Answered step by step

Verified Expert Solution

Question

1 Approved Answer

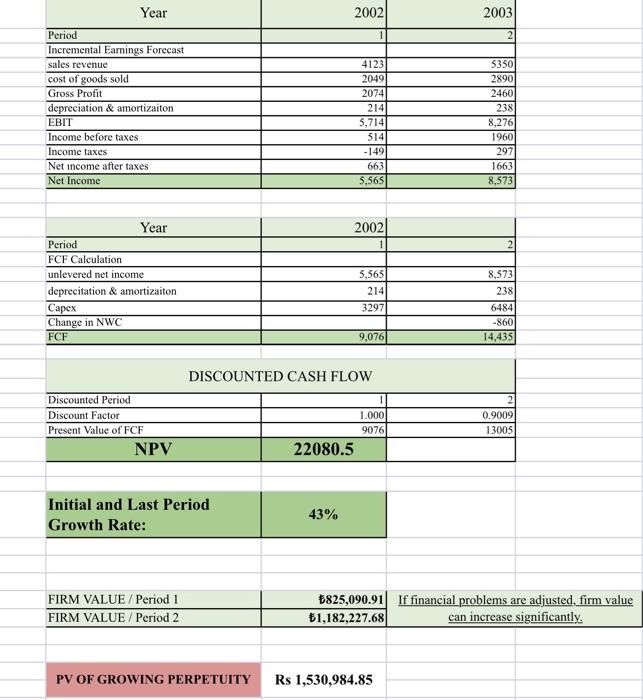

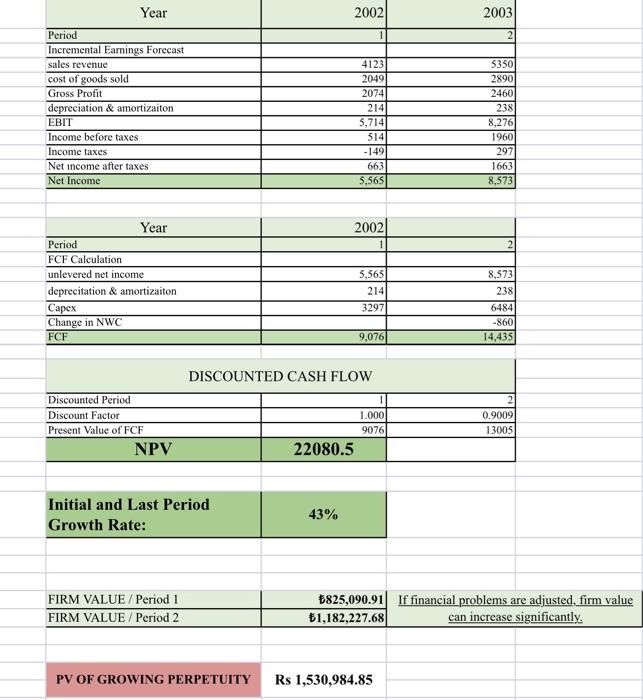

Comment on the financial data in the table. Coal market values 2002) 2003 1 2 Year Period Incremental Earnings Forecast sales revenue cost of goods

Comment on the financial data in the table.

Coal market values

2002) 2003 1 2 Year Period Incremental Earnings Forecast sales revenue cost of goods sold Gross Profit depreciation & amortizaiton EBIT Income before taxes Income taxes Net income after taxes Net Income 4123 2049 2074 214 5,714 514 -149 663 5,565 5350 2890 2460 238 8,276 1960 297 1663 8,573 Year 2002 1 2 Period FCF Calculation unlevered net income deprecitation & amortizaiton Capex Change in NWC FCF 5,565 214 3297 8,573 238 6484 -860 14,435 9,076 DISCOUNTED CASH FLOW Discounted Period Discount Factor Present Value of FCF NPV 1 1.000 9076 0.9009 13005 22080.5 Initial and Last Period Growth Rate: 43% FIRM VALUE / Period 1 FIRM VALUE / Period 2 $825,090.91 If financial problems are adjusted, firm value $1,182,227.68 can increase significantly PV OF GROWING PERPETUITY Rs 1,530,984.85 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started