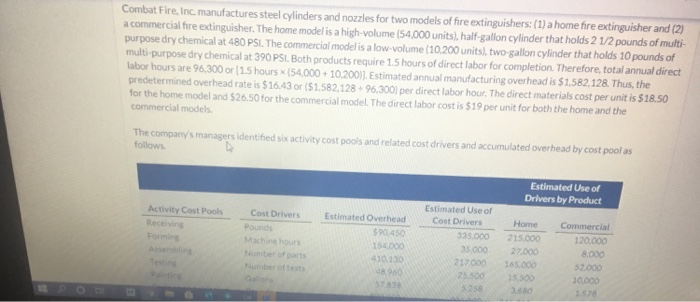

Combat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSL. The commercial model is a low-volume (10.200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PS1. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or 15 hours x (54.000 + 10.2001). Estimated annual manufacturing overhead is $1,582, 128. Thus, the predetermined overhead rate is $16.43 or ($1.582.128 96,3001 per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is 519 per unit for both the home and the commercial models The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. Estimated Use of Drivers by Product Activity Cost Pools Receiving Forming Cost Drivers Pounds Maching hours Estimated Overhead $90.450 154.000 410130 Estimated Use of Cost Drivers 325.000 35 000 217.000 25.500 Home 215.000 Commercial 120.000 8,000 52000 10.000 1578 165.000 15.500 Combat Fire, Inc. manufactures steel cylinders and nozzles for two models of fire extinguishers: (1) a home fire extinguisher and (2) a commercial fire extinguisher. The home model is a high-volume (54,000 units), half-gallon cylinder that holds 2 1/2 pounds of multi- purpose dry chemical at 480 PSL. The commercial model is a low-volume (10.200 units), two-gallon cylinder that holds 10 pounds of multi-purpose dry chemical at 390 PS1. Both products require 1.5 hours of direct labor for completion. Therefore, total annual direct labor hours are 96,300 or 15 hours x (54.000 + 10.2001). Estimated annual manufacturing overhead is $1,582, 128. Thus, the predetermined overhead rate is $16.43 or ($1.582.128 96,3001 per direct labor hour. The direct materials cost per unit is $18.50 for the home model and $26.50 for the commercial model. The direct labor cost is 519 per unit for both the home and the commercial models The company's managers identified six activity cost pools and related cost drivers and accumulated overhead by cost pool as follows. Estimated Use of Drivers by Product Activity Cost Pools Receiving Forming Cost Drivers Pounds Maching hours Estimated Overhead $90.450 154.000 410130 Estimated Use of Cost Drivers 325.000 35 000 217.000 25.500 Home 215.000 Commercial 120.000 8,000 52000 10.000 1578 165.000 15.500