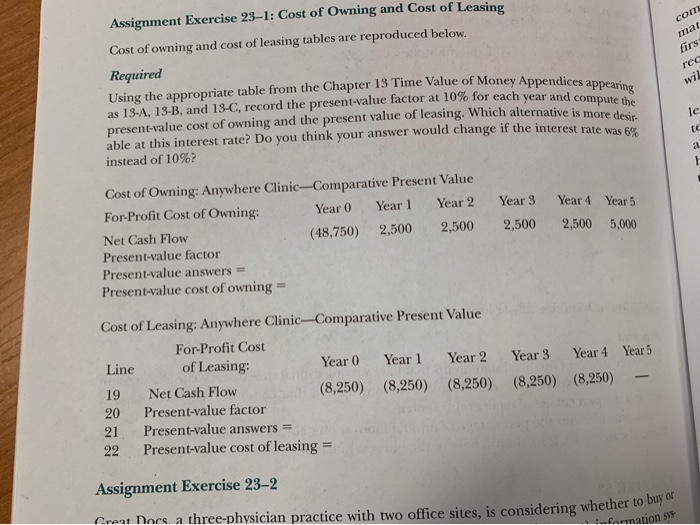

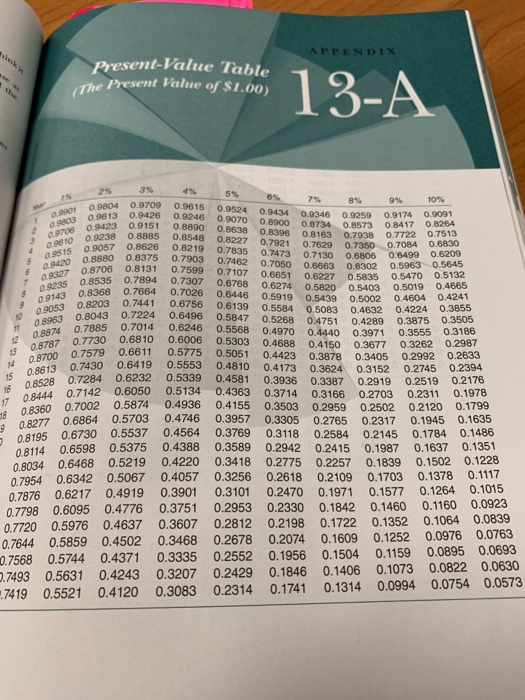

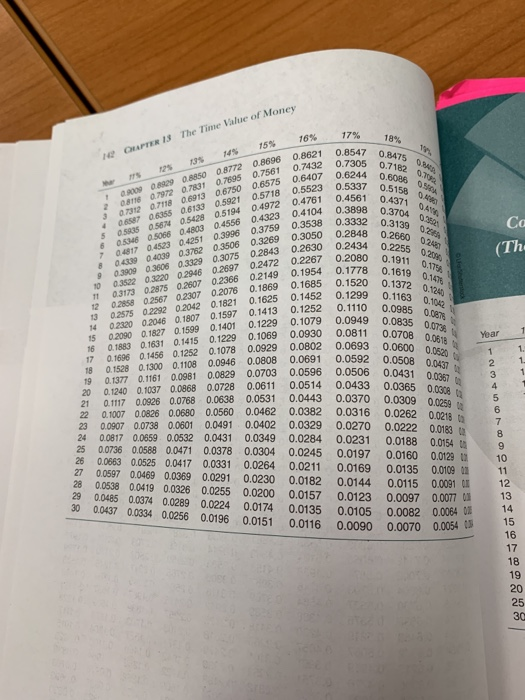

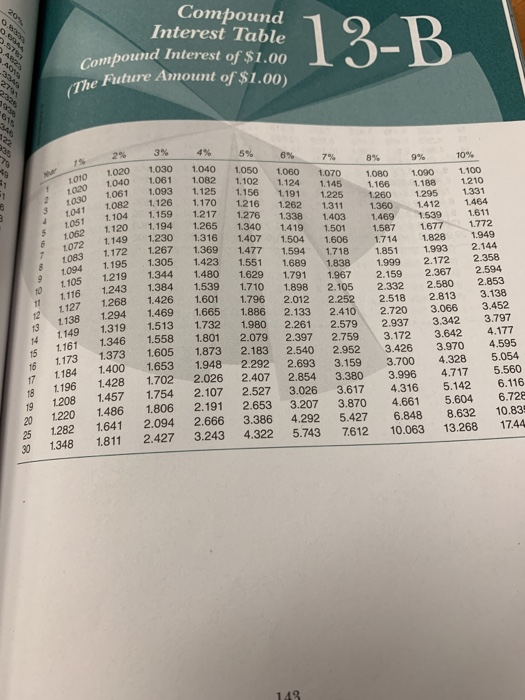

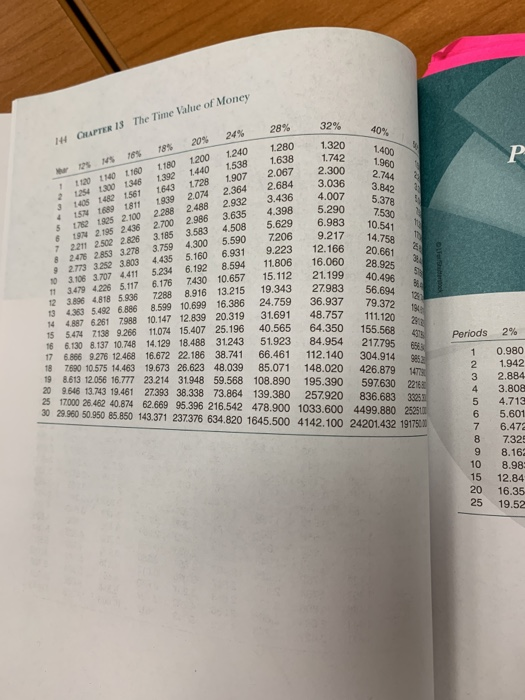

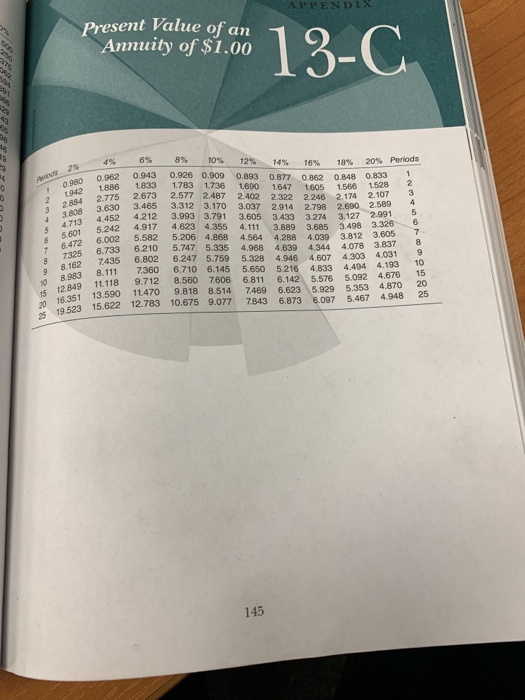

com mat rec Assignment Exercise 23-1: Cost of Owning and Cost of Leasing Cost of owning and cost of leasing tables are reproduced below. Required Using the appropriate table from the Chapter 13 Time Value of Money Appendi as 13-A, 13-B, and 13-C, record the present value factor at 10% for each year and a present-value cost of owning and the present value of leasing. Which alternative is m able at this interest rate? Do you think your answer would change if the interest rate instead of 10%? of Money Appendices appearing 10% for each year and compute the wil Year 3 2,500 Year 4 2,500 Year 5 5,000 Cost of Owning: Anywhere Clinic-Comparative Present Value For-Profit Cost of Owning: Year 0 Year 1 Year 2 Net Cash Flow (48,750) 2,500 2,500 Present-value factor Present-value answers = Present-value cost of owning = Year 5 Cost of Leasing: Anywhere Clinic-Comparative Present Value For Profit Cost Line of Leasing: Year 0 Year 1 Year 2 19 Net Cash Flow (8,250) (8,250) (8,250) 20 Present-value factor 21 Present-value answers = 22 Present-value cost of leasing = Year 3 Year 4 (8,250) (8,250) Assignment Exercise 23-2 Cast Docs a three-physician practice with two office sites, is considering whether Information 515 APPENDIX Present-Value Table The Present Value of $1.00) The present Value os 81.00 1 3 -A a y 0804 0.9709 0.9615 0.9613 0.9426 0.920 0.91 0.9423 9708 9515 0.9057 04.200.8880 0 B 0.83 0 0.7664 0.8535 0.8368 0.8203 09235 09143 0.9053 oz 0.8963 120.8874 0.6810 0. 0.7730 0.8787 0.8700 0 16 0.8528 0.71420 0.8444 17 0.9423 0.9151 0.8890 0.97 9238 0.8885 0.8548 3 9810 9057 0.8626 0.8219 8880 0.8375 0.7903 4 0.8706 0.8131 0.7599 0 0 R535 0,7894 07307 0.8368 0.7664 0.7026 0.8203 0.7441 0.6756 8043 0.7224 0.6496 0.7885 0.7014 0.6246 - 07730 0.6810 0.6006 19 20 0.7579 0.6611 0.5775 249 0.7430 0.6419 0.5553 528 0.7284 0.6232 0.5339 114 0.7142 0.6050 0.5134 8360 0.7002 0.5874 0.4936 8277 0.6864 0.5703 0.4746 8195 0.6730 0.5537 0.4564 08114 0.6598 0.5375 0.4388 08034 0.6468 0.5219 0.4220 0.7954 0.6342 0.5067 0.4057 0.7876 0.6217 0.4919 0.3901 0.7798 0.6095 0.4776 0.3751 0.7720 0.5976 0.4637 0.3607 0.7644 0.5859 0.4502 0.3468 0.7568 0.5744 0.4371 0.3335 0.7493 0.5631 0.4243 0.3207 7419 0.5521 0.4120 0.3083 7% 8% 9% 10% 0.9524 0.9434 09259 0.9174 0.909 0.9070 0.8900 0.74 573 0.8417 0.8264 0.8638 0.8396 0.8163 0.79.38 0.8227 0.7722 0.7519 27 0.7921 0.7629 0.7350 0.7084 0.6830 0.7835 0.7473743 6 0.6499 0.6209 0.7462 0.7050 8302 0.5963 0.5645 0.7107 0.6651 06227 5835 0.5470 0.5132 0 0/68 0 2 0 Enon EYA 0 509 04665 0.6446 0.5919 05439 5002 0.4604 0.4241 0.6139 0.5504 05083 04632 0.4224 0.3855 0.5847 0.5263 04751 289 0.3875 0.3505 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.5303 0.4688 04150 03677 0.3262 0.2987 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.4810 0.4173 0.3624 0.3152 0.2745 0.2394 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.3589 0.2942 0.2415 0.1987 0.1637 0.1351 0.3418 0.2775 0.2257 0.1839 0.1502 0.1228 0.3256 0.2618 0.2109 0.1703 0.1378 0.1117 0.3101 0.2470 0.1971 0.1577 0.1264 0.1015 0.2953 0.2330 0.1842 0.1460 0.1160 0.0923 0.2812 0.2198 0.1722 0.1352 0.1064 0.0839 0.2678 0.2074 0.1609 0.1252 0.0976 0.0763 0.2552 0.1956 0.1504 0.1159 0.0895 0.0693 0.2429 0.1846 0.1406 0.1073 0.0822 0.0630 0.2314 0.1741 0.1314 0.0994 0.0754 0.0573 16% OUPTER 13 The Time Value of Money 21 0.8475 0.88 Ca 135 145 15% 0.8621 0.8696 0.8772 0.8850 2000 A929 0 0.7432 0.7561 0.7695 07972 0.7831 207118 0.6913 0.6750 0.875 0.6407 06 DA 0655 0.6133 0.5921 0.5718 0.5523 