Answered step by step

Verified Expert Solution

Question

1 Approved Answer

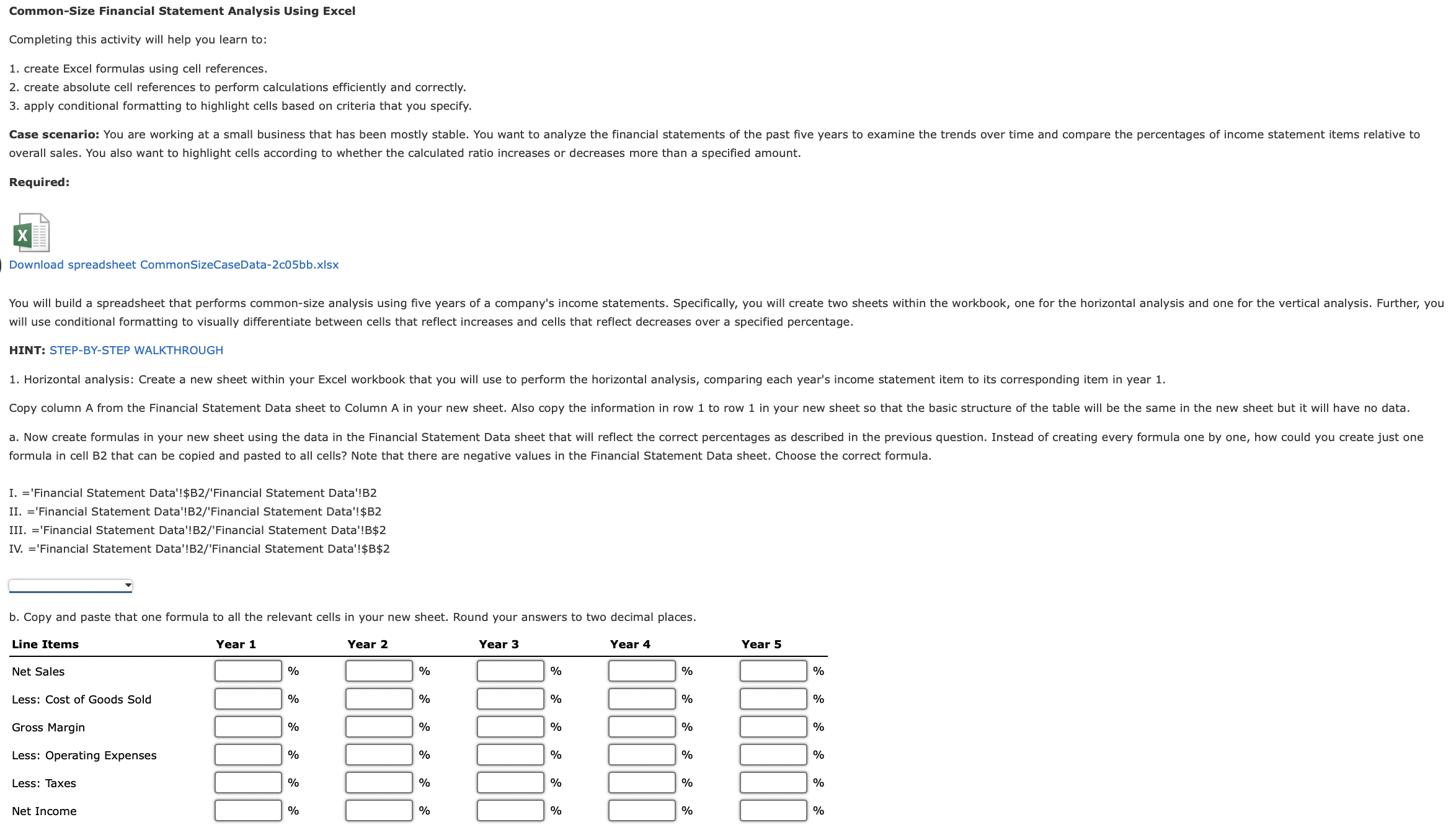

Common - Size Financial Statement Analysis Using Excel Completing this activity will help you learn to: create Excel formulas using cell references. create absolute cell

CommonSize Financial Statement Analysis Using Excel

Completing this activity will help you learn to:

create Excel formulas using cell references.

create absolute cell references to perform calculations efficiently and correctly.

apply conditional formatting to highlight cells based on criteria that you specify.

overall sales. You also want to highlight cells according to whether the calculated ratio increases or decreases more than a specified amount.

Required:

Download spreadsheet CommonSizeCaseDatacbbxlsx

will use conditional formatting to visually differentiate between cells that reflect increases and cells that reflect decreases over a specified percentage.

HINT: STEPBYSTEP WALKTHROUGH

Horizontal analysis: Create a new sheet within your Excel workbook that you will use to perform the horizontal analysis, comparing each year's income statement item to its corresponding item in

formula in cell B that can be copied and pasted to all cells? Note that there are negative values in the Financial Statement Data sheet. Choose the correct formula.

I. 'Financial Statement Data'!$BFinancial Statement Data'!B

II'Financial Statement Data'!BFinancial Statement Data'!$B

III. 'Financial Statement Data'!BFinancial Statement Data'!B $

IV'Financial Statement Data'!BFinancial Statement Data'!$B$

b Copy and paste that one formula to all the relevant cells in your new sheet. Round your answers to two decimal places. Explain the use of the common size financial statements. If you were a manager, which area would require further analysis?

The input in the box below will not be graded, but may be reviewed and considered by your instructor. tableLine Items,Year Year Year Year Year Net Sales,$$$$$Less: Cost of Goods Sold,$$$$$Gross Margin,$$$$$Less: Operating Expenses,$$$$$Less: Taxes,$$$$$Net Income,$$$$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started