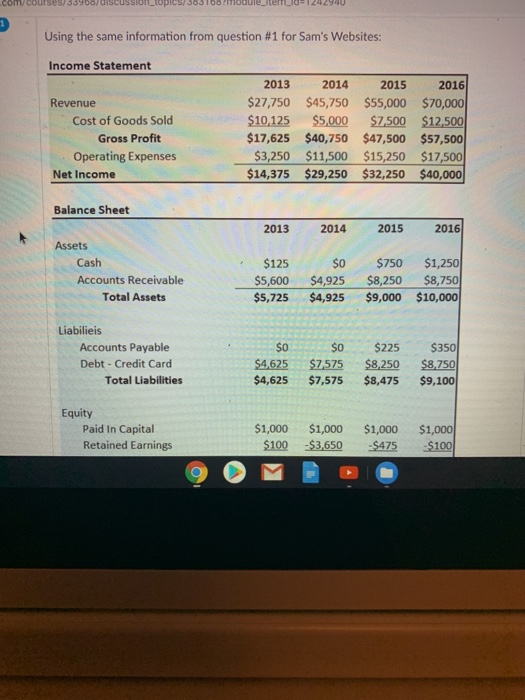

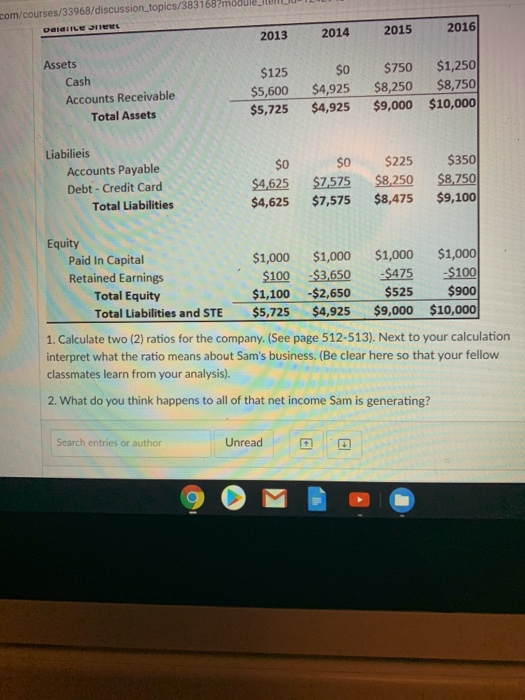

com courses/33 Using the same information from question #1 for Sam's Websites: Income Statement Revenue Cost of Goods Sold Gross Profit Operating Expenses Net Income 2013 2014 2015 2016 $27,750 $45,750 $55,000 $70,000 $10,125 $5,000 $7,500 $12.500 $17,625 $40,750 $47,500 $57,500 $3,250 $11,500 $15,250 $17,500 $14,375 $29,250 $32,250 $40,000 Balance Sheet 2013 2014 2015 2016 Assets Cash Accounts Receivable Total Assets $125 $5,600 $5,725 $0 $4,925 $4,925 $750 $1,250 $8,250 $8,750 $9,000 $10,000 Liabilieis Accounts Payable Debt - Credit Card Total Liabilities $0 $4,625 $4,625 $0 $7575 $7,575 $225 $8,250 $8,475 $350 $8.750 $9,100 Equity Paid In Capital Retained Earnings $1,000 $100 $1,000 -$3,650 $1,000 -$475 $1,000 $100 com/courses/33968/discussion topics/383168? Dalaille See 2013 2014 2015 2016 Assets Cash Accounts Receivable Total Assets $125 $5,600 $5,725 $0 $4,925 $4,925 $750 $1,250 $8,250 $8,750 $9,000 $10,000 Liabilieis Accounts Payable Debt - Credit Card Total Liabilities $0 $4,625 $4,625 $0 $7,575 $7,575 $225 $8,250 $8,475 $350 $8,750 $9,100 Equity Paid In Capital $1,000 $1,000 $1,000 $1,000 Retained Earnings $100-$3,650 -$475 $100 Total Equity $1,100 $2,650 $525 $900 Total Liabilities and STE $5,725 $4,925 $9,000 $10,000 1. Calculate two (2) ratios for the company. (See page 512-513). Next to your calculation interpret what the ratio means about Sam's business. (Be clear here so that your fellow classmates learn from your analysis). 2. What do you think happens to all of that net income Sam is generating? Search entries or author Unread com courses/33 Using the same information from question #1 for Sam's Websites: Income Statement Revenue Cost of Goods Sold Gross Profit Operating Expenses Net Income 2013 2014 2015 2016 $27,750 $45,750 $55,000 $70,000 $10,125 $5,000 $7,500 $12.500 $17,625 $40,750 $47,500 $57,500 $3,250 $11,500 $15,250 $17,500 $14,375 $29,250 $32,250 $40,000 Balance Sheet 2013 2014 2015 2016 Assets Cash Accounts Receivable Total Assets $125 $5,600 $5,725 $0 $4,925 $4,925 $750 $1,250 $8,250 $8,750 $9,000 $10,000 Liabilieis Accounts Payable Debt - Credit Card Total Liabilities $0 $4,625 $4,625 $0 $7575 $7,575 $225 $8,250 $8,475 $350 $8.750 $9,100 Equity Paid In Capital Retained Earnings $1,000 $100 $1,000 -$3,650 $1,000 -$475 $1,000 $100 com/courses/33968/discussion topics/383168? Dalaille See 2013 2014 2015 2016 Assets Cash Accounts Receivable Total Assets $125 $5,600 $5,725 $0 $4,925 $4,925 $750 $1,250 $8,250 $8,750 $9,000 $10,000 Liabilieis Accounts Payable Debt - Credit Card Total Liabilities $0 $4,625 $4,625 $0 $7,575 $7,575 $225 $8,250 $8,475 $350 $8,750 $9,100 Equity Paid In Capital $1,000 $1,000 $1,000 $1,000 Retained Earnings $100-$3,650 -$475 $100 Total Equity $1,100 $2,650 $525 $900 Total Liabilities and STE $5,725 $4,925 $9,000 $10,000 1. Calculate two (2) ratios for the company. (See page 512-513). Next to your calculation interpret what the ratio means about Sam's business. (Be clear here so that your fellow classmates learn from your analysis). 2. What do you think happens to all of that net income Sam is generating? Search entries or author Unread