Question: Commercial real estate Three multiple regressions, MODEL A, MODEL B, and MODEL C, were run on data from 52 commercial rental real estate properties in

Commercial real estate

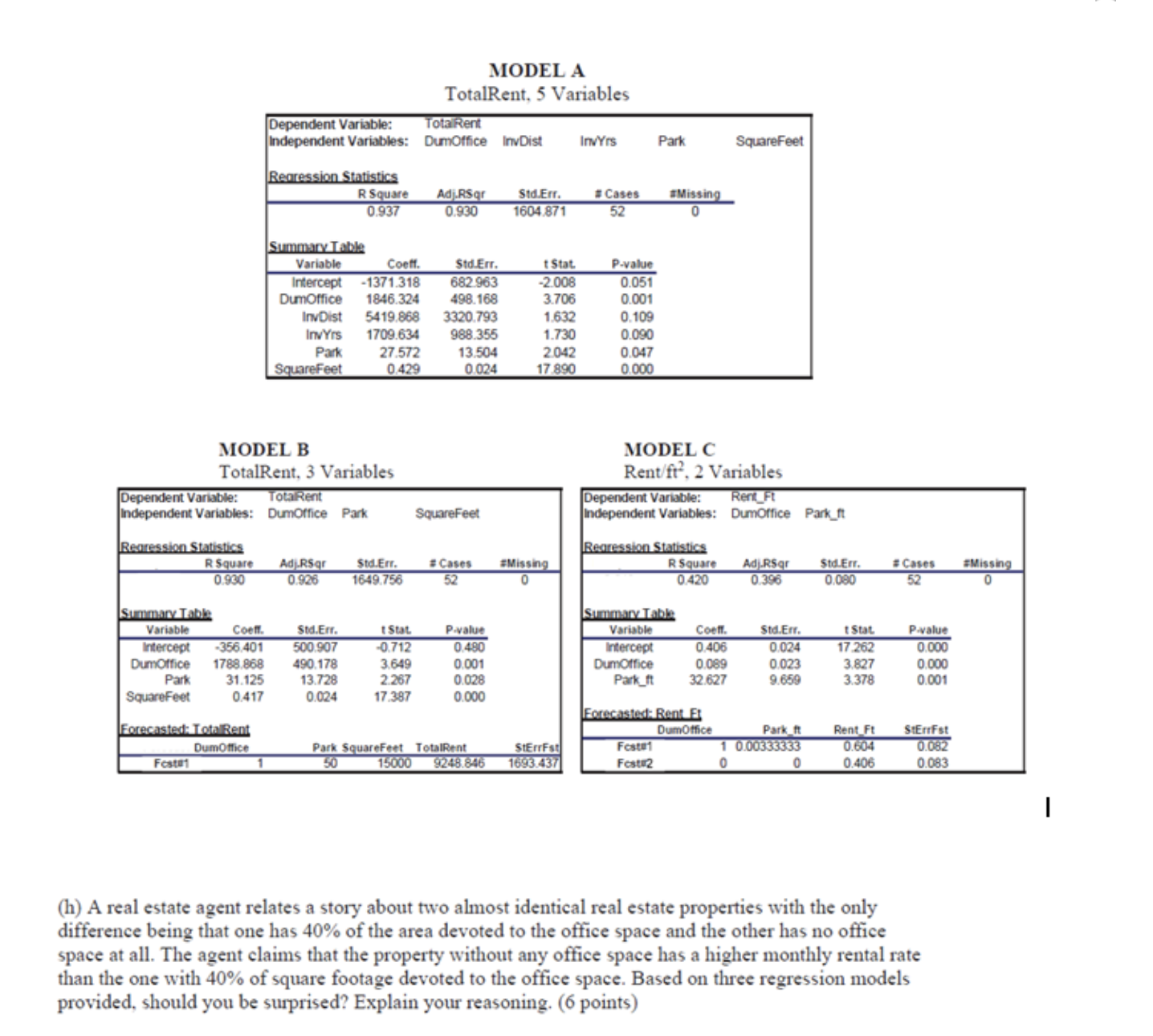

Three multiple regressions, MODEL A, MODEL B, and MODEL C, were run on data from 52 commercial rental real estate properties in the San Fernando valley of Los Angeles. The regression outputs for all three re- gressions are provided in the worksheetCommercialRealEstateof the Excel workbookFinalExam Outputs. All variables in these regressions are described below.

Variables:

- DumOffice:dummy variable that is equal to 1 if more than 25% of the area (measured in square feet) is devoted to oce space and is equal to 0 otherwise

- InvDist:1/(1+ distance in minutes from the building to the nearest freeway entrance)

- InvYrs:1/(1+ the age of the building in years)

- Park:the number of on-site parking spaces

- Park ft:the number on-site parking spaces per square foot (Park/SquareFeet)

- Rent:the monthly rent expressed in dollars per square foot

- SquareFeet:the building size in square feet

- TotalRent:the monthly rent expressed in dollars (i.e.,SquareFeet?Rent)

A real estate agent relates a story about two almost identical real estate properties, with the only dierence being that one has 40% of the area devoted to oce space and the other has no oce space at all. The agent claims that the property without any oce space has a higher monthly rental rate than the one with 40% of square footage devoted to oce space. Based on the three regression models provided, should you be surprised? Explain your reasoning. (250 words max.)

MODEL A TotalRent, 5 Variables Dependent Variable: TotalRent Independent Variables: DumOffice InvDist InvYrs Park SquareFeet Regression Statistics R Square Adj.RSqr Sid.Err. # Cases #Missing 0.937 0.930 1604.871 52 Summary Table Variable Coeff Std.Err. t Stat. P-value Intercept -1371.318 682 963 -2.00 0.051 DumOffice 1846.324 498.168 3.706 0.001 InDist 5419.868 3320.793 1.632 0.109 InvYrs 1709.634 988.355 1.730 Park 27.572 13.504 2042 0.047 SquareFeet 0.429 0.024 17 890 0.000 MODEL B MODEL C TotalRent, 3 Variables Rent/ft . 2 Variables Dependent Variable: TotalRent Dependent Variable: Rent_F Independent Variables: DumOffice Park SquareFeet ndependent Variables: DumOffice Park_ft Regression Statistics Regression Statistics R Square AdjRSqr Std.Err. # Cases #Missing R Square Adj.RSgr StolErr. # Cases #Missing 0.930 0.926 1649.756 0.420 0.396 0.080 52 Summary Table Summary Table Variable Coeff td.Err t Stat P.value Variable Coeff. Std.Err. t Stat P.value Intercept -356.401 500.907 0.712 0.490 Intercept 0.406 0.024 17.262 0.000 DumOffice 1788.868 490.178 3.649 0.001 DumOffice 0.089 0.023 3.827 0.000 Park 31.125 13.728 2.267 0.028 Park_ft 32.62 9.659 3.378 0.001 SquareFeet 0.417 0.024 17.387 0.000 Forecasted: Bent Et Forecasted: TotalRent DumOffice Park It Rent Ft StErFet DumOffice Park SquareFeet TotalRent StErrFs Fest#1 1 0.00535333 0.604 0.082 Fest#1 50 15000 9248.846 1693.437 Fest 2 o 0 0.406 0.083 (h) A real estate agent relates a story about two almost identical real estate properties with the only difference being that one has 40% of the area devoted to the office space and the other has no office space at all. The agent claims that the property without any office space has a higher monthly rental rate than the one with 40% of square footage devoted to the office space. Based on three regression models provided, should you be surprised? Explain your reasoning. (6 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts