In 1998, Bernard Duroc-Danner merged his oilfield equipment company with Weatherford Services to create Houston-based Weatherford International.

Question:

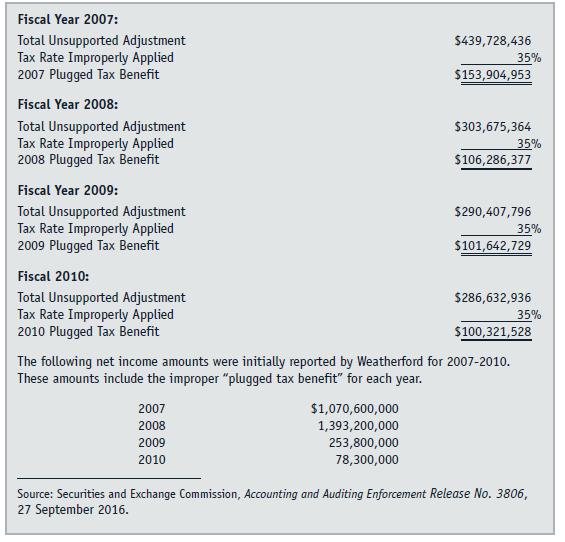

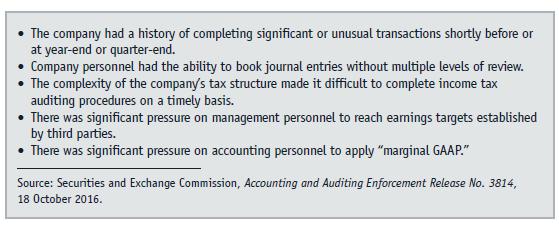

In 1998, Bernard Duroc-Danner merged his oilfield equipment company with Weatherford Services to create Houston-based Weatherford International. The native of France had emigrated to the United States a decade earlier at the age of 34.Duroc Danner's father, a wealthy executive with the large French petroleum company Total, reportedly gave his son $20 million and encouraged him to go to the United States to seek his fortune. Because of his familiarity with oil and gas exploration, Duroc-Danner ultimately decided to pursue a career in oilfield services.Following the merger creating Weatherford International, the new company's board chose Duroc-Danner as its chief executive officer (CEO). The young executive immediately set out to enhance the stature of his company in the global and highly competitive oilfield services industry, a goal he would fiercely pursue over the next two decades.Duroc-Danner constantly preached a message of growth to his subordinates and focused relentlessly on that theme when communicating with financial analysts and the investing public. "Growth is who we are and what we do. The day we stop growth, you won't see me around . . . I hate plateaus."3 From 1998 through 2011, Duroc-Danner dramatically increased Weatherford's total revenues and expanded its global footprint to more than 100 countries by acquiring almost 300 companies. The fiery CEO also frequently reshuffled Weatherford's management team as he searched for like-minded individuals to carry out his "take-no-prisoners" approach to doing business. Duroc Danner exerted such pervasive control over Weatherford that one observer suggested he served not as the company's CEO but rather as its "absolute monarch."4 In 2008, Ernst & Young recognized Duroc-Danner's skill as a corporate executive by presenting him with its "Entrepreneur of the Year Award." That same year, Weatherford's stock reached a split-adjusted record price of nearly $50 per share, which was more than ten times higher than the company's stock price in 1998.Duroc-Danner relied heavily on Weatherford's stock to finance the company's worldwide acquisition spree. To keep the company's stock price rising and attractive to potential takeover candidates, he recognized that he had to grow Weatherford's earnings as well as its revenues. A strategic initiative the company implemented to achieve that goal was reducing one of its largest expense items, namely, income tax expense. To drive down Weatherford's effective tax rate (ETR) and thus lower its income tax expense, the company's executives began shifting revenues from relatively high-tax jurisdictions, such as the United States and Canada, to low-tax jurisdictions such as Bermuda, Hungary, Ireland, Luxembourg, and Switzerland.To accelerate Weatherford's revenue-shifting strategy, Duroc-Danner reincorporated the company in Bermuda in 2002. Over the next several years, Duroc-Danner reincorporated the company two more times when significant tax-reduction opportunities arose in other low-tax jurisdictions. In 2009, he made Switzerland the company's corporate home base and then five years later transferred that home base to Ireland. Despite these legal maneuvers, Houston remained Weatherford's de facto worldwide headquarters- following the 2009 relocation, the television news serial 60 Minutes reported that Weatherford maintained "little more than a nondescript mail drop"5 in Switzerland.Another key feature of Weatherford's revenue-shifting strategy was the use of "hybrid instruments." According to the Securities and Exchange Commission (SEC), "hybrid instruments are structured to incorporate features of both debt and equity, such that an instrument typically qualifies as