivable 900 000 Cash 1 800 000 7 500 000 EQUITY AND LIABILITIES Equity 6 540 000 Non-current liabilities 300 000 Loan 300 000 Current liabilities 660 000 Accounts payable 660 000 7 500 000 Additional information for 2022 is as follows: 1. Sales for the year ended 31 December 2022 are expected to total R30 000 000 2. . Company tax is calculated at 30% of the pre-tax profit. 3. Seventy percent (70%) of the profit after tax will be paid out in dividends. 4. The amount of external funding required (non-current liabilities) must be calculated (balancing figure). 5. Except for the above, the pro forma financial statements must be prepared used the percentage-of-sales method. Use the information provided below to calculate the following: 4.1 Break-even quantity 4.2 Break-even value, using the marginal income ratio 4.3 The total Marginal Income and Net Profit/Loss if all 15 000 units are sold 4.4 Margin of safety (as a percentage) 4.5 The sales volume required to achieve a net profit of R504 000