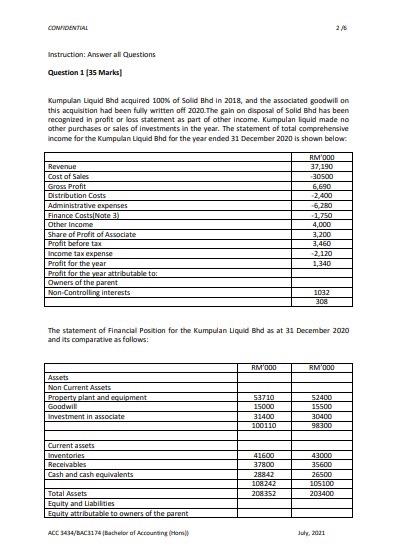

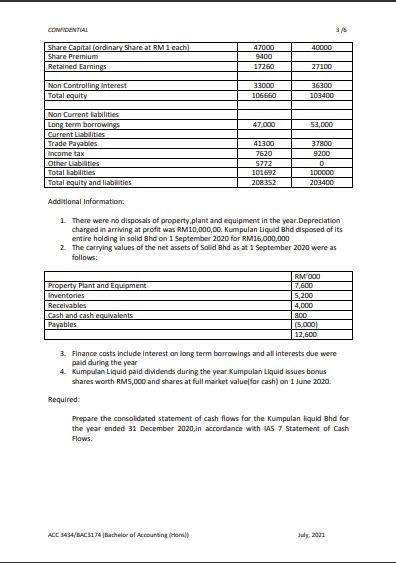

COMIDENTIAL 25 Instruction: Answer all Questions Question 1 (35 Marks! Kumpulan Liquid Bhd acquired 100% of Solid Bhd in 2018, and the associated goodwilion this acquisition had been fully written off 2020. The gain on disposal of Solid Bhd has been recognized in profit or loss statement as part of other income. Kumpulan liquid made no other purchases or sales of investments in the year. The statement of total comprehensive income for the Kumpulan Liquid Bhd for the year ended 31 December 2020 is shown below. RM'000 37,190 30500 6,690 -2.400 -6.250 1750 Revenue Cost of Sales Gross Profit Distribution Costs Administrative expenses Finance Costs Note 3 Other Income Share of Profit of Associate Profit before tax Income tax expense Profit for the year Profit for the year attributable to Owners of the parent Non Controlling interests 4,000 3.200 3,460 2.120 1,340 1032 309 The statement of Financial Position for the Kumpulan Liquid Bhd as at 31 December 2020 and its comparative as follows: RM'000 RM 000 Assets Non Current Assets Property plant and equipment Goodwill Investment in associate 53710 15000 31400 100110 52400 15500 30400 98300 Current assets Inventories Receivables Cash and cash equivalents 41600 37800 28842 108242 208352 43000 35600 26500 104100 203400 Total Assets Equity and Liabilities Equity attributable to owners of the parent ACC 3454/BAC3174 Bachelor of Accounting and July 2021 COW IDENTIAL SA 40000 Share Capital fordinary Share at RM 1 each) Share Premium Retained Earnings 47000 9400 17260 27100 Non Controlling Interest Total equity 33000 106660 36300 103400 47.000 53,000 Non Current abilities Long term borrowings Current Liabilities Trade Payables Income tax Other Liabilities Total abilities Total equity and liabilities 41300 7620 5772 101692 208352 37800 9200 D 100000 203400 Additional Information: 1 There were no disposals of property.plant and equipment in the year.Depreciation charged in arriving at profit was RM10,000,00. Kumpulan Liquid Bhd disposed of its entire holding in solid Bhd on 1 September 2020 for RM15,000,000 2 The carrying values of the net assets of Solid Bhd as at 1 September 2020 were as follows: Property Plant and Equipment Inventories Receivables Cash and cash equivalents Payables RM 000 7,600 5,200 4,000 800 (5,000) 12,600 3. Finance costs include Interest on long term borrowings and all interests due were paid during the year 4. Kumpulan Liquid paid dividends during the year Kumpulan Liquid issues bonus shares worth RM5,000 and shares at full market value for cash) on 1 June 2020. Required: Prepare the consolidated statement of cash flows for the Kumpulan liquid Bhd for the year ended 31 December 2020, in accordance with AS 7 Statement of Cash Flows. ACC 5434/34C3114 Bachelor of Accounting (Pril July 2011 COMIDENTIAL 25 Instruction: Answer all Questions Question 1 (35 Marks! Kumpulan Liquid Bhd acquired 100% of Solid Bhd in 2018, and the associated goodwilion this acquisition had been fully written off 2020. The gain on disposal of Solid Bhd has been recognized in profit or loss statement as part of other income. Kumpulan liquid made no other purchases or sales of investments in the year. The statement of total comprehensive income for the Kumpulan Liquid Bhd for the year ended 31 December 2020 is shown below. RM'000 37,190 30500 6,690 -2.400 -6.250 1750 Revenue Cost of Sales Gross Profit Distribution Costs Administrative expenses Finance Costs Note 3 Other Income Share of Profit of Associate Profit before tax Income tax expense Profit for the year Profit for the year attributable to Owners of the parent Non Controlling interests 4,000 3.200 3,460 2.120 1,340 1032 309 The statement of Financial Position for the Kumpulan Liquid Bhd as at 31 December 2020 and its comparative as follows: RM'000 RM 000 Assets Non Current Assets Property plant and equipment Goodwill Investment in associate 53710 15000 31400 100110 52400 15500 30400 98300 Current assets Inventories Receivables Cash and cash equivalents 41600 37800 28842 108242 208352 43000 35600 26500 104100 203400 Total Assets Equity and Liabilities Equity attributable to owners of the parent ACC 3454/BAC3174 Bachelor of Accounting and July 2021 COW IDENTIAL SA 40000 Share Capital fordinary Share at RM 1 each) Share Premium Retained Earnings 47000 9400 17260 27100 Non Controlling Interest Total equity 33000 106660 36300 103400 47.000 53,000 Non Current abilities Long term borrowings Current Liabilities Trade Payables Income tax Other Liabilities Total abilities Total equity and liabilities 41300 7620 5772 101692 208352 37800 9200 D 100000 203400 Additional Information: 1 There were no disposals of property.plant and equipment in the year.Depreciation charged in arriving at profit was RM10,000,00. Kumpulan Liquid Bhd disposed of its entire holding in solid Bhd on 1 September 2020 for RM15,000,000 2 The carrying values of the net assets of Solid Bhd as at 1 September 2020 were as follows: Property Plant and Equipment Inventories Receivables Cash and cash equivalents Payables RM 000 7,600 5,200 4,000 800 (5,000) 12,600 3. Finance costs include Interest on long term borrowings and all interests due were paid during the year 4. Kumpulan Liquid paid dividends during the year Kumpulan Liquid issues bonus shares worth RM5,000 and shares at full market value for cash) on 1 June 2020. Required: Prepare the consolidated statement of cash flows for the Kumpulan liquid Bhd for the year ended 31 December 2020, in accordance with AS 7 Statement of Cash Flows. ACC 5434/34C3114 Bachelor of Accounting (Pril July 2011