Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comment on the source of employment in respect of Mr Egger's employment with Genie (HK) Limited. You need to quote the relevant IRO and/or

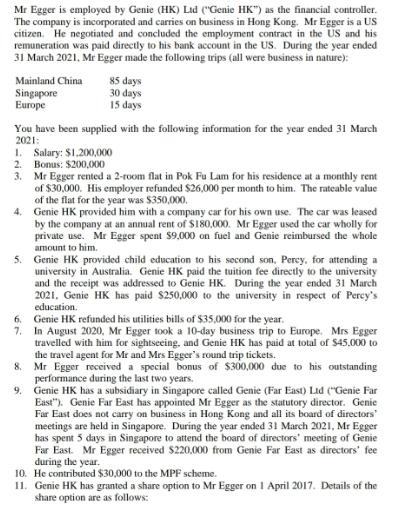

Comment on the source of employment in respect of Mr Egger's employment with Genie (HK) Limited. You need to quote the relevant IRO and/or DIPN. Comment on the taxability of the directors' fee received by Mr Egger from Genie (Far East) Limited. Compute the salaries tax payable by Mr Egger for the year of assessment 2020/21. Show all workings and ignore provisional tax and tax rebates. Please use the allowance table provided via Moodle and use the correct deductions and allowances for 2020/21. Mr Egger is employed by Genie (HK) Ltd ("Genie HK") as the financial controller. The company is incorporated and carries on business in Hong Kong. Mr Egger is a US citizen. He negotiated and concluded the employment contract in the US and hist remuneration was paid directly to his bank account in the US. During the year ended 31 March 2021, Mr Egger made the following trips (all were business in nature): Mainland China Singapore Europe 85 days 30 days 15 days You have been supplied with the following information for the year ended 31 March 2021: 1. Salary: $1,200,000 2. Bonus: $200,000 3. Mr Egger rented a 2-room flat in Pok Fu Lam for his residence at a monthly rent of $30,000. His employer refunded $26,000 per month to him. The rateable value of the flat for the year was $350,000. 4. Genie HK provided him with a company car for his own use. The car was leased by the company at an annual rent of $180,000. Mr Egger used the car wholly for private use. Mr Egger spent $9,000 on fuel and Genie reimbursed the whole amount to him. 5. Genie HK provided child education to his second son, Percy, for attending a university in Australia. Genie HK paid the tuition fee directly to the university and the receipt was addressed to Genie HK. During the year ended 31 March 2021, Genie HK has paid $250,000 to the university in respect of Percy's education. 6. Genie HK refunded his utilities bills of $35,000 for the year. 7. In August 2020, Mr Egger took a 10-day business trip to Europe. Mrs Egger travelled with him for sightseeing, and Genie HK has paid at total of $45.000 to the travel agent for Mr and Mrs Egger's round trip tickets. 8. Mr. Egger received a special bonus of $300,000 due to his outstanding performance during the last two years. 9. Genie HK has a subsidiary in Singapore called Genie (Far East) Ltd ("Genie Far East"). Genie Far East has appointed Mr Egger as the statutory director. Genie Far East does not carry on business in Hong Kong and all its board of directors' meetings are held in Singapore. During the year ended 31 March 2021, Mr Egger has spent 5 days in Singapore to attend the board of directors' meeting of Genie Far East. Mr Egger received $220,000 from Genie Far East as directors' fee during the year. 10. He contributed $30,000 to the MPF scheme. 11. Genie HK has granted a share option to Mr Egger on 1 April 2017. Details of the share option are as follows:

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Regarding the source of employment of Mr Egger with Genie HK Limited According to the Inland Revenue ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started