52 5 g 0.58 0.5429 0.5194 0.4972 0.4761 0.4 0 0 5066 0.4803 0.4556 0.4323 0.4104 0.20 0417 04523 0.4251 0.3998 0.3759 0.3538 0.32 041904039 03762 0.3506 0.3209 0.30500 00 282 0308 0.3329 0.3075 02843 0.85220.3220 0.2630 0.2424 0.2946 0.2697 0.2472 03173 02875 0.2607 0.2366 0.2267 0.209 0.2149 0.1954 6 0.2434 0.2080 7 (Th. 0.2255 0.1911 67 0.1954 # 17% 18% 0.8547 0.8475 0.7305 0.7182 6244 0.6086 DER 0.5337 0.5158 4561 0.4371 0 BOB 0.3704 0350 3332 0.3139 02 0.2848 0.2660 020 020 0.175 0.1478 520 0.1372 0.124 299 0.1163 0.1042 0 0.0985 0.087 49 0.0835 0.073. 11 0.0708 0.0618 03 0.0600 0.0620 2 0.0508 0.0437 0,0506 0.0431 0.0367 4 0.0433 0.0365 0.0008 370 0.0309 0.0259 0.1778 0.1619 0 Year 149 11 0.1869 0.2076 02567 0.2307 1202958 3 0257502292 0.2042 0.1821 0.1625 1 02020 2046 0.1807 0.1597 0.1413 1 02090 0.1827 0.1599 0.1401 0.1229 183 0.1631 0.1415 0.1229 0.1009 ADR 0.1456 0.1252 0.1078 0.0329 18 0.1528 0.1300 0.1108 0.0946 0.0808 19 0.1377 0.1161 0.0981 0.0829 0.0703 2 1240 0.1037 0.0868 0.0728 0.0611 24 1117 0.0926 0.0768 0.0638 0.0531 22 0.1007 0.0826 0.0680 0.0560 0.0462 0.1520 0.1299 0.1110 0.0949 0.0811 0.0693 0020 0.00 0.1685 0.1452 0.1252 0.1079 0.0930 0.0002 0.0 0.0596 0.0514 0.0443 0.0382 23 0.0907 0.0738 0.0601 0.0491 0.0402 24 0.0817 0.0659 0.0532 0.0431 0.0349 25 0.0736 0.0588 0.0471 0.0378 0.0304 260.0663 0.0525 0.0417 0.0331 0.0264 27 0.0597 0.0469 0.0369 0.0291 0.0230 28 0.0538 0.0419 0.0326 0.0255 0.0200 29 0.0485 0.0374 0.0289 0.0224 0.0174 30 0.0437 0.0334 0.0256 0.0196 0.0151 0.0329 0.0284 0.0245 0.0211 0.0182 0.0157 0.0135 0.0116 0.0506 0.0433 0.0370 0.0316 0.0270 0.0231 0.0197 0.0169 0.0144 0.0123 0.0105 0.0090 0.0431 0.0365 0.0309 0.0262 0.0222 0.0188 0.0160 0.0135 0.0115 0.0097 0.0082 0.0070 0.0218 0.0189 0.0154 0.0129 u 0.0109 0.0091 0.0077 0.0064 0.005 EO DO OWN S Compound Interest Table ompound Interest of $1.00 The Future Amount of $1.00) 13-B 8888 4% 5% 6% 7% 1010 1020 10:30 1041 1051 1062 1949 1072 1083 1094 1105 1116 2% 3% 4020 1.030 1040 1.061 1061 1,093 1. 126 1.159 1.120 1.194 1.149 1.230 172 1.267 1305 1219 1.344 1 243 1.384 1.268 1.426 1.294 1.469 1.319 1.513 1.346 1.558 1.373 1.605 1.400 1.653 1428 1.702 1.457 1.754 1.486 1.806 1.6412.094 1.811 2.427 1127 1.138 898 Datsun 1.040 1.082 1.125 1.170 1.217 1.265 1.316 1.369 1.423 1.480 1.539 1.601 1.665 1.732 1.801 1.873 1.948 2.026 2.107 2.191 2.666 3.243 1.050 1.102 1.150 1.216 1.276 1.340 1,407 1.477 1.551 1. 629 1.710 1.796 1.886 1.980 2.079 2.183 2.292 2.407 2.527 2.653 3.386 4.322 9% 10% 1.OBO 1.090 1.100 1.166 1.188 1.210 1.260 1295 1.331 1.360 1.412 1.464 1.469 1.539 1.611 1.587 1.677 1.772 1.714 1.828 1.851 1.993 2.144 1.999 2.172 2.358 2.159 2.367 2.594 2.332 2.580 2.853 2.518 2.813 3.138 2.720 3.066 3.452 2.937 3.342 3.797 3.172 3.642 4.177 3.426 3.970 4.328 5.054 3.996 4.717 5.560 4.316 5.142 6.116 4.661 5.604 6.728 6.848 8.632 10.83 10.063 13.268 17.44 1.124 1.145 1.191 1.225 1.262 1.311 1.338 1,403 1.419 1.501 1.504 1.606 1.594 1.689 1.838 1.791 1.791 1.967 1.89B 2.105 2.012 2.252 2.133 2.410 2.261 2.261 2.579 2.579 2.3972.759 2.540 2.952 2.693 3.159 2.854 3.380 3.026 3.617 3.207 3.870 4.292 5.427 5.743 7.612 1.149 1.161 1.173 1196 1 208 1220 1282 1.348 143 28% 40% 144 CUPTER 13 The Time Value of Money 1240 1.638 1.400 1.960 2.744 3.842 3.436 25 NS 16% 78% 20% 24% 120 1 1140 1160 1.200 1180 2 2541.300 1348 1392 1440 1.538 3 1408 1482 581 1643 1728 1.907 15 1689 1811 1839 2.074 2.364 5 2 1925 2.100 2.288 2.488 2.932 6 9 2.195 2436 2.700 2.986 3.635 7 2211 2.502 2.826 3.185 8 3.583 4.508 2.475 2850 3.278 3.759 4.300 5.590 10.541 14.758 20.661 32% 1280 1.320 1.742 2067 2.300 2.684 3.036 4.007 5.378 4.398 5.290 7.530 5.629 6.983 7.206 9.217 12.166 16.060 28.925 21.19940.496 215 19.343 27.983 56.694 8.599 10.699 4.363 