debt in one jurisdiction and equity in another."6 The SEC reported that Weatherford used hybrid instruments to "facilitate the movement of revenue" from high-tax jurisdictions to corporate tax havens. The "interest payments" on these securities would be deducted from taxable income by a Weatherford entity in a high-tax jurisdiction, while the "dividends receipts" on these same securities by another Weatherford entity in a low-tax jurisdiction would be either exempt from taxes or taxed at a very modest rate.The aggressive taxation strategies employed by Weatherford during Bernard Duroc Danner's early years as CEO significantly reduced the company's annual income tax expense and increased its reported profits. From 2001 to 2006, those strategies lowered the company's ETR from approximately 36 percent to 25 percent. The company's taxation strategies were so successful that they became a focal point of Weatherford's quarterly earnings conferences with financial analysts tracking the company. In April 2007, a Bear Stearns analyst noted that the company exceeded its consensus earnings forecast for the first quarter of 2007 "primarily" because it lowered its ETR.7 Frequent statements by Weatherford executives that the company's ETR would continue to decline prompted financial analysts to issue favorable earnings forecasts for the company and raise their target price for the company's stock.In early 2008, as Weatherford prepared to file its 2007 Form 10-K with the SEC, two senior members of the company's tax department discovered that Weatherford's ETR for fiscal 2007 was considerably higher than the estimated ETR that had been communicated to the company's financial analysts earlier in the year. The tax officials realized that the unexpectedly high ETR would come as an unpleasant surprise to those financial analysts and, more importantly, to their superiors, particularly Bernard Duroc-Danner. The unsettling discovery panicked the two men and sent them in search of a solution.

Questions1. What are the key audit objectives for an audit client's income tax expense and tax-related assets and liabilities? Identify one audit procedure that could be applied to address each audit objective you listed.2. What was the most pervasive internal control weakness evident in this case? Defend your answer. Do you believe the internal control weakness you identified qualified as a "material weakness" in internal control? Why or why not? What implications did the internal control weakness you identified have for the Weatherford auditors?3. Inadequate staffing was a major problem that influenced the performance of Ernst & Young's Weatherford audits. Identify the profession's quality control standards that relate most directly to the staffing of audits. What measures should have been taken by Craig Fronkiewicz to ensure that the Weatherford audits were properly staffed?4. One member of the Ernst & Young audit team described James Hudgins as "difficult, intimidating . . . and stubborn, particularly with respect to the tax positions he took on behalf of the company." What measures can auditors take to cope effectively and properly with uncooperative client personnel?5. During the 2009 audit, Sarah Adams "made clear" to Craig Fronkiewicz that she "distrusted" James Hudgins and "believed he was misrepresenting the company's ETR and net income." What should the Ernst & Young auditors have done at this point in the audit? Defend your answer.6. The AICPA Code of Professional Conduct identifies six ethical principles. Which of those principles, if any, were apparently violated by one or more members of the Weatherford audit engagement teams? Explain.7. James Hudgins, Darryl Kitay, Craig Fronkiewicz, and Sarah Adams neither admitted nor denied the charges of misconduct filed against them by the SEC. Do you believe the SEC should have sought admissions of guilt from these individuals? Why or why not?

Step by Step Answer: