Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Commercial banks' profit before tax stands at $192.7m By MONIKA SINGH NET profit before tax for commercial banks in Fiji stood at $192.7 million

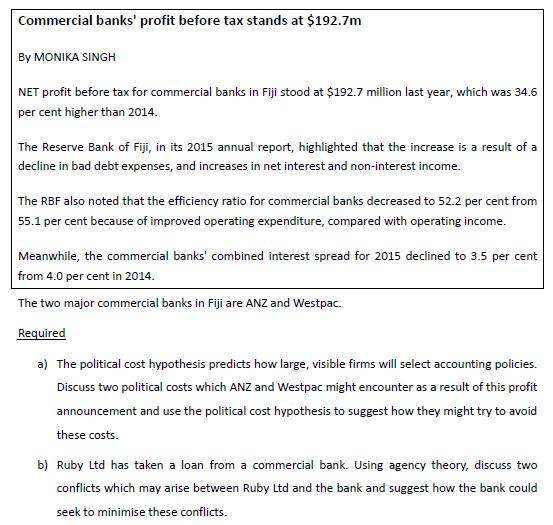

Commercial banks' profit before tax stands at $192.7m By MONIKA SINGH NET profit before tax for commercial banks in Fiji stood at $192.7 million last year, which was 34.6 per cent higher than 2014. The Reserve Bank of Fiji, in its 2015 annual report, highlighted that the increase is a result of a decline in bad debt expenses, and increases in net interest and non-interest income. The RBF also noted that the efficiency ratio for commercial banks decreased to 52.2 per cent from 55.1 per cent because of improved operating expenditure, compared with operating income. Meanwhile, the commercial banks' combined interest spread for 2015 declined to 3.5 per cent from 4.0 per cent in 2014. The two major commercial banks in Fiji are ANZ and Westpac. Required a) The political cost hypothesis predicts how large, visible firms will select accounting policies. Discuss two political costs which ANZ and Westpac might encounter as a result of this profit announcement and use the political cost hypothesis to suggest how they might try to avoid these costs. b) Ruby Ltd has taken a loan from a commercial bank. Using agency theory, discuss two conflicts which may arise between Ruby Ltd and the bank and suggest how the bank could seek to minimise these conflicts.

Step by Step Solution

★★★★★

3.28 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Political costs are the government imposed transfer of wealthPolitical cost hypothesis predict that ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started