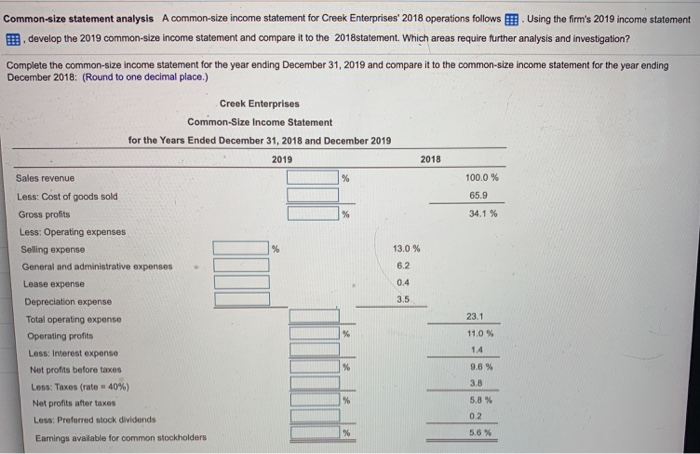

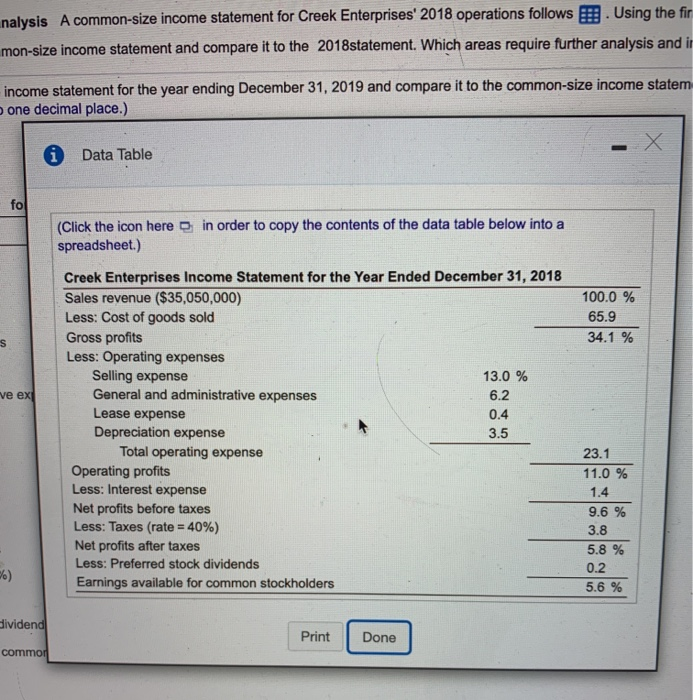

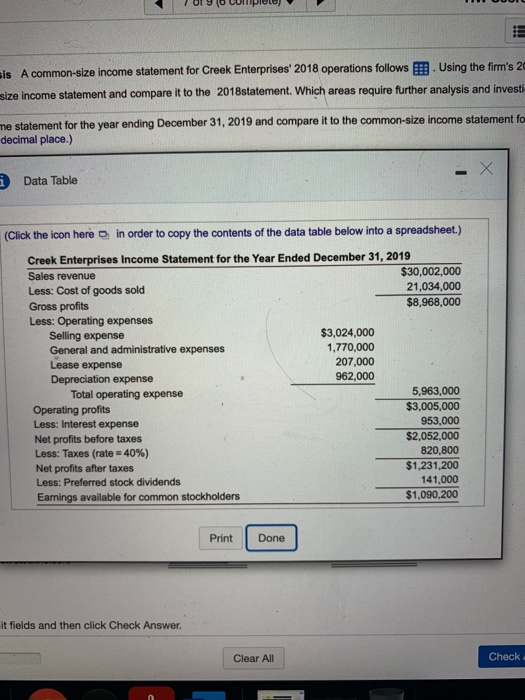

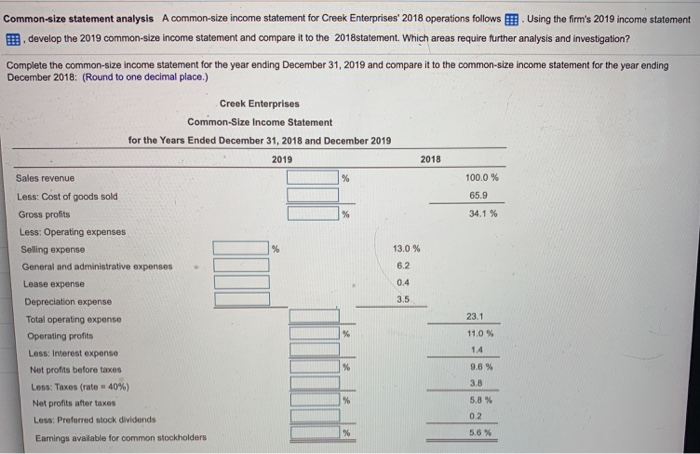

Common-size statement analysis A common-size income statement for Creek Enterprises' 2018 operations follows Using the firm's 2019 income statement develop the 2019 common-size income statement and compare it to the 2018statement. Which areas require further analysis and investigation? Complete the common-size income statement for the year ending December 31, 2019 and compare it to the common-size income statement for the year ending December 2018: (Round to one decimal place.) Creek Enterprises Common-Size Income Statement for the Years Ended December 31, 2018 and December 2019 2019 2018 % 100.0 % 65.9 % 34.1 % % 13.0 % 6.2 0.4 Sales revenue Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense General and administrative expenses Lease expense Depreciation expense Total operating expense Operating profits Loss: Interest expense Net profits before taxes Less: Taxes (rate 40%) Net profits after taxes Less: Preferred stock dividends 3.5 23.1 % 11.0% 1.4 9.6% 3,8 % 5.8 % 02 % 5,6% Earnings available for common stockholders nalysis A common-size income statement for Creek Enterprises' 2018 operations follows B. Using the fir mon-size income statement and compare it to the 2018statement. Which areas require further analysis and in income statement for the year ending December 31, 2019 and compare it to the common-size income statem one decimal place.) i Data Table fo (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) 100.0 % 65.9 34.1 % S ve ex Creek Enterprises Income Statement for the Year Ended December 31, 2018 Sales revenue ($35,050,000) Less: Cost of goods sold Gross profits Less: Operating expenses Selling expense 13.0 % General and administrative expenses 6.2 Lease expense 0.4 Depreciation expense 3.5 Total operating expense Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 23.1 11.0 % 1.4 9.6 % 3.8 5.8 % 0.2 5.6 % %) dividend Print Done commor Sis A common-size income statement for Creek Enterprises' 2018 operations follows. Using the firm's 20 size income statement and compare it to the 2018statement. Which areas require further analysis and investi me statement for the year ending December 31, 2019 and compare it to the common-size income statement fo decimal place.) - X Data Table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $30,002,000 Less: Cost of goods sold 21,034,000 Gross profits $8,968,000 Less: Operating expenses Selling expense $3,024,000 General and administrative expenses 1,770,000 Lease expense 207,000 Depreciation expense 962,000 Total operating expense 5,963,000 Operating profits $3,005,000 Less: Interest expense 953,000 Net profits before taxes $2,052,000 Less: Taxes (rate=40%) 820,800 Net profits after taxes $1,231,200 Less: Preferred stock dividends 141,000 Earnings available for common stockholders $1,090,200 Print Done it fields and then click Check Answer. Clear All Check