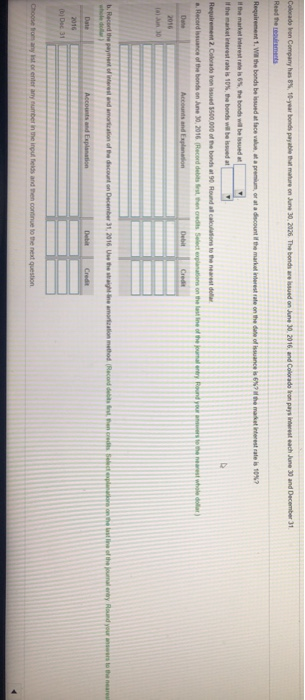

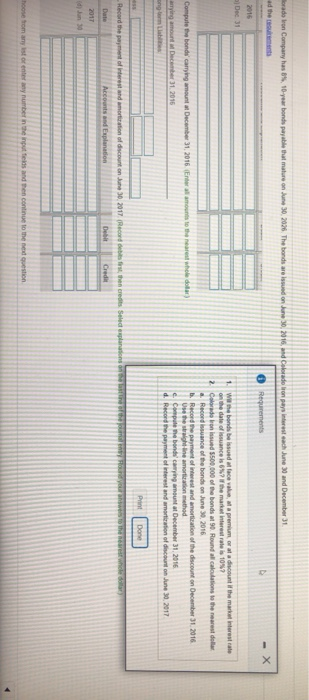

Colorado von Company has 8, 10-year bonds payable that mature on June 30,2026. The bonds are hoved on June 30, 2016, and Colorado con par nerest each June 39 and December 31 Read the requirements Requirement 1. W the bonds besued at face valuta premium or at a discount of the market interest rate on the date of bance is made rest rate is 10? It the market interest rate is 6%, the bonds will be issued at If the market interest rate is 10%, the bonds will be issued at D Requirement 2. Colorado Trono 500.000 of the bonds at 90 Houndations to the nearesto Record issuance of the bonds on June 30, 2016. Record debih credits to on the last line of the entry Round you to the nearest Wholedo Accounts and Explanation Deba Credit 2016 10 b. Record the payment of interest and mortation of the discount on December 31, 2016. Use the way the amortization method Record content here st line of the journalery Round you to the near Date Account and Explanation Credit 2016 Dec 31 Choose from any esto enter any number in the input fields and then continue to the next question Horado Tron Company has 8, 10-year bonds payable that mature on June 30, 2026. The bonds are issued on June 30, 2016 Colorado ropa interest each June and December 31 Requirements a) Dec 31 1. W the bonds be issued faceva la premium alacount the market interest rate the date of issuance is the market interest rate is 1042 Colorado broneed $500,000 of the bonds 90. Round all cations to the nearest dollar & Recordance of the bends on June 30, 2016 6. Record the payment of interest and amortization of the discount on December 31, 2016 Use the strane amortization method c. Complemente caring amount at December 31, 2016 d. Record the payment of Interest and amortization of discount on June 30, 2017 Compute the bonds carrying amount December 31, 2016. Entramounts to the nearest Wholedo agamo December 31, 2016 Print Done Record the payment of interest and mortation of discount on June 30, 2017 Records, the credits Select options est whole Date Accounts and Explanation Debu Credit 2017 hoose from any list or enter any number in the input this and then continue to the next gestion Colorado von Company has 8, 10-year bonds payable that mature on June 30,2026. The bonds are hoved on June 30, 2016, and Colorado con par nerest each June 39 and December 31 Read the requirements Requirement 1. W the bonds besued at face valuta premium or at a discount of the market interest rate on the date of bance is made rest rate is 10? It the market interest rate is 6%, the bonds will be issued at If the market interest rate is 10%, the bonds will be issued at D Requirement 2. Colorado Trono 500.000 of the bonds at 90 Houndations to the nearesto Record issuance of the bonds on June 30, 2016. Record debih credits to on the last line of the entry Round you to the nearest Wholedo Accounts and Explanation Deba Credit 2016 10 b. Record the payment of interest and mortation of the discount on December 31, 2016. Use the way the amortization method Record content here st line of the journalery Round you to the near Date Account and Explanation Credit 2016 Dec 31 Choose from any esto enter any number in the input fields and then continue to the next question Horado Tron Company has 8, 10-year bonds payable that mature on June 30, 2026. The bonds are issued on June 30, 2016 Colorado ropa interest each June and December 31 Requirements a) Dec 31 1. W the bonds be issued faceva la premium alacount the market interest rate the date of issuance is the market interest rate is 1042 Colorado broneed $500,000 of the bonds 90. Round all cations to the nearest dollar & Recordance of the bends on June 30, 2016 6. Record the payment of interest and amortization of the discount on December 31, 2016 Use the strane amortization method c. Complemente caring amount at December 31, 2016 d. Record the payment of Interest and amortization of discount on June 30, 2017 Compute the bonds carrying amount December 31, 2016. Entramounts to the nearest Wholedo agamo December 31, 2016 Print Done Record the payment of interest and mortation of discount on June 30, 2017 Records, the credits Select options est whole Date Accounts and Explanation Debu Credit 2017 hoose from any list or enter any number in the input this and then continue to the next gestion