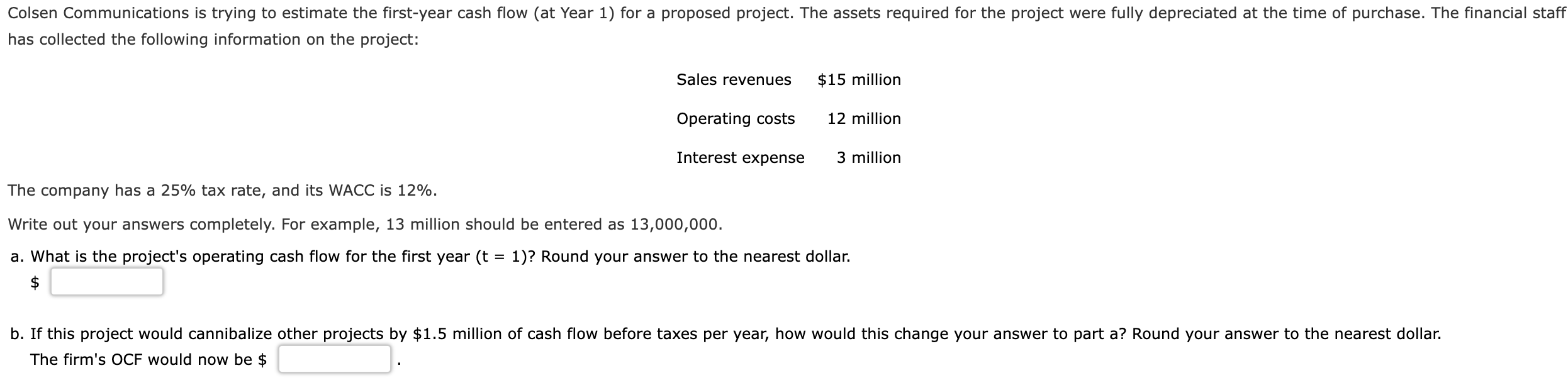

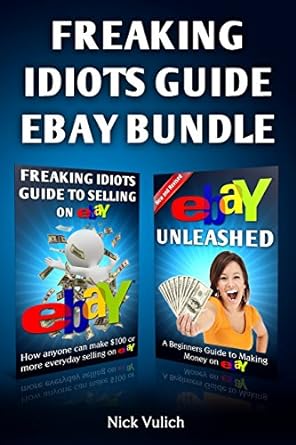

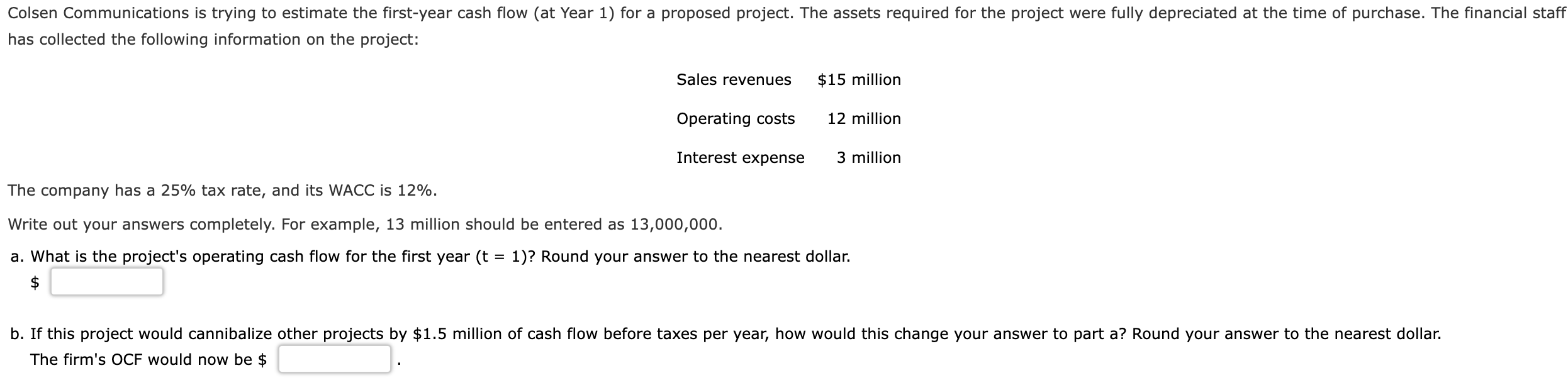

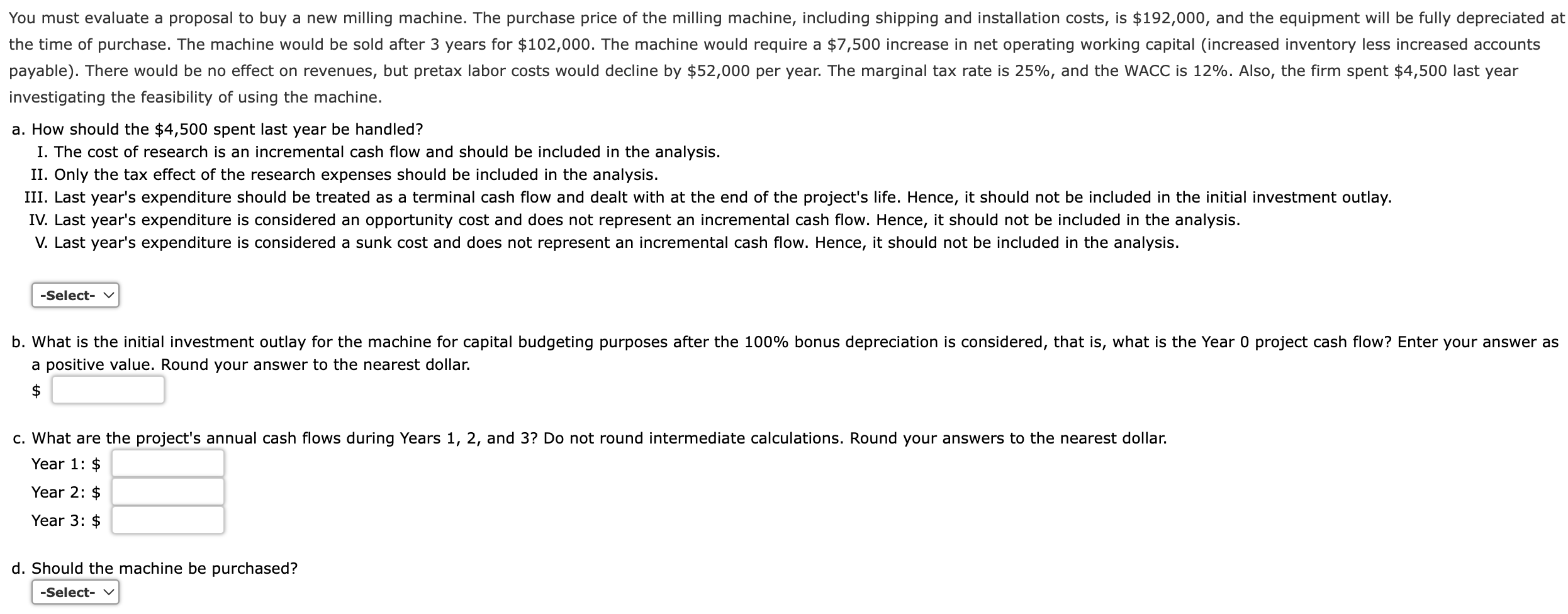

Colsen Communications is trying to estimate the first-year cash flow (at Year 1) for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information on the project: Sales revenues $15 million Operating costs 12 million Interest expense 3 million The company has a 25% tax rate, and its WACC is 12%. Write out your answers completely. For example, 13 million should be entered as 13,000,000. a. What is the project's operating cash flow for the first year (t = 1)? Round your answer to the nearest dollar. b. If this project would cannibalize other projects by $1.5 million of cash flow before taxes per year, how would this change your answer to part a? Round your answer to the nearest dollar. The firm's OCF would now be $ You must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $192,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $102,000. The machine would require a $7,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $52,000 per year. The marginal tax rate is 25%, and the WACC is 12%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. The cost of research is an incremental cash flow and should be included in the analysis. II. Only the tax effect of the research expenses should be included in the analysis. III. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay. IV. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. V. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. -Select- v b. What is the initial investment outlay for the machine for capital budgeting purposes after the 100% bonus depreciation is considered, that is, what is the Year O project cash flow? Enter your answer as a positive value. Round your answer to the nearest dollar. $ c. What are the project's annual cash flows during Years 1, 2, and 3? Do not round intermediate calculations. Round your answers to the nearest dollar. Year 1: $ Year 2: $ Year 3: $ d. Should the machine be purchased? -Select- v