Common size financial ststemsnt needed.

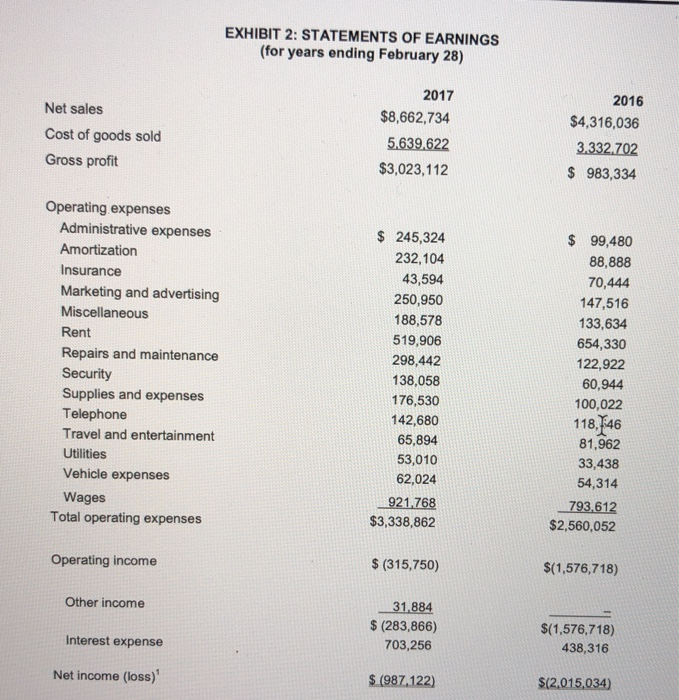

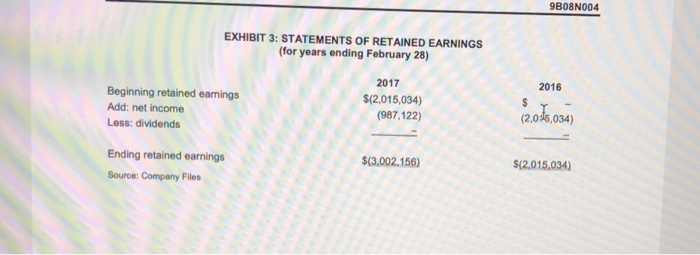

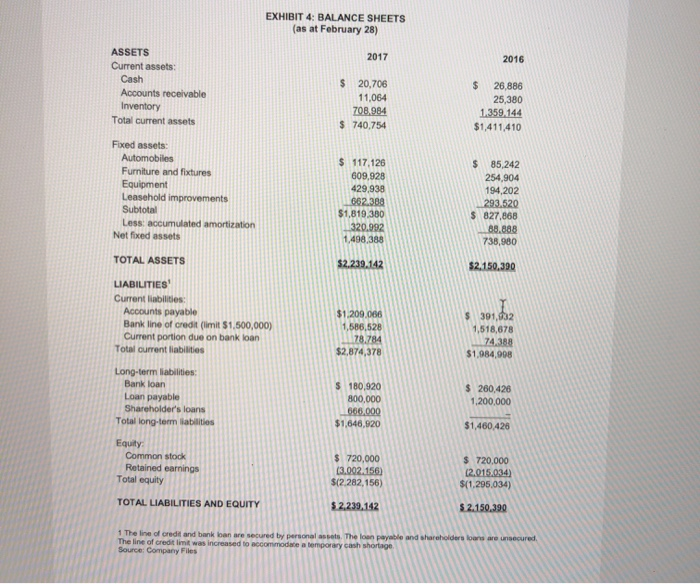

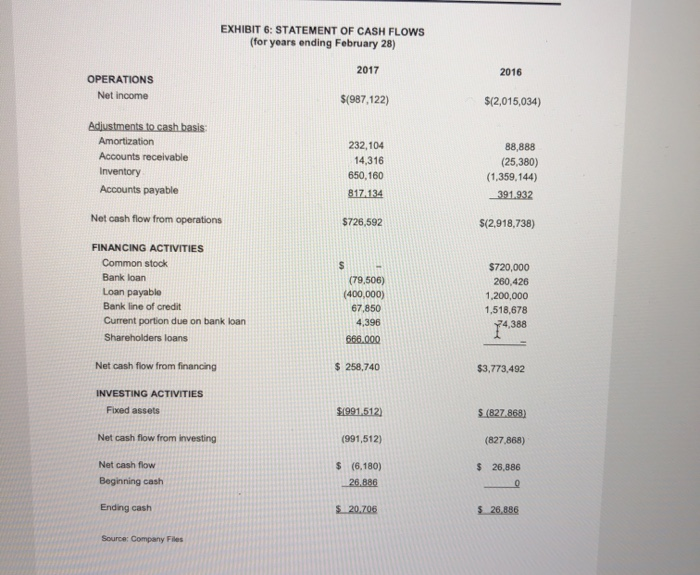

EXHIBIT 2: STATEMENTS OF EARNINGS (for years ending February 28) Net sales Cost of goods sold Gross profit 2017 $8,662,734 5.639.622 $3,023,112 2016 $4,316,036 3.332.702 $ 983,334 Operating expenses Administrative expenses Amortization Insurance Marketing and advertising Miscellaneous Rent Repairs and maintenance Security Supplies and expenses Telephone Travel and entertainment Utilities Vehicle expenses Wages Total operating expenses $ 245,324 232,104 43,594 250,950 188,578 519,906 298,442 138,058 176,530 142,680 65,894 53,010 62,024 921,768 $3,338,862 $ 99,480 88,888 70,444 147,516 133,634 654,330 122,922 60,944 100,022 118,146 81,962 33,438 54,314 793,612 $2,560,052 Operating income $ (315,750) $(1,576,718) Other income 31,884 $ (283,866) 703,256 Interest expense $(1,576,718) 438,316 Net income (loss)' $ (987.122) $(2,015.034) 9B08N004 EXHIBIT 3: STATEMENTS OF RETAINED EARNINGS (for years ending February 28) Beginning retained earnings Add: net income Less: dividends 2017 $(2,015,034) (987,122) (2,045,034) Ending retained earnings $(3.002.156) $12,015.034) Source: Company Files EXHIBIT 4: BALANCE SHEETS (as at February 28) 2017 2016 ASSETS Current assets Cash Accounts receivable Inventory Total current assets $ 20,706 11,064 708.984 $ 740,754 $ 26,886 25,380 1.359.144 $1,411,410 Fixed assets Automobiles Furniture and fixtures Equipment Leasehold improvements Subtotal Less: accumulated amortization Net fixed assets $ 117,126 609,928 