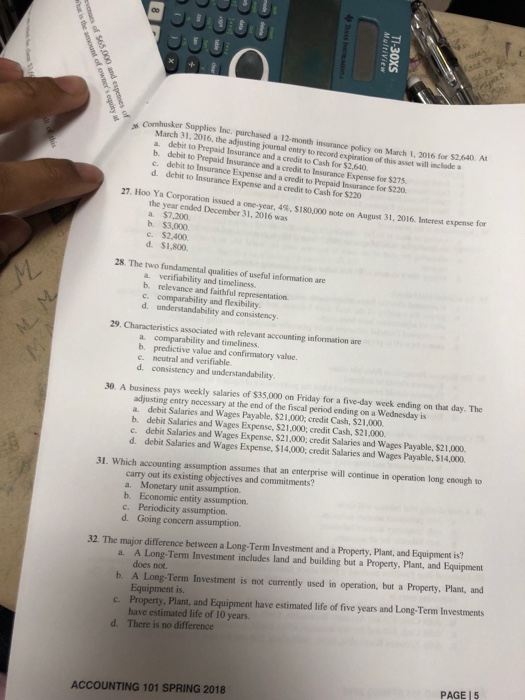

Comhusker Supplies Inc. purchased a 12-month insarance March 31. 2016, the adjusting journal al entry to record expiration of this asset will inclade a record b. debit to Prepaid Insurance and a credit to Insurance Expense for $275 c. debit to Insurance Expense and a credit to Prepaid Insurance for $220. d. debit to Insurance Expense and a credit to Cash for $220 27. I loo Ya Corporation issued a one-year, 4%, s 180.000 note on August 31, 2016. Interest expense for the year ended December 31, 2016 was a. $7,200. b. $3,000. e. $2.400 d. $1,800. 28. The two fundamental qualities of useful information are a. verifiability and timeliness b. relevance and faithful representation. c. comparability and flexibility d. understandability and consistency 29. Characteristics associated with relevant accounting information are a comparability and timeliness b. predictive value and confirmatory value. c. neutral and verifiable 30. A business pays weekly salaries of $35,000 on Friday for a five-day week ending on that day. The adjusting entry necessary at the end of the fiscal period ending on a Wednesday is a. debit Salaries and Wages Payable, $21,000, credit Cash, $21,000. b. debit Salaries and Wages Expense, $21,000, credit Cash, $21,000 c. debit Salaries and Wages Expense, $21.000, credit Salaries and Wages Payable, $21,000. d. debit Salaries and Wages Expense, $14,000, credit Salaries and Wages Payable, $14,000 31. Which accounting assumption assumes that an enterprise will continue in operation long enough to carry out its existing objectives and commitments? a. Monetary unit assumption. b. Economic entity assumption. c. Periodicity assumption. d. Going concern assumption 32. The major difference between a Long-Term Investment and a Property, Plant, and Equipment is? a. A Long-Term Investment includes land and building but a Property, Plant, and Equipment b. A Long-Term Investment is not currently used in operation, but a Property, Plant, and c. Property, Plant, and Equipment have estimated life of five years and Long-Term Investments d. There is no difference does not. Equipment is. have estimated life of 10 years PAGE 5 ACCOUNTING 101 SPRING 2018