Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alliance Case Assignment FIN 600 Capital Investment and Financing Decisions - University of Kentucky Spring 2020 The purpose of this document is to outline

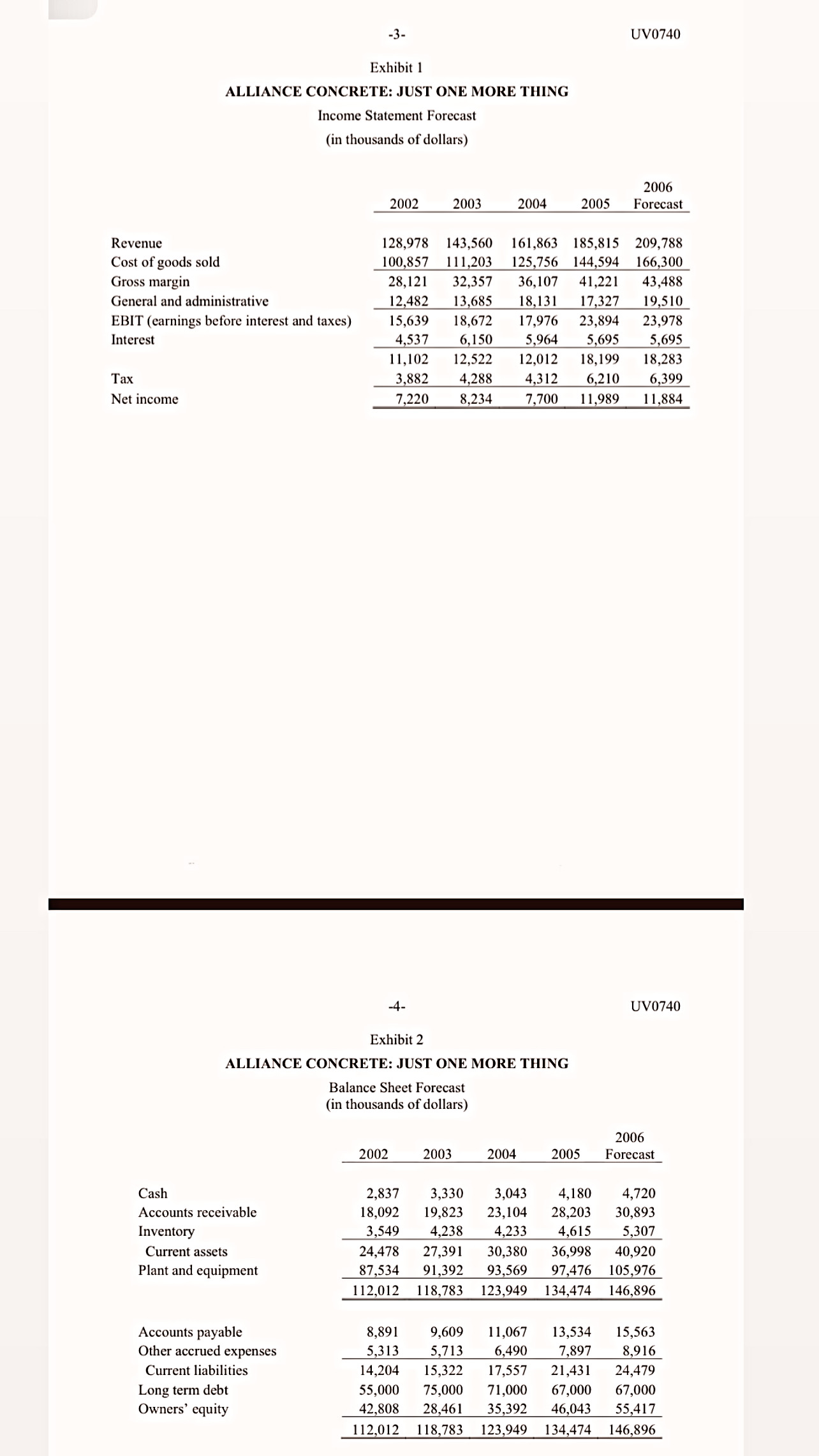

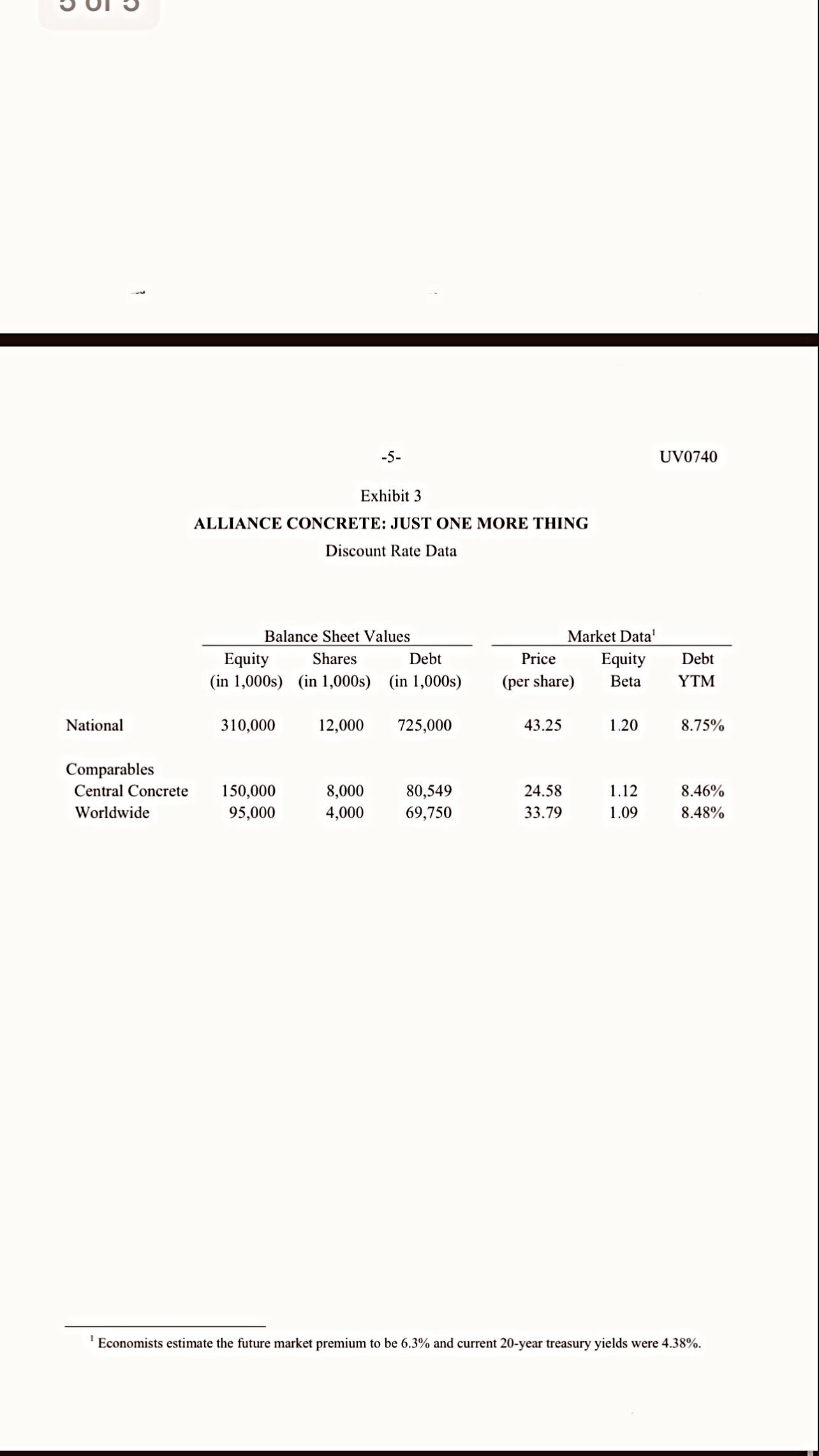

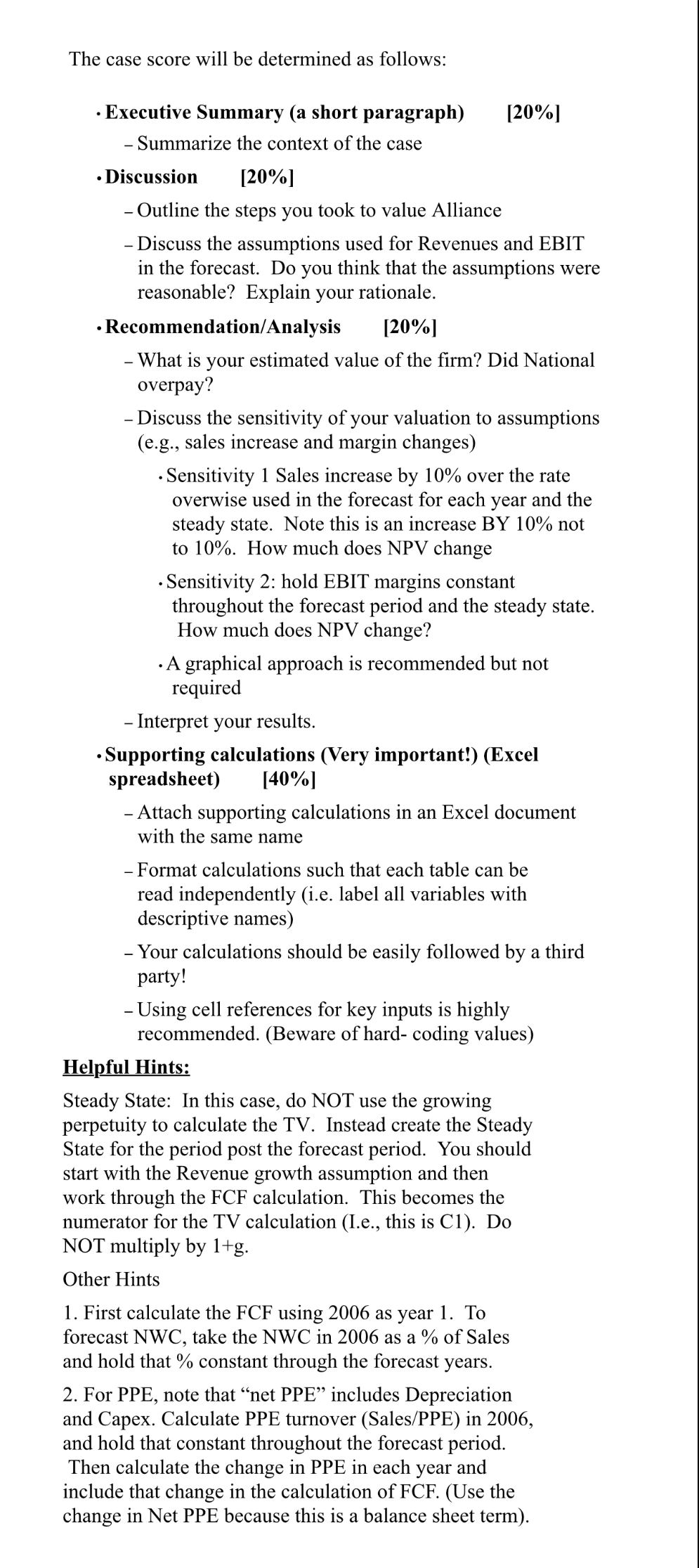

Alliance Case Assignment FIN 600 Capital Investment and Financing Decisions - University of Kentucky Spring 2020 The purpose of this document is to outline the proper format for writing up the Alliance case recommendation. The filename should consist of the case name, and the group name: (e.g., Alliance_Group101.docx). The Final document and spreadsheet should be uploaded to Canvas. If you have technical problems, email to jon.chait@uky.edu The document should have a cover page with the case name, the group name, and a list of all group members. The recommendation should be written in a professional manner (i.e., do not use non-standard abbreviations, personal anecdotes, or colloquial expressions). The purpose of professional writing is to convey information in a clear and succinct fashion. As such, while there is a maximum of two pages, there is no minimum page requirement and extraneous material should be omitted. While not directly scored, grammatical errors, misspellings or other shortcomings that inhibit clarity will detract from your score. -3- Exhibit 1 ALLIANCE CONCRETE: JUST ONE MORE THING Income Statement Forecast (in thousands of dollars) UV0740 2006 2002 2003 2004 2005 Forecast Revenue Cost of goods sold Gross margin 128,978 143,560 100,857 111,203 28,121 32,357 161,863 185,815 209,788 General and administrative 12,482 125,756 144,594 166,300 36,107 41,221 43,488 13,685 18,131 17,327 19,510 EBIT (earnings before interest and taxes) 15,639 18,672 17,976 23,894 23,978 Interest 4,537 6,150 5,964 5,695 5,695 11,102 12,522 12,012 18,199 18,283 Tax Net income 3,882 4,288 7,220 8,234 4,312 6,210 7,700 6,399 11,989 11,884 -4- Exhibit 2 ALLIANCE CONCRETE: JUST ONE MORE THING Balance Sheet Forecast (in thousands of dollars) Cash Accounts receivable Inventory Current assets Plant and equipment UV0740 2002 2003 2004 2005 2006 Forecast 2,837 3,330 3,043 4,180 4,720 18,092 19,823 23,104 28,203 30,893 3,549 4,238 4,233 4,615 5,307 24,478 27,391 30,380 36,998 40,920 87,534 91,392 93,569 97,476 105,976 112,012 118,783 123,949 134,474 146,896 Accounts payable Other accrued expenses Current liabilities Long term debt Owners' equity 8,891 9,609 11,067 13,534 5,313 5,713 6,490 7,897 8,916 14,204 15,322 17,557 21,431 24,479 55,000 75,000 71,000 67,000 67,000 42,808 28,461 35,392 46,043 55,417 15,563 112,012 118,783 123,949 134,474 146,896 -5- Exhibit 3 ALLIANCE CONCRETE: JUST ONE MORE THING Discount Rate Data Equity Balance Sheet Values Shares Debt (in 1,000s) (in 1,000s) (in 1,000s) UV0740 Market Data Price Equity Debt (per share) Beta YTM 43.25 1.20 8.75% National 310,000 12,000 725,000 Comparables Central Concrete Worldwide 150,000 95,000 8,000 4,000 80,549 24.58 1.12 8.46% 69,750 33.79 1.09 8.48% Economists estimate the future market premium to be 6.3% and current 20-year treasury yields were 4.38%. The case score will be determined as follows: Executive Summary (a short paragraph) - Summarize the context of the case Discussion [20%] [20%] - Outline the steps you took to value Alliance Discuss the assumptions used for Revenues and EBIT in the forecast. Do you think that the assumptions were reasonable? Explain your rationale. .Recommendation/Analysis What is overpay? [20%] your estimated value of the firm? Did National - Discuss the sensitivity of your valuation to assumptions (e.g., sales increase and margin changes) Sensitivity 1 Sales increase by 10% over the rate overwise used in the forecast for each year and the steady state. Note this is an increase BY 10% not to 10%. How much does NPV change Sensitivity 2: hold EBIT margins constant throughout the forecast period and the steady state. How much does NPV change? . A graphical approach is recommended but not required - Interpret your results. Supporting calculations (Very important!) (Excel spreadsheet) [40%] - Attach supporting calculations in an Excel document with the same name - Format calculations such that each table can be read independently (i.e. label all variables with descriptive names) -Your calculations should be easily followed by a third party! - Using cell references for key inputs is highly recommended. (Beware of hard-coding values) Helpful Hints: Steady State: In this case, do NOT use the growing perpetuity to calculate the TV. Instead create the Steady State for the period post the forecast period. You should start with the Revenue growth assumption and then work through the FCF calculation. This becomes the numerator for the TV calculation (I.e., this is C1). Do NOT multiply by 1+g. Other Hints 1. First calculate the FCF using 2006 as year 1. To forecast NWC, take the NWC in 2006 as a % of Sales and hold that % constant through the forecast years. 