Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Colwood Corp has 8% Coupon bonds making annual payments with a YTM of 7.2%, current market value of $1059.6. How many years do these bonds

Colwood Corp has 8% Coupon bonds making annual payments with a YTM of 7.2%, current market value of $1059.6. How many years do these bonds have left until maturity?

Colwood Corp has 8% Coupon bonds making annual payments with a YTM of 7.2%, current market value of $1059.6. How many years do these bonds have left until maturity?

Can someone please help me understand how they went from the first line to the second? I dont understand how they got there.

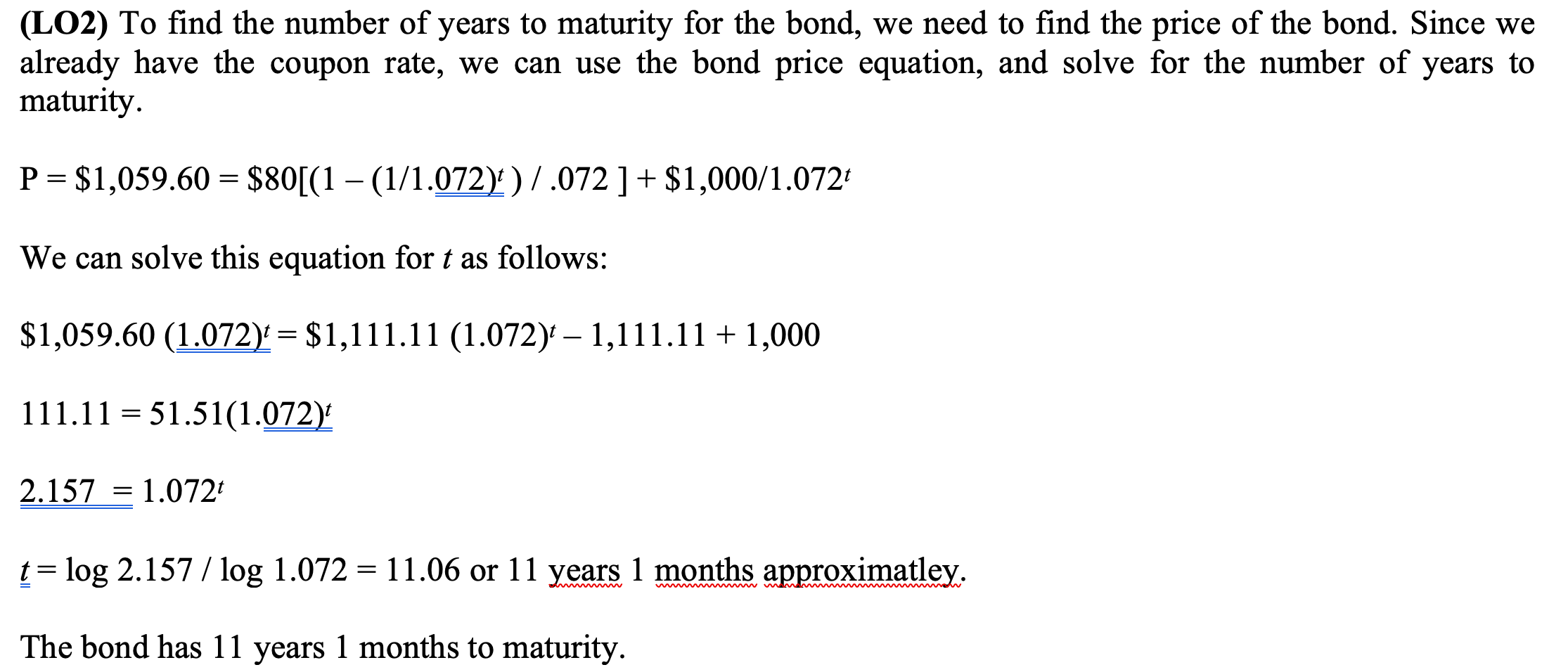

(LO2) To find the number of years to maturity for the bond, we need to find the price of the bond. Since we already have the coupon rate, we can use the bond price equation, and solve for the number of years to maturity. P = $1,059.60 = $80[(1 (1/1.072))/.072 ] + $1,000/1.072 = We can solve this equation for t as follows: $1,059.60 (1.072) = $1,111.11 (1.072) 1,111.11 + 1,000 111.11 = 51.51(1.072) = 2.157 = 1.072 - = t= log 2.157 / log 1.072 = 11.06 or 11 years 1 months approximatley. - The bond has 11 years 1 months to maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started