Question

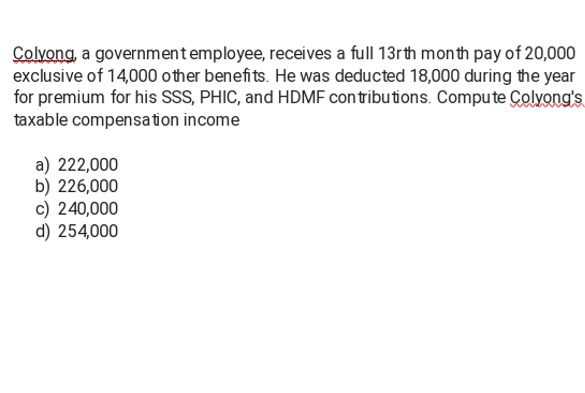

Colvong, a government employee, receives a full 13rth month pay of 20,000 exclusive of 14,000 other benefits. He was deducted 18,000 during the year

Colvong, a government employee, receives a full 13rth month pay of 20,000 exclusive of 14,000 other benefits. He was deducted 18,000 during the year for premium for his SSS, PHIC, and HDMF contributions. Compute Colyong's taxable compensation income a) 222,000 b) 226,000 c) 240,000 d) 254,000

Step by Step Solution

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental financial accounting concepts

Authors: Thomas P. Edmonds, Frances M. Mcnair, Philip R. Olds, Edward

8th edition

978-007802536, 9780077648831, 0078025362, 77648838, 978-0078025365

Students also viewed these Law questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App