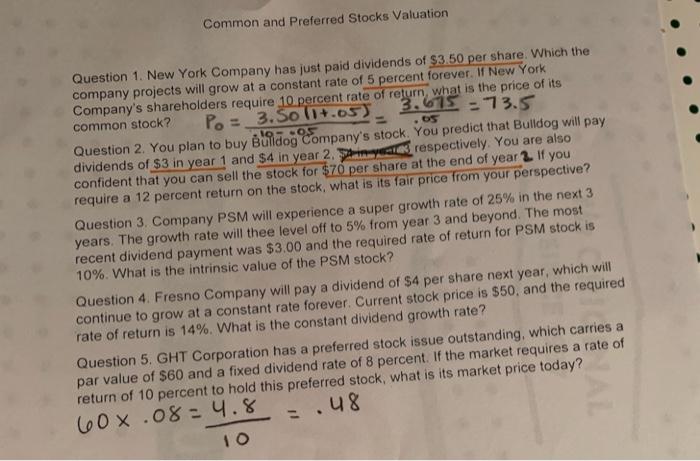

Common and Preferred Stocks Valuation .65 Question 1. New York Company has just paid dividends of $3.50 per share. Which the company projects will grow at a constant rate of 5 percent forever. If New York Company's shareholders require 10 percent rate of return what is the price of its common stock? Po 3. So (1+.05) 3.615 = 13.5 Question 2. You plan to buy lindog Company's stock. You predict that Bulldog will pay dividends of $3 in year 1 and $4 in year 2. in respectively. You are also confident that you can sell the stock for $70 per share at the end of year 2. If you require a 12 percent return on the stock, what is its fair price from your perspective? Question 3. Company PSM will experience a super growth rate of 25% in the next 3 years. The growth rate will thee level off to 5% from year 3 and beyond. The most recent dividend payment was $3.00 and the required rate of return for PSM stock is 10%. What is the intrinsic value of the PSM stock? Question 4. Fresno Company will pay a dividend of $4 per share next year, which will continue to grow at a constant rate forever. Current stock price is $50, and the required rate of return is 14%. What is the constant dividend growth rate? Question 5. GHT Corporation has a preferred stock issue outstanding, which carries a par value of $60 and a fixed dividend rate of 8 percent. If the market requires a rate of return of 10 percent to hold this preferred stock, what is its market price today? 60.08 -4.8 10 =.48 Common and Preferred Stocks Valuation .65 Question 1. New York Company has just paid dividends of $3.50 per share. Which the company projects will grow at a constant rate of 5 percent forever. If New York Company's shareholders require 10 percent rate of return what is the price of its common stock? Po 3. So (1+.05) 3.615 = 13.5 Question 2. You plan to buy lindog Company's stock. You predict that Bulldog will pay dividends of $3 in year 1 and $4 in year 2. in respectively. You are also confident that you can sell the stock for $70 per share at the end of year 2. If you require a 12 percent return on the stock, what is its fair price from your perspective? Question 3. Company PSM will experience a super growth rate of 25% in the next 3 years. The growth rate will thee level off to 5% from year 3 and beyond. The most recent dividend payment was $3.00 and the required rate of return for PSM stock is 10%. What is the intrinsic value of the PSM stock? Question 4. Fresno Company will pay a dividend of $4 per share next year, which will continue to grow at a constant rate forever. Current stock price is $50, and the required rate of return is 14%. What is the constant dividend growth rate? Question 5. GHT Corporation has a preferred stock issue outstanding, which carries a par value of $60 and a fixed dividend rate of 8 percent. If the market requires a rate of return of 10 percent to hold this preferred stock, what is its market price today? 60.08 -4.8 10 =.48