2. For PPE, note that net PPE includes Depreciation and Capex. Calculate PPE turnover (Sales/PPE) in 2006, and hold that constant throughout the forecast period. Then calculate the change in PPE in each year and include that change in the calculation of FCF. (Use the change in Net PPE because this is a balance sheet term). Next Year's Financial Statement Forecast -2- UV0740 As a starting point for his valuation, Harris had the agreed-upon forecast for the coming year. The forecasted income statement and balance sheet are presented, along with the past years' results, in Exhibit 1 and Exhibit 2, respectively. To address the valuation request, Harris needed a longer horizon forecast. He approached his staff for their thoughts: The sales manager recognized a slowdown was quite likely. He expected sales growth of 10% for 2007 and 8% for 2008. After that was pretty much guessing, but when pressed he thought 6% was reasonable. He noted that if sales simply kept pace with long-term economic growth, that would imply about 4% growth per year. Despite numerous discussions regarding costs with his staff, it was difficult to arrive at any consensus. Most of the staff believed the last four years had been particularly good ones and realistically expected margins to tighten after 2007. Based on his discussions, Harris believed margins would erode by 0.5% each year starting in 2007. For the long- run, he expected margins similar to the industry level, which would be an EBIT-to-Sales ratio of 9%. As for investments in plant and equipment, the plant manager continued to argue that plant and equipment were in need of improvement. Just how much was hard to determine. He was quite clear, however, that even with the large capital expenditures approved for 2006, the company had still not invested enough and there could be production problems. Finding an appropriate discount rate was also a challenge. Alliance had always been privately held and there was little information on the owners' required returns, let alone any market information. The capital structure of the company was a moving target-management had borrowed substantially in the past and had been paying down its debt since then. Alliance currently paid 8.5% interest on its borrowings. To provide additional insights, Harris had his assistant gather information on two publicly held companies that were in businesses much like Alliance's, though located in different parts of the country. Harris also had a memo from National that described its capital structure and provided market information. All that information is summarized in Exhibit 3. Valuation With all the information gathered, Harris began to build his valuation model. While putting together the base-case valuation was going to be something of a challenge, he was even more nervous about what variations on the analysis he should consider. Clearly, there was growing concerns about an economic slowdown and this would attenuate near term growth. He was also unsure about what level of plant and equipment was needed Finally, he was very uncomfortable with the scant information he had with which to derive a discount rate. DARDEN BUSINESS PUBLISHING UNIVERSITY of VIRGINIA ALLIANCE CONCRETE: JUST ONE MORE THING UV0740 Rev. Jun. 30, 2011 Alliance Concrete was a small ready-mix concrete producer in Michigan's northern Lower Peninsula. The company operated 14 mixing plants and owned a fleet of 240 mixing trucks. Its customers were predominantly in the residential and commercial construction industry with some additional sales related to road construction and repair. The company had been extremely successful, with substantial revenue and income growth over the last few years driven by a strong residential real estate market. Although Alliance was purchased in 2006 by National Industrial Supplies, a Canadian construction conglomerate with assets in both the United States and Canada, it continued to operate as a separate legal entity. For Martin Harris, Alliance's chief financial officer, late January 2006 was the best of times and the worst of times. Harris had been recently promoted to this position after the departure of some of Alliance's senior management upon the completion of the acquisition. His first major task was to forecast Alliance's operations for the coming year. What he discovered was that despite strong growth and profitability, Alliance was going to find itself short on cash. This meant the company would have to skip a dividend to the parent company, miss a principal repayment to its bank, or defer much-needed capital investments. Harris was able to renegotiate the principal repayment with Alliance's bank, who agreed to reset Alliances borrowing limit to an amount greater than their current outstanding loan. In the subsequent conversations with Alliance's parent company, Harris successfully argued for making the full capital improvements recommended by his plant manager which meant a slightly smaller than anticipated dividend. As Harris finished the conference call with National's executive team in which he outlined his plans for the coming year, his immediate supervisor asked him to do "just one more thing" specifically, to provide an estimate of the value of Alliance together with some discussion as to how that value would be impacted by changes in key economic drivers. National had spent $150 million to acquire Alliance just 10 months ago. It was suddenly clear to Harris that in arguing for the capital investments and negotiating a reduction in the anticipated dividend, he may have raised concerns that National had overpaid for Alliance. He was now going to have to address those concerns. Unfortunately, Harris had played only a small role in those negotiations, and was not familiar with the assumptions that gave rise to that price. He would have to build his valuation from the ground up. This case was prepared by Associate Professor Marc Lipson. It was written as a basis for class discussion rather than to illustrate effective or ineffective handling of an administrative situation. Copyright 2007 by the University of Virginia Darden School Foundation, Charlottesville, VA. All rights reserved. To order copies, send an e-mail to sales@dardenbusinesspublishing.com. No part of this publication may be reproduced, stored in a retrieval system, used in a spreadsheet, or transmitted in any form or by any means-electronic, mechanical, photocopying, recording, or otherwise-without the permission of the Darden School Foundation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Case Recommendation Alliance Group Name Group101 Group Members Insert Group Member 1 Name Insert Group Member 2 Name Insert ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started