Answered step by step

Verified Expert Solution

Question

1 Approved Answer

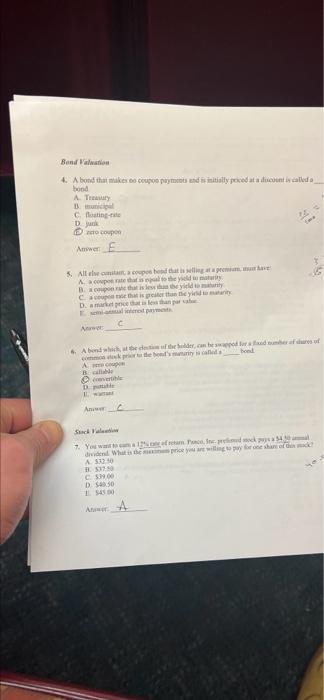

COMFORT Bond Valuation 4. A bond that makes no coupon payments and is initially priced at a discount is called a bond. A. Treasury B.

COMFORT Bond Valuation 4. A bond that makes no coupon payments and is initially priced at a discount is called a bond. A. Treasury B. municipal C. floating-rate D. junk zero coupon Answer: E 5. All else constant, a coupon bond that is selling at a premium, must have: A. a coupon rate that is equal to the yield to maturity. B. a coupon rate that is less than the yield to maturity. C. a coupon rate that is greater than the yield to maturity. D. a market price that is less than par value. E. semi-annual interest payments. Answer: convertible D. puttable E. warrant Answer: 6. A bond which, at the election of the holder, can be swapped for a fixed number of shares of common stock prior to the bond's maturity is called a bond. A. zero coupon B. callable Stock Valuation Answer: (2 A N 7. You want to earn a 12% rate of return. Panco, Inc. preferred stock pays a $4.50 annual dividend. What is the maximum price you are willing to pay for one share of this stock? A. $32.50 B. $37.50 C. $39.00 D. $40.50 E. $45.00 M SE yo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started