5.492 6.886 16.386 24.759 3 6,937 79.372 10.147 14 4887 6.261 7988 12.839 20.319 31.691 48.757 15 543 7139 9266 11.074 15,407 25.196 40.565 6 4.350 155 SAD 100.000 TL 18 6.130 8.137 10.748 14.129 18.488 31.243 51.923 84.954 17 6.866 9.276 12.468 16.672 22.186 38.741 66.461 112.140 304.914 187890 10.575 14.463 19.673 26.623 48.039 85.071 148.020 426.87914 198.613 12.056 16.777 23.214 31.948 59.568 108.890 195.390 597.630 20 9.546 13.743 19.461 27.393 38.338 73.864 2216 25 17000 26.462 40.874 62.669 95.396 216.542 478.900 139.380 257.920 836.683 33265 30 29.960 50.950 85.850 143.371 237376 634.820 1645.500 4142.100 24201.432 191750 1033.600 4499.880 2525 4.435 5.234 6.176 7288 9 2.773 3.252 3.803 103.106 3.707 4.411 1 3479 4 2265.117 123.896 4.818 5.936 13 5.160 6.931 6.192 8.594 7430 10.657 8.916 13.215 9.223 11.806 15.112 19.343 21.199 SON 111.120 21 217.795 Periods 2% 1 0.980 2 1.942 3 2.884 4 3.808 5 4.713 6 5.601 7 6.472 8 7.32 98.162 108.98 15 12.84 20 16.35 25 19.52 APPENDIX Present Value of an Annuity of $1.00 fir 25 0.98000 182 1886 1942 2894 3.808 3.630 4% 6% 8% 062 0.943 0.926 1886 1833 1.783 2775 2.673 2.577 630 3.465 3.312 4.452 4.212 3.993 4713 5.242 4.917 4.623 8002 5.5825 .206 0 6.7336 .210 5.747 2 7435 6.802 6.247 03 8.111 7.360 6.710 949 11.118 9.712 8.560 251 13.590 11.470 9.818 1952315.622 12.783 10.675 4.917 5.242 5601 10% 0.909 1736 2.487 3.170 3.791 4.355 4.86.8 5.335 5.759 6.145 7.606 8. 514 9.077 12% 14% 16% 18% 20% Periods 0.893 0.877 0.62 0.348 0.833 1,600 1,647 1605 1568 1.528 2.402 2.322 2.248 2.174 2.107 3,037 2.914 2.798 2.690 2.589 3.605 3.433 3.274 3.127 2.991 4.111 3.889 3.65 3.498 3.3266 4.564 4.2 4039 3.812 3.605 7 4.968 4.639 4.344 4.078 3.837 8 5.328 4.946 4.607 4.303 4.031 9 5.6505216 4,833 4.494 4.193 10 6.811 6.142 5.576 5.092 4.676 7.469 6.623 5.9295.353 4.870 20 7.843 6.873 6.097 5,467 4.948 25 6.003 6.472 15 U 145