Caterpillar traces its roots to the early 1900s when Benjamin Holt invented a slowmoving but functional tractor-previous

Question:

Caterpillar traces its roots to the early 1900s when Benjamin Holt invented a slowmoving but functional tractor-previous efforts at developing tractors for agricultural use had produced bulky machines whose production cost was prohibitively high. In marveling at the new tractor, one of Holt's acquaintances remarked that it crawled like a "caterpillar." Holt seized on that analogy to name his new piece of equipment.That original tractor would lead to Caterpillar Inc. becoming the world's largest manufacturer of construction equipment. The company also became a leading producer of industrial turbines, diesel locomotives, and diesel and gas engines. By 2014, Caterpillar's annual revenues exceeded $55 billion, and the company's stock had become a mainstay of the Dow Jones Industrial Average (DJIA).

In 2014, U.S. Senator Carl Levin of Michigan referred to Caterpillar as an "iconic American company" but then berated the firm for using "financially engineered transactions" to slash its income taxes. For decades, critics of the U.S. tax system had complained of the declining proportion of U.S. income taxes paid by corporations. Senator Levin joined those critics by accusing U.S. multinational corporations of offloading a disproportionate percentage of the nation's tax burden to individuals and small businesses that "don't have an army of lawyers and accountants at their disposal."3 At the time, Caterpillar boasted of having the lowest effective corporate income tax rate among the 30 companies making up the DJIA.

In the early 1950s, corporate income taxes accounted for 32.1 percent of gross U.S. federal tax revenue. By 2014, that percentage had dropped to less than nine percent. A major factor contributing to declining corporate tax receipts has been the efforts of U.S. multinational companies to transfer profits to countries with modest corporate income tax rates. "A number of studies show that U.S. multinational corporations are moving income out of or away from the United States into low or no tax jurisdictions." One widely cited study referenced by Senator Levin found that "the income-shifting of multinational firms" deprived the United States each year of nearly $100 billion in corporate tax collections.

By 2014, U.S. multinational firms had an estimated two trillion dollars of "undistributed foreign earnings" that had gone untaxed by the IRS and other U.S. taxing authorities. Those firms held much, if not most, of those foreign earnings in the form of cash and cash equivalents. According to Senator Levin, Caterpillar had "indefinitely reinvested earnings held offshore," totaling $17 billion at the end of 2013, which accounted for approximately 20 percent of the company's total assets. Similar to other U.S. multinationals, Caterpillar realized that the IRS would impose large taxes on those offshore assets if they were "repatriated" to the U.S.

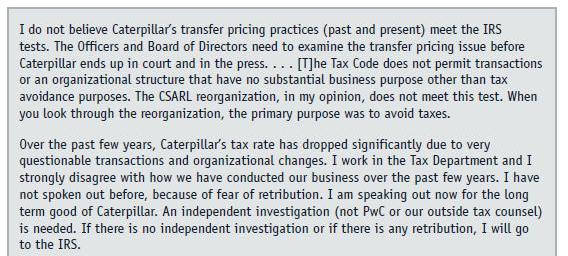

Senator Levin launched a congressional investigation of Caterpillar's Swiss tax strategy in 2014. At the time, Senator Levin served as the chairman of the Subcommittee on Investigations of the U.S. Senate Committee on Homeland Security and Governmental Affairs. Over the previous decade, a stated mission of that subcommittee had been to investigate "how U.S. multinational corporations have exploited and, at times, abused or violated U.S. tax statutes, regulations, and accounting rules to shift profits and valuable assets offshore to avoid U.S. taxes."

Questions

1. Did PwC behave unethically or immorally in helping Caterpillar develop its "Swiss tax strategy?" Defend your answer. What specific ethical principles, if any, were violated by the PwC tax consulting services provided to Caterpillar? Explain.

2. What accounting or financial reporting principles, if any, were violated by Caterpillar's Swiss tax strategy? Explain.

3. Identify the key differences between tax consulting services and independent audit services. Which professional standards govern the provision of "tax consulting" services? Do these standards require CPAs involved in such services to act in the public interest?

4. What audit tests should PwC have applied to the Caterpillar financial statement amounts produced or impacted by the company's Swiss tax strategy? Identify the underlying audit objective for each of those tests.

5. A PwC workpaper for the 2011 Caterpillar audit indicated that the intercompany transaction involving the exchange of cash between CSARL and the U.S.-based parent company had been "reviewed" by the audit team. What specific auditrelated risks are posed by intercompany transactions? What audit objectives would the auditors have had in reviewing the Caterpillar intercompany transaction? What types of audit evidence should the auditors have collected in reviewing that transaction?

6. Was James Bowers in a position to perform an "independent" analysis of Caterpillar's Swiss tax strategy and the related financial statement implications? Should the audit workpapers have included documentation of his analysis?

Step by Step Answer: