Answered step by step

Verified Expert Solution

Question

1 Approved Answer

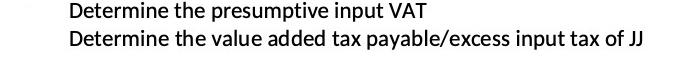

Determine the presumptive input VAT Determine the value added tax payable/excess input tax of JJ Determine the vat payable/excess input tax for the 1st

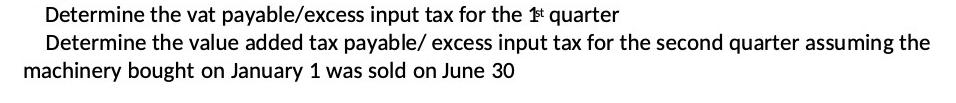

Determine the presumptive input VAT Determine the value added tax payable/excess input tax of JJ Determine the vat payable/excess input tax for the 1st quarter Determine the value added tax payable/ excess input tax for the second quarter assuming the machinery bought on January 1 was sold on June 30 DETERMINE THE VAT PAYABLE FOR THE QURTERENDING MARCH 32,2018 2nd Quarter Sales Purchases REQUIRED: a. Determine the vat payable/excess input tax for the 1st quarter b. Determine the value added tax payable/ excess input tax for the second quarter assuming the machinery bought on January 1 was sold on June 30 4. An owner of warehouse, which used to be vat exempt, because its annual receipts never exceeded the vat threshold, decided to register under the vat system on January 2,2018, The following data were from the 1st quarter ending March 31, 2018: Rental from warehousing services, net of vat Purchases of supplies in February, gross of vat Inventory of supplies, January 1, 2018 Vat on inventory of supplies, January 1, 2018 4,800,000 3,000,000 REQUIRED: DETERMINE THE VAT PAYABLE FOR THE QURTERENDING MARCH 32,2018 SALES (processed sardines, exclusive of vat) PURCHASES/PAYMENTS: 5. JJ is a vat registered processor of sardines. The following data were provided for purposes of determining the taxpayer's payable: Sardines purchased from fish dealers (invoice amount) Tomatoes purchased from farmers Purchased of olive oil (invoice amount) Purchased of can containers (excl. of vat) Payments for paper labels (excl. of vat) Purchased of cardboard for boxes (incl. of vat) Payments for hauling services from non-VAT registered Required: P 336,000 112,000 100,000 10,000 a. Determine the presumptive input VAT b. Determine the value added tax payable/excess input tax of JJ Sales (processed fruits, inclusive of VAT) Purchases/payments: Purchased of fruits from farmers Purchased of raw sugar from millers Purchased of bottles (invoice amount) Purchased of can containers (exc. of VAT) P800,000 6. JJ is a VAT registered processor of fruits. The following data were provided for purposes of determining the taxpayer's VAT payable: 200,000 85,000 67,200 25,000 12,000 8,960 100,000 P 672,000 200,000 60,000 22,400 50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the VAT payableexcess input tax for the 1st quarter we need to calculate the output VAT ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started