Answered step by step

Verified Expert Solution

Question

1 Approved Answer

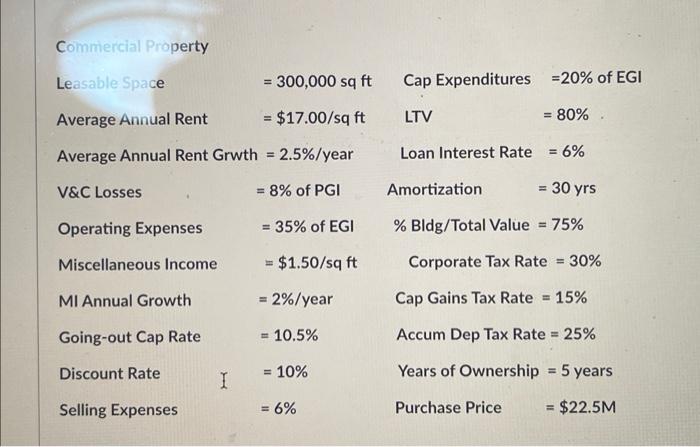

Commercial Property Leasable Space = 300,000 sq ft Average Annual Rent = $17.00/sq ft LTV Cap Expenditures =20% of EGI = 80%. Average Annual

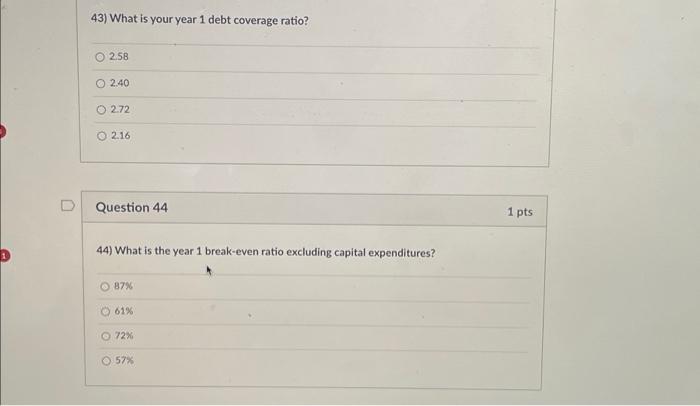

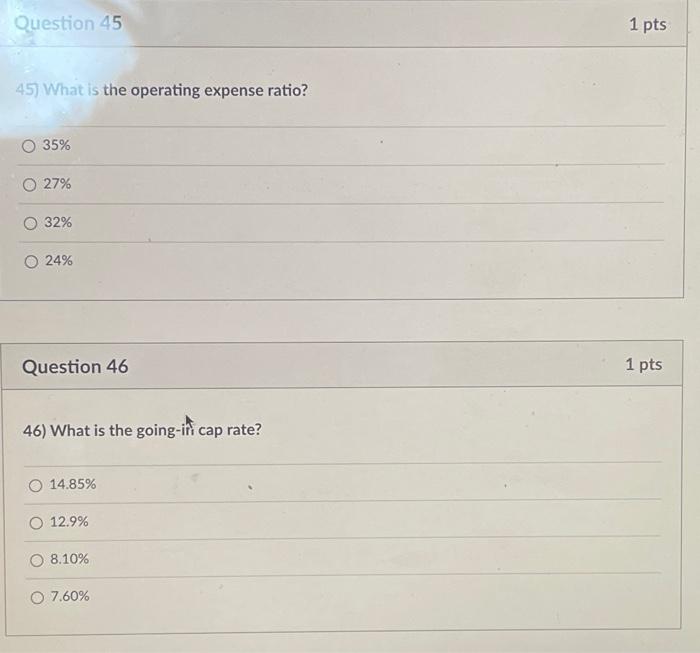

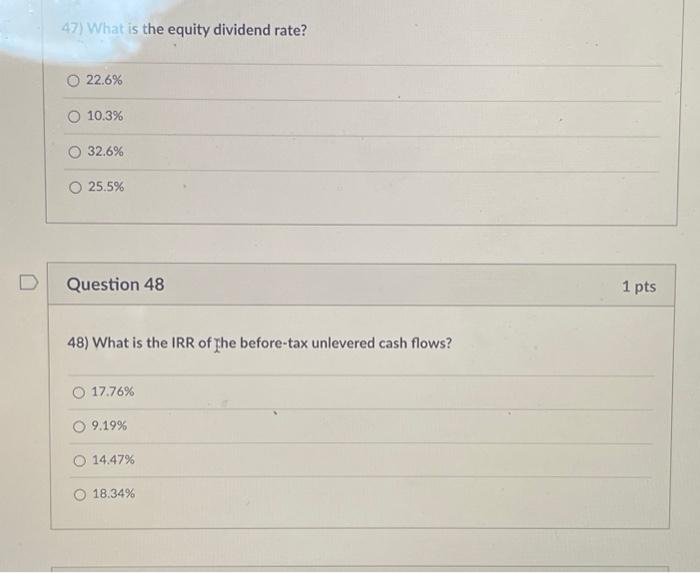

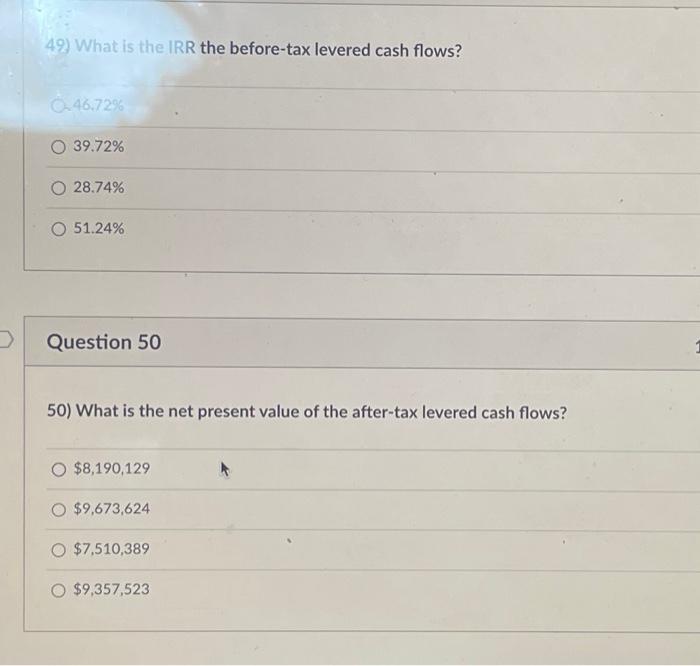

Commercial Property Leasable Space = 300,000 sq ft Average Annual Rent = $17.00/sq ft LTV Cap Expenditures =20% of EGI = 80%. Average Annual Rent Grwth = 2.5%/year V&C Losses = 8% of PGI Operating Expenses = 35% of EGI Miscellaneous Income = $1.50/sq ft Loan Interest Rate = 6% Amortization % Bldg/Total Value = 75% Corporate Tax Rate = 30% = 30 yrs MI Annual Growth = 2%/year Going-out Cap Rate = 10.5% Discount Rate = = 10% I Selling Expenses = 6% Cap Gains Tax Rate = 15% Accum Dep Tax Rate = 25% Years of Ownership = 5 years Purchase Price = $22.5M 43) What is your year 1 debt coverage ratio? 2.58 2.40 2.72 2.16 Question 44 44) What is the year 1 break-even ratio excluding capital expenditures? O 87% 61% 72% 57% 1 pts Question 45 45) What is the operating expense ratio? 35% 27% 32% 24% Question 46 46) What is the going-in cap rate? O 14.85% O 12.9% 8.10% O 7.60% 1 pts 1 pts 47) What is the equity dividend rate? 22.6% 10.3% 32.6% O 25.5% D Question 48 48) What is the IRR of the before-tax unlevered cash flows? 17.76% 9.19% 14.47% 18.34% 1 pts 49) What is the IRR the before-tax levered cash flows? O-46.72% 39.72% 28.74% O 51.24% > Question 50 50) What is the net present value of the after-tax levered cash flows? O $8,190,129 O $9,673,624 O $7,510,389 $9,357,523

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started