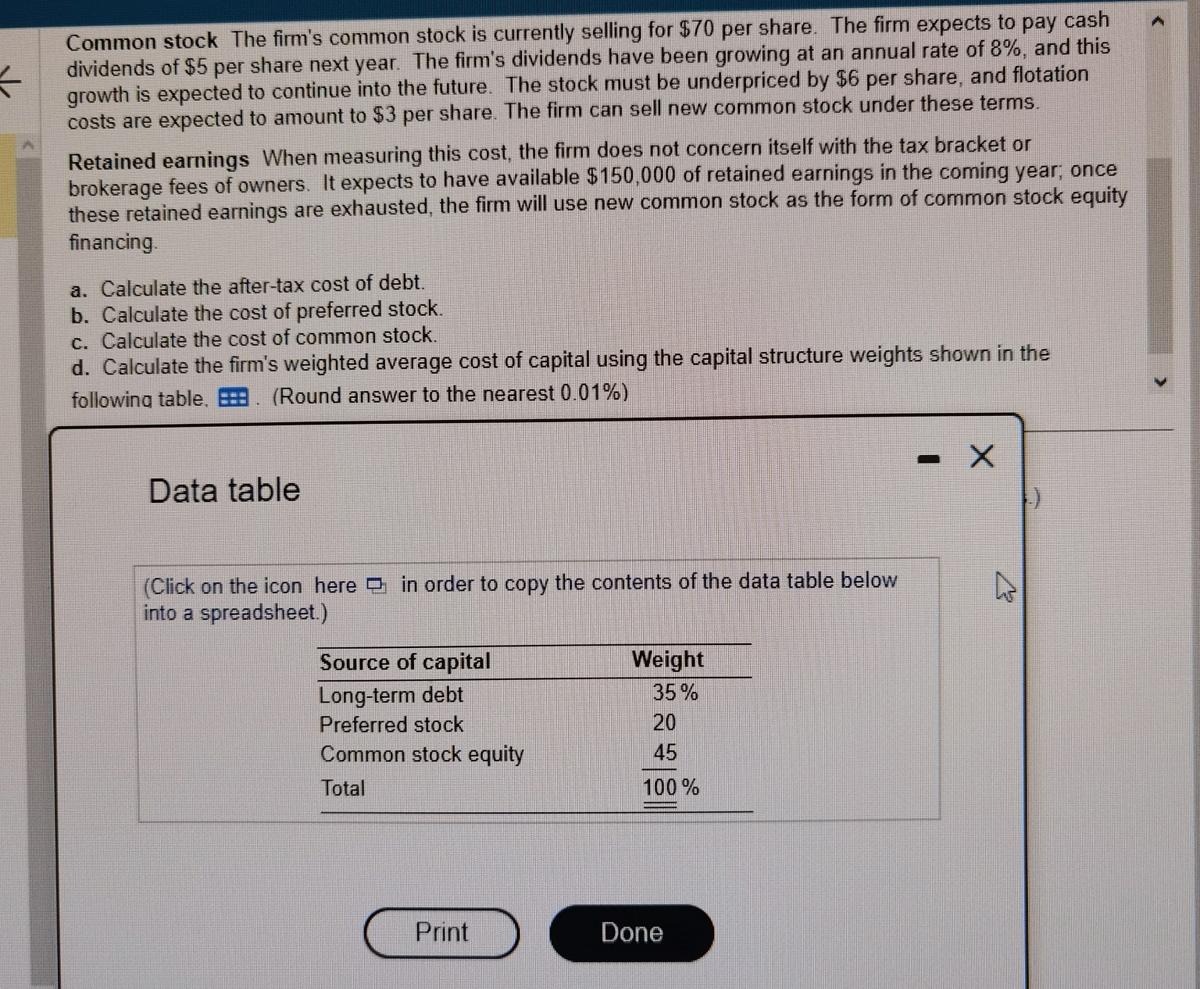

Common stock The firm's common stock is currently selling for $70 per share. The firm expects to pay cash dividends of $5 per share next year. The firm's dividends have been growing at an annual rate of 8%, and this growth is expected to continue into the future. The stock must be underpriced by $6 per share, and flotation costs are expected to amount to $3 per share. The firm can sell new common stock under these terms. Retained earnings When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $150,000 of retained earnings in the coming year; once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock. c. Calculate the cost of common stock. d. Calculate the firm's weighted average cost of capital using the capital structure weights shown in the followina table. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Common stock The firm's common stock is currently selling for $70 per share. The firm expects to pay cash dividends of $5 per share next year. The firm's dividends have been growing at an annual rate of 8%, and this growth is expected to continue into the future. The stock must be underpriced by $6 per share, and flotation costs are expected to amount to $3 per share. The firm can sell new common stock under these terms. Retained earnings When measuring this cost, the firm does not concern itself with the tax bracket or brokerage fees of owners. It expects to have available $150,000 of retained earnings in the coming year; once these retained earnings are exhausted, the firm will use new common stock as the form of common stock equity financing. a. Calculate the after-tax cost of debt. b. Calculate the cost of preferred stock. c. Calculate the cost of common stock. d. Calculate the firm's weighted average cost of capital using the capital structure weights shown in the followina table. Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)