429,938 662,388 $1,819,300 320.992 1,498,388 $ 85.242 254,904 194,202 293.520 $ 827,868 88,888 738,980 TOTAL ASSETS 52.239.142 $2.150,390 LIABILITIES Current liabilities Accounts payable Bank line of credit (imit $1,500,000) Current portion due on bank loan Total current liabilities $1.200.000 $ 391,132 1,518,678 74,388 $1,984,908 $2.874,378 Long-term abilities: Bank loan Loan payable Shareholder's loans Total long-term abilities $ 260,426 1.200,000 $ 180,920 800.000 666,000 $1,646,920 $1,460,426 Equity Common stock Retained earnings Total equity $ 720,000 13.002.156) $(2.282,156) $ 720.000 12.015.034) $(1.295,034) TOTAL LIABILITIES AND EQUITY 5 2.239.142 52.150,390 ere are we recured The line of credit and bank loan we ecured by personal use. The loan payable and wh The line of credit was increased to accommodate a tempowy cash shortage Source: Company Files EXHIBIT 6: STATEMENT OF CASH FLOWS (for years onding February 28) 2017 2016 OPERATIONS Net income $(987,122) $(2,015,034) Adjustments to cash basis: Amortization Accounts receivable Inventory Accounts payable 232,104 14,316 650, 160 817.134 88,888 (25,380) (1,359,144) 391.932 Net cash flow from operations $726,592 $(2,918,738) FINANCING ACTIVITIES Common stock Bank loan Loan payable Bank line of credit Current portion due on bank loan Shareholders loans (79,506) (400,000) 67,850 4,396 666.000 $720,000 260,426 1,200,000 1,518,678 74,388 Net cash flow from financing $ 258,740 $3,773,492 INVESTING ACTIVITIES Fixed assets $1991,512) $ (827.868) Net cash flow from Investing (991,512) (827,868) $ 26,886 Net cash flow Beginning cash $ (6,180) 26,886 Ending cash $ 20,706 $ 26,886 Source: Company Files