Question

Commercial Banking. You are a corporate account officer with the Commercial & Industrial Bank Corporation (CIBC). One of your major manufacturing clients, who are retooling

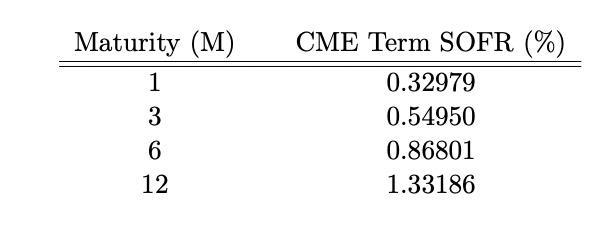

Commercial Banking. You are a corporate account officer with the Commercial & Industrial Bank Corporation (CIBC). One of your major manufacturing clients, who are retooling one of their factories, just bought a piece of customized machinery to be delivered in six months time. The companys treasurer intends to initially finance the purchase in the short-term loan market for six months and inquires about the possibilities of locking in the borrowing cost now. The amount is USD 10m and the loan would be disbursed in a six months from now to be repaid in exactly one years time from now. The current SOFR term structure is as follows (CME, March 17, 2022):

-

(a) What kind of solution to their problem would you suggest to your manufacturing client?

-

(b) Quote a borrowing cost for the preceding suggestion. Since your boss is of a somewhat suspicious nature you better indicate your methodology to derive the quote.

-

(c) What alternative could you suggest to your customer?

-

(d) Define and calculate the SOFR forward curve. Why or why not is it a good predictor for future SOFR rates?

-

(e) At expiration, i.e., six months after entering into the agreement, the 6M 20 SOFR stands at 0.95%. Who wins and who loses? Calculate the clients gain or loss from your suggestion or the alternative, whichever you prefer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started