Answered step by step

Verified Expert Solution

Question

1 Approved Answer

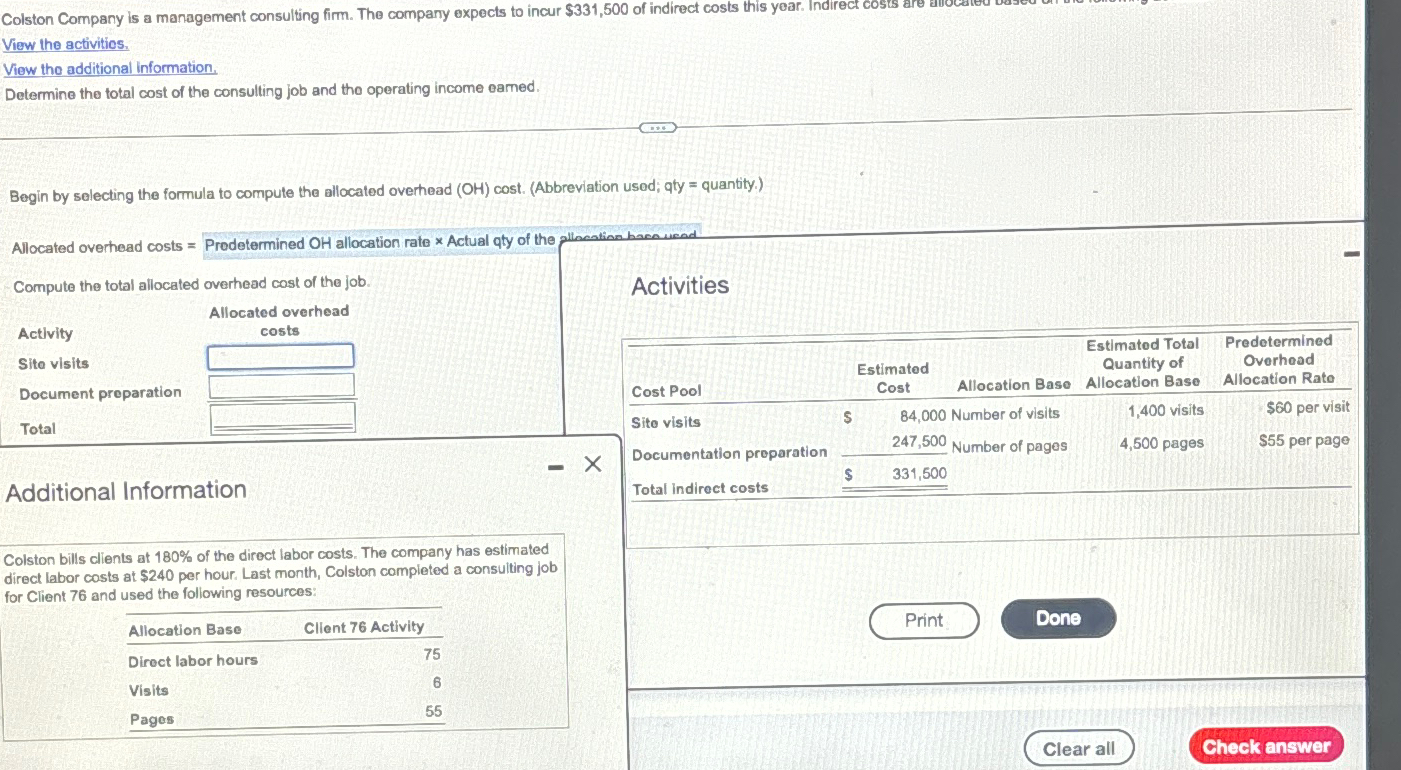

Colston Company is a management consulting firm. The company expects to incur $331,500 of indirect costs this year. Indirect costs are View the activities.

Colston Company is a management consulting firm. The company expects to incur $331,500 of indirect costs this year. Indirect costs are View the activities. View the additional information. Determine the total cost of the consulting job and the operating income earned. Begin by selecting the formula to compute the allocated overhead (OH) cost. (Abbreviation used; qty = quantity.) Allocated overhead costs = Predetermined OH allocation rate x Actual qty of the allocation bace used Compute the total allocated overhead cost of the job. Activities Activity Site visits Document preparation Total Allocated overhead costs Additional Information Colston bills clients at 180% of the direct labor costs. The company has estimated direct labor costs at $240 per hour. Last month, Colston completed a consulting job for Client 76 and used the following resources: Allocation Base Client 76 Activity Direct labor hours 75 6 Visits 55 Pages Estimated Total Estimated Cost Pool Cost Site visits $ Documentation preparation Allocation Base 84,000 Number of visits 247,500 Number of pages Quantity of Allocation Base Predetermined Overhead 1,400 visits Allocation Rate $60 per visit 4,500 pages $55 per page $ 331,500 Total indirect costs Print Done Clear all Check answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started