Answered step by step

Verified Expert Solution

Question

1 Approved Answer

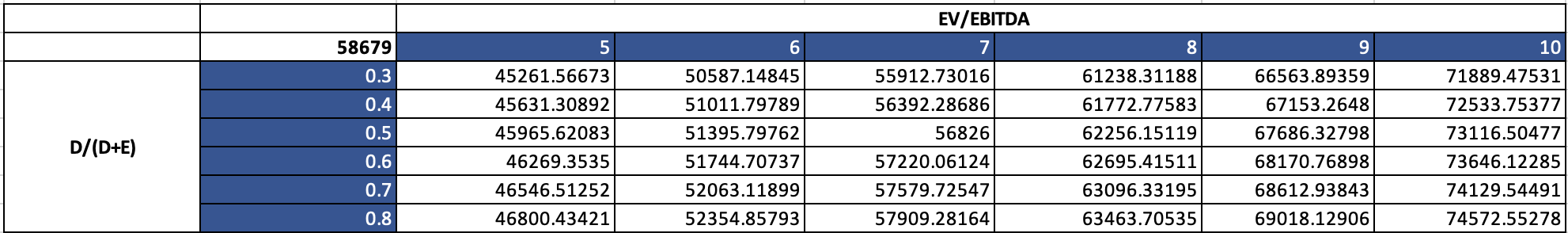

Comment on the sensitivity of your valuation to changes in capital structure and implicit Terminal Value exit EV/EBITDA multiples. Regarding the The Bid for Bell

Comment on the sensitivity of your valuation to changes in capital structure and implicit Terminal Value exit EV/EBITDA multiples.

Regarding the The Bid for Bell Canada Enterprise (HBS Case Study)

D/(D+E) 58679 0.3 0.4 0.5 0.6 0.7 0.8 5 45261.56673 45631.30892 45965.62083 46269.3535 46546.51252 46800.43421 6 50587.14845 51011.79789 51395.79762 51744.70737 52063.11899 52354.85793 EV/EBITDA 7 55912.73016| 56392.28686 56826 57220.06124 57579.72547 57909.28164 8 61238.31188 61772.77583 62256.15119 62695.41511 63096.33195 63463.70535 9 66563.89359 67153.2648 67686.32798 68170.76898 68612.93843 69018.12906 10 71889.47531 72533.75377 73116.50477 73646.12285 74129.54491 74572.55278

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer In the context of valuation sensitivity analysis helps assess the impact of changes